Bitcoin has been hanging round this $20,000 stage – or near it – for fairly some time now.

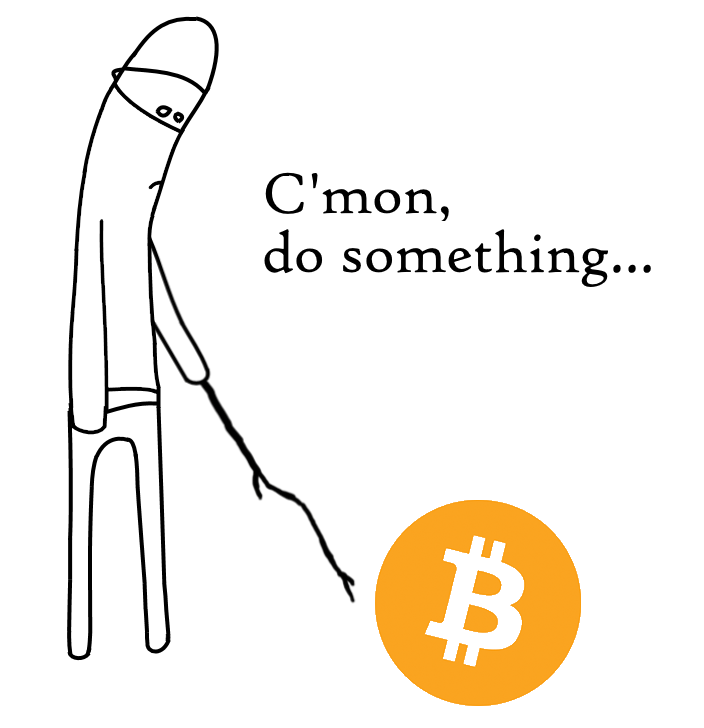

It’s humorous how issues work. Commerce sideways for a few weeks and all of the merchants develop impatient.

However folks: watch out what you would like for. There may be cause to imagine that Bitcoin’s present flirtation with $20,000 could also be regarded again upon because the “good outdated days” someday quickly.

What can we inform from earlier cycles?

In wanting again at earlier cycles, it’s notable that Bitcoin not often traces again past the height of the prior bull market. On this case, the earlier bull market peaked near Christmas in 2017, when Bitcoin exploded upwards to commerce at $19,345.

It’s thus noticeable that now we have now dipped beneath this stage – albeit solely by a small quantity. In wanting on the chart, you’ll be able to see this represents an outlier traditionally.

I don’t pay lots of consideration to assist and resistance – I imagine that within the present surroundings, the ominous macro local weather is all that issues. Bitcoin, alongside the inventory market, merely strikes on inflation readings and the phrases of Jerome Powell.

Nevertheless, it will be remiss to miss psychological whims completely. They do play a consider all market strikes, and oftentimes in crypto they are often extra pronounced than most.

That is why I concern that Bitcoin is one unhealthy information occasion away from a catastrophic day, and a pointy pink candle. The world’s largest cryptocurrency has been in crab movement at these ranges for almost 4 months now. The longer it does this, the extra vital that stage turns into.

Moreover, the very fact this crabbing is happening across the psychologically vital $20,000 quantity provides a bit of little bit of symbolism and poignancy. Lastly, given the truth that the height of the earlier bull has been erased, it actually does carry all elements into play.

Macro nonetheless calls the photographs

After all, macro continues to be very a lot the chief. And with the state of the world so precarious proper now – rising curiosity rises, spiralling value of residing, a struggle in Europe, an vitality disaster – the unhealthy information is in every single place you look. It isn’t onerous to think about a nasty information occasion coming down the pipeline someday quickly.

If this occasion does materialise, that’s after I concern for Bitcoin. I’d not be shocked to see the orange coin plummet to a stage not many thought doable – a minimum of, not when speak of “supercycles” was in vogue in the course of the pandemic surge.

It is very important be aware that the financial system is a unique beast proper now to something Bitcoin has ever skilled. Folks neglect that Bitcoin was solely launched in 2009. Which means that it has by no means earlier than existed in a high-interest charge surroundings, nor a world the place the inventory market was not printing outrageous positive factors (the S&P 500 6X’d from its nadir within the GFC to its all-time excessive lower than a 12 months in the past).

So on this context, what good is it to blindly preach that Bitcoin has drawn down comparable quantities earlier than, solely to roar again?

Right this moment, we’re squarely within the midst of a wider bear market, for the primary time in crypto historical past. The S&P 500 is off almost 25% this 12 months. Bonds are within the dumps. Even the king of the protected havens, gold, has lagged.

Bitcoin can be a totally totally different asset than earlier cycles. There may be robust liquidity within the markets and institutional adoption. In brief, it’s a mainstream monetary asset. It’s even authorized tender in a few international locations. No person in monetary circles has not heard of Bitcoin at this level.

So once more, what can earlier cycles inform us?

When does the pink candle come?

Let me be clear. I don’t know when this may come, so it’s not a lot good. If I did, I wouldn’t be typing away on a laptop computer, I’d be mendacity on a seaside someplace sipping from a coconut I picked with my naked arms.

I’m simply articulating a hunch that I’d be very afraid of Bitcoin at this level. It has been treading water at this mark for fairly some time – and that mark is a major one, each when it comes to the spherical $20K determine and the comparability to earlier cycles.

Volatility isn’t distant from Bitcoin. So for the merchants lamenting sideways motion – you may look again upon today with envy someday quickly. It will not shock me one bit to see a destructive information occasion and a violent wick south of $15,000.

Then once more – I’m only a boy on the Web, what do I do know?