In a major growth for Ethereum, the typical gasoline charge on the community has dropped to six.8 Gwei, marking the bottom degree since January 2020, as proven by YCharts.

This lower in gasoline charges has made all on-chain operations, together with asset swaps, cross-chain bridging, and non-fungible token (NFT) minting, significantly extra reasonably priced for customers.

Dencun Improve Lowers Ethereum Charges

The plunge in transaction charges has impacted a number of operations on the Ethereum network. As an example, based on knowledge from Etherscan, asset swaps can now be executed for simply $7.32, bridging at $2.35, and borrowing at $6.21, whereas NFT minting is priced at roughly $12.37.

This discount in charges follows the post-Dencun improve, which launched blobs and optimized community utilization. This improve sparked curiosity amongst builders concerning the potential enhance in gasoline costs ought to market exercise surge.

The Dencun improve has notably decoupled Ethereum’s transaction charges from community exercise, sustaining low charges even in periods of excessive utilization.

This variation advantages customers and adjusts the deflationary mechanism set by earlier upgrades like EIP-1559 and The Merge.

With this new charge construction, the anticipated stress from ETH’s burning mechanism has lessened, indicating a shift in the direction of a extra inflationary development within the quick time period, as decrease transaction charges imply much less ETH is burned.

Impression on Ethereum’s Market Dynamics And Future Projections

Martin Koppelmann, the co-founder of GnosisDAO, highlighted the present charge dynamics on Ethereum, questioning whether or not the low base charge and unexplored worth discovery of blob charges are the brand new regular or if the community will expertise spikes to over 100 Gwei once more.

Ethereum base charge is at report lows. The blob charge nonetheless has not even entered worth discovery (with a really quick exception) and thus is at completely 0.

Is that this the brand new regular or will we see intervals of +100 GWEI once more and by what demand will they be pushed?— Martin Köppelmann 🦉💳 (@koeppelmann) May 10, 2024

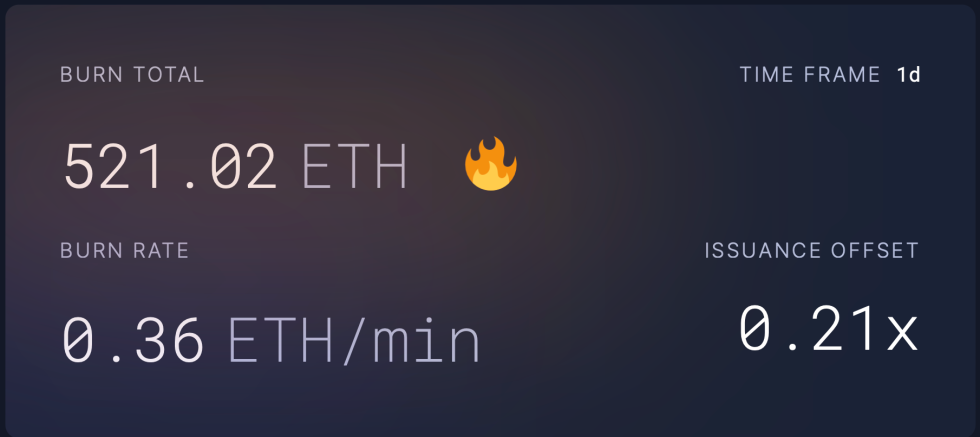

This uncertainty underscores the challenges in predicting community demand and its implications on charges. In the meantime, Ultrasoundmoney’s data exhibits a major lower within the burn price of ETH, with solely 521.02 ETH burned previously day, additional proof of the softened deflationary impact post-Dencun.

The broader market reactions to those developments are blended. ETH’s worth has proven volatility, with an early enhance of about 2% to a excessive of $3,058, adopted by a downturn to $2,920, marking a 16% decline over the previous 30 days.

As famous by crypto analyst Shin Foreign exchange, this worth habits is partly influenced by liquidity dynamics. His ETH/BTC chart evaluation means that liquidity is transferring in the direction of Bitcoin moderately than altcoins like Ethereum, resulting in a possible lower in investor curiosity in Ethereum.

The analyst additionally noticed that the ETH/BTC pair has damaged under its assist degree of 0.05, a sample that traditionally precedes a worth crash. He predicts Ethereum may spiral to round $2,500 if the ETH/BTC pair falls under 0.04.

Featured picture from Unsplash, Chart from TradingView