The cryptocurrency market is going through a pointy downturn as main property proceed to tumble. Nonetheless, Jelly-My-Jelly (JELLYJELLY), a Solana-based meme coin, has bucked the pattern, hovering to a brand new all-time excessive.

The record-breaking rally has drawn suspicion from blockchain analytics platform Bubblemaps, which raised issues about coordinated buying and selling and doable market manipulation.

JELLYJELLY Soars to Report Excessive as Crypto Market Plunges

The cryptocurrency market suffered a pointy decline on November 4. Bitcoin (BTC) briefly fell below $100,000. In the meantime, Ethereum (ETH) slipped to as low as $3,000, a low final seen in July.

Sponsored

Sponsored

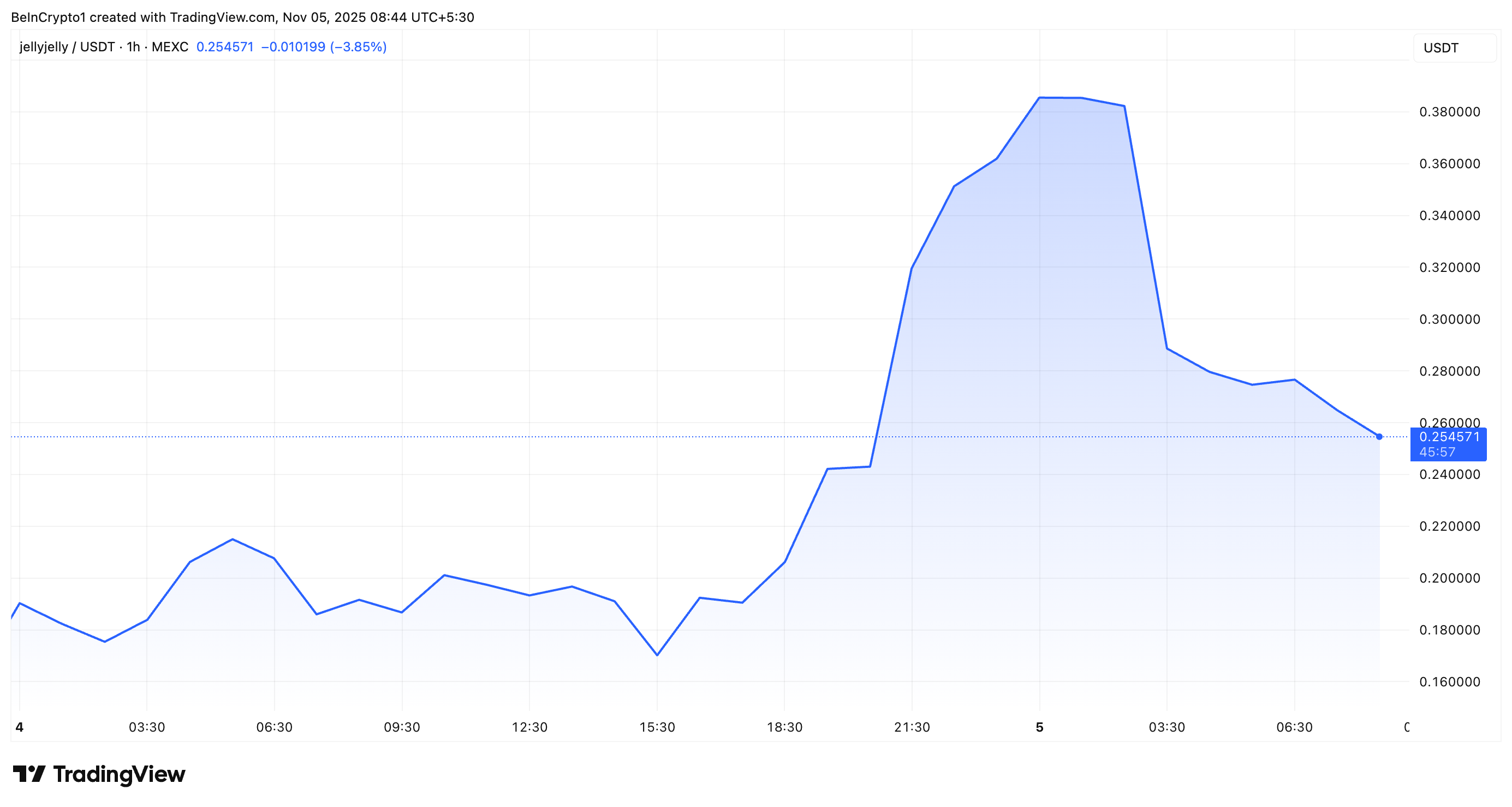

Regardless of the turmoil, JELLYJELLY emerged as a standout performer. The token reached an all-time excessive of $0.5 on November 4. With this rise, its market capitalization additionally surged to $500 million.

Nonetheless, the meme coin faced a modest correction after. On the time of writing, JELLYJELLY traded at $0.25, nonetheless up 31.7% up to now 24 hours.

The meme coin’s market worth additionally adjusted to round $250 million. Nonetheless, buying and selling exercise remained sturdy. CoinGecko information confirmed that the every day buying and selling quantity rose by 96% to succeed in $462 million.

Is the JELLYJELLY Token Rally One other Case of Coordinated Buying and selling?

The value spike attracted Bubblemaps’ consideration. The blockchain analytics platform famous that seven wallets with no prior exercise pulled out 20% of JELLYJELLY’s provide from Gate.io and Bitget over the previous 4 days.

“Shortly after these CEX withdrawals, JELLYJELLY jumped +600%…. after dropping 80% from earlier highs,” Bubblemaps posted.

This prompt doable market manipulation, because the coordinated withdrawal of a good portion of the token’s provide seemingly constrained liquidity on centralized exchanges, making it simpler to push costs upward. Such strikes can create a false sense of market momentum.

In the meantime, this isn’t the primary time JELLYJELLY has skilled coordinated exercise. In March 2025, the token was central to an incident on decentralized exchange HyperLiquid.

A whale manipulated the value, creating a brief squeeze that threatened as much as $230 million in losses in HyperLiquid’s HLP vault. Within the aftermath of this incident, the perp DEX delisted JELLYJELLY, refunded merchants, and boosted security with stricter delisting and open curiosity caps.