A sample within the Bitcoin alternate reserve ratio that has traditionally preceded the beginning of bull runs hasn’t shaped for the cryptocurrency but.

Bitcoin Trade Reserve Ratio Has Continued To Decline Just lately

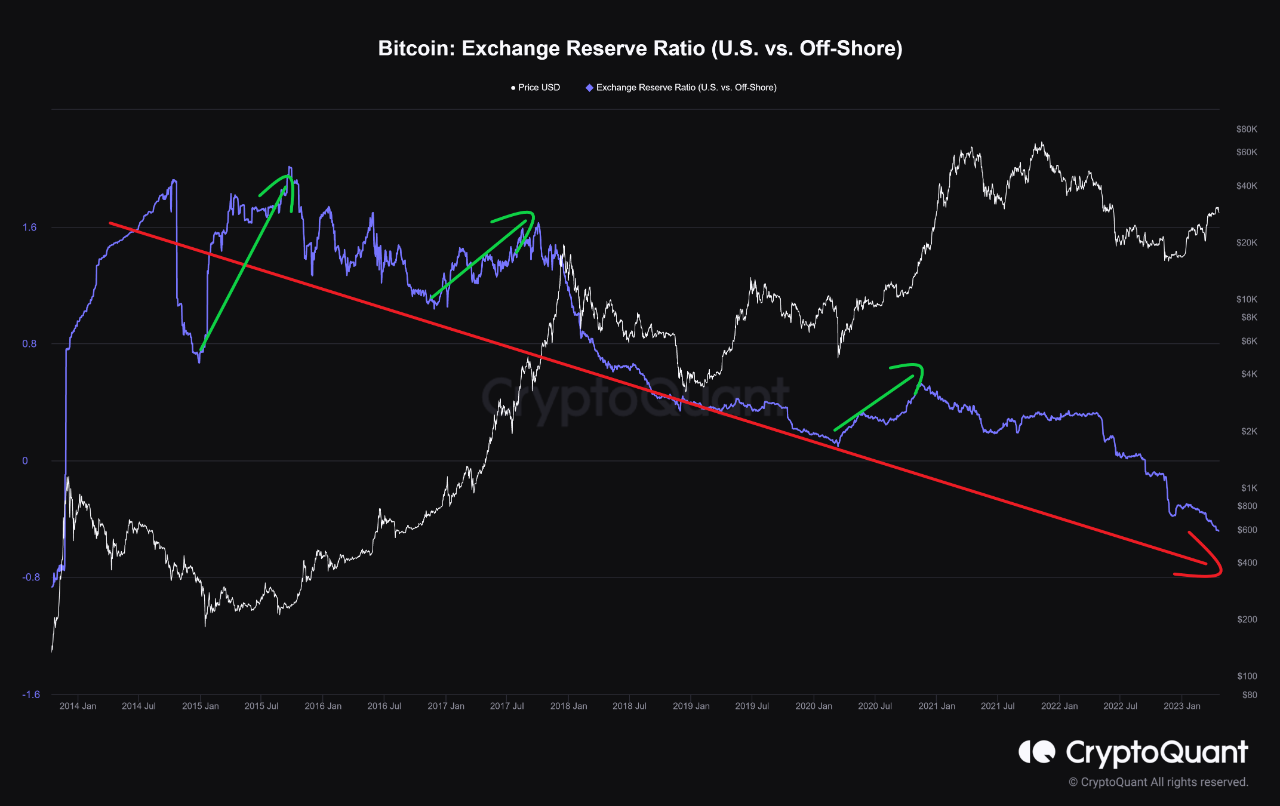

As identified by an analyst in a CryptoQuant post, bull markets up to now have began with US exchanges growing their holdings. The related indicator right here is the “alternate reserve ratio,” which measures the ratio between the alternate reserves of any two alternate platforms or teams of them.

The “exchange reserve” right here refers to a metric that tells us concerning the whole quantity of Bitcoin that’s presently sitting within the wallets of a centralized alternate (or within the mixed wallets of a number of platforms).

Within the context of the present dialogue, the alternate reserve ratio is being taken between the mixed reserve of the US-based platforms and that of the overseas ones.

When the worth of this ratio will increase, it means the full variety of cash on the American exchanges goes up relative to the worldwide platforms proper now. Then again, a lower implies that offshore platforms are receiving extra deposits (or simply observing fewer withdrawals) presently.

Now, here’s a chart that reveals the pattern within the Bitcoin alternate reserve ratio for the US versus offshore platforms over the previous couple of cycles:

The worth of the metric appears to have been taking place in current months | Supply: CryptoQuant

As proven within the above graph, the Bitcoin alternate reserve ratio for these units of platforms has been continuously reducing in current months. In truth, the indicator has been using an total downtrend since 2014, which implies that the share of the US-based exchanges has been shrinking over time.

This pattern would make sense as many new offshore exchanges have come up (and have grown to appreciable sizes) throughout this era because the cryptocurrency has change into common worldwide.

There have been some stretches up to now, nonetheless, the place the metric has deviated from this downtrend line. The quant has highlighted these occurrences within the chart.

Apparently, these durations of an uptrend for the Bitcoin alternate reserve ratio have come as bear markets have ended, and the buildup in direction of bull markets has taken place.

This is able to recommend that the US-based platforms have traditionally grown their holdings relative to the overseas exchanges when the asset has been heading towards bull markets.

Just lately, nonetheless, the Bitcoin alternate reserve ratio has proven no indicators of a breakdown away from the downtrend construction but, implying that the holdings of those platforms are nonetheless reducing.

“The share of Bitcoin held by U.S.-based exchanges, banks, and funds has not but risen,” notes the analyst. “I imagine it’s nonetheless too early for a real bull market to reach.”

BTC Worth

On the time of writing, Bitcoin is buying and selling round $28,000, down 9% within the final week.

Appears to be like like the worth of the asset has plunged throughout the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com