Bitcoin bulls are waning and bearish sentiment is selecting up within the crypto market. The concern and greed index clearly signifies buyers’ sentiment falling from a Might excessive of 65 (greed) to 48 right this moment.

Macro elements stay the first cause behind that weakening Bitcoin worth rally to $30,000 this month. Additionally, US Fed Chair Jerome Powell’s speech on Friday fails to offer a transparent path and price hike potentialities sooner or later. Whereas President Joe Biden and Republicans are hopeful about avoiding the debt ceiling disaster, different points live on.

CME FedWatch Instrument indicates a likelihood of a 25 bps price hike in June, whereas DXY rises and the roles market stays tight.

Additionally Learn: US Fed, ECB, BOE Officials Calls For More Rate Hikes, Bitcoin Price To Fall?

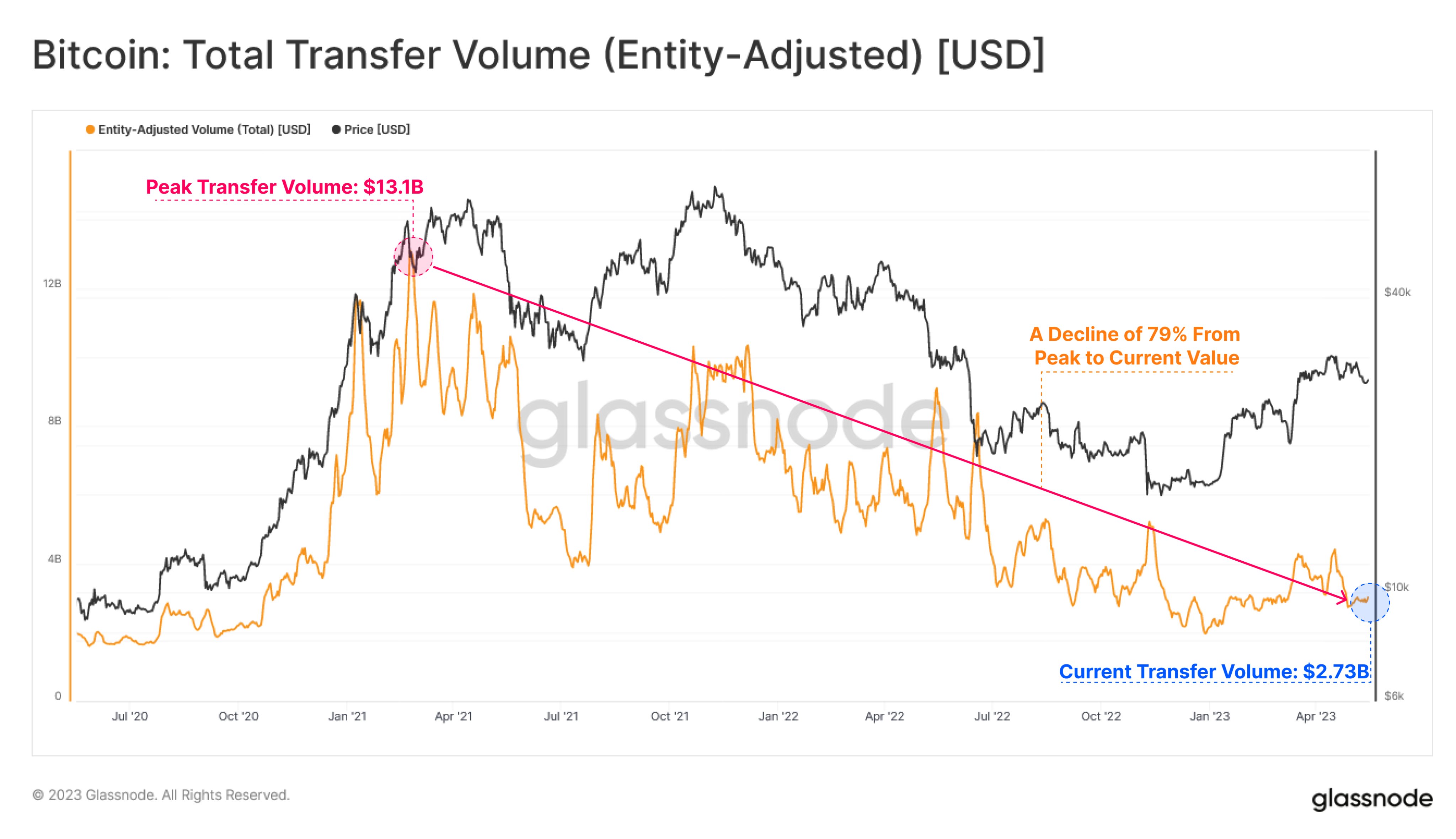

Regardless of Bitcoin worth recovering 75% this 12 months, the bull market situations stay weak. Based on Glassnode, the total switch quantity moved on the Bitcoin community has declined to a present worth of $2.73 billion per day. The community throughput fell 79% from its peak of $13.1 billion throughout the bull market in 2021.

The query now’s whether or not the current consolidation we’re seeing will find yourself in a brand new low, which can counsel decrease costs. Specialists predict a drop properly beneath the 200-WMA to the essential assist of $24,800.

Additionally Learn: Bitcoin (BTC) Price At “Inflection Point”, Big Move Happening In Cardano (ADA)

Will Bitcoin Worth Breakout From Consolidation

In an earlier report by CoinGape Media, we detailed how whales and miners are promoting their holdings amid a current flip of occasions. It will put extra promoting stress on BTC price.

Well-liked analysts CredibleCrypto and Michael van de Poppe predict the consolidation is almost definitely over and BTC worth ought to transfer increased. Nonetheless, it’s vital to think about the 50-moving common and Bollinger bands indicating a weak chart sample.

Bitcoin is vary certain, with $27,640 as resistance and $26,340 as assist. The path of the BTC development will solely be decided by a transparent shut outdoors this space.

Additionally Learn: Ledger Co-Founder Clarifies On Backdoor and Security Risk In Open Source

The offered content material might embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.