Key Takeaways

- Crypto volatility has come down and excessive on-chain exercise subsided in interval of relative calm

- A number of regarding developments round Genesis, Gemini and DCG are nonetheless ongoing, nevertheless

- Volatility might additionally spark up as soon as the US inflation information is revealed this week

- Interval is paying homage to the low drama surroundings pre-FTX in October

After a tumultuous rollercoaster following the shocking demise of FTX, a interval of notable serenity has descended upon cryptocurrency markets.

With 2022 being a whole and utter massacre, it nearly feels suspicious that there’s even a few weeks of low drama within the digital market area.

However the metrics present that the previous few weeks have been among the many quietest of the final couple of years. Given the fear of contagion that transpired out of FTX’s collapse, that may be a good factor.

Concern nonetheless elevated in crypto circles

Having stated that, there may be a lot to be involved about proper now. As Coinbase CEO Brian Armstrong acknowledged yesterday when he introduced Coinbase was cutting an additional 20% of its workforce, there are possible “extra sneakers to drop” and there may be “nonetheless a whole lot of market concern” on the market.

Crypto lender Genesis final week laid off 30% of its workforce and is reportedly mulling chapter. Crypto alternate Gemini, based by the Winklevoss twins, has $900 million of buyer belongings caught in limbo with Genesis, its sole lending associate for its Earn product.

The twins have demanded Barry Silbert, CEOP of Digital Forex Group (DCG), which owns Genesis, to step down, accusing him of defrauding Gemini Earn prospects.

DCG fired again, calling it “one other determined and unconstructive publicity stunt from Cameron Winklevoss to deflect blame”. It additionally affirmed it was “preserving all authorized treatments in response to those malicious, false, and defamatory assaults).

DCG can also be the mum or dad firm of the Grayscale Bitcoin Belief, which has seen an enormous low cost to its internet asset worth, peaking at 50% within the aftermath of the FTX collapse as traders questioned whether or not reserves have been secure (I wrote about GBTC yesterday).

Markets stand agency for now

For now, whereas all these episodes play out, the markets are standing agency. Motion has been comparatively muted, and in reality there was a tangible return to regular ranges for lots of on-chain exercise that went wacky over latest intervals.

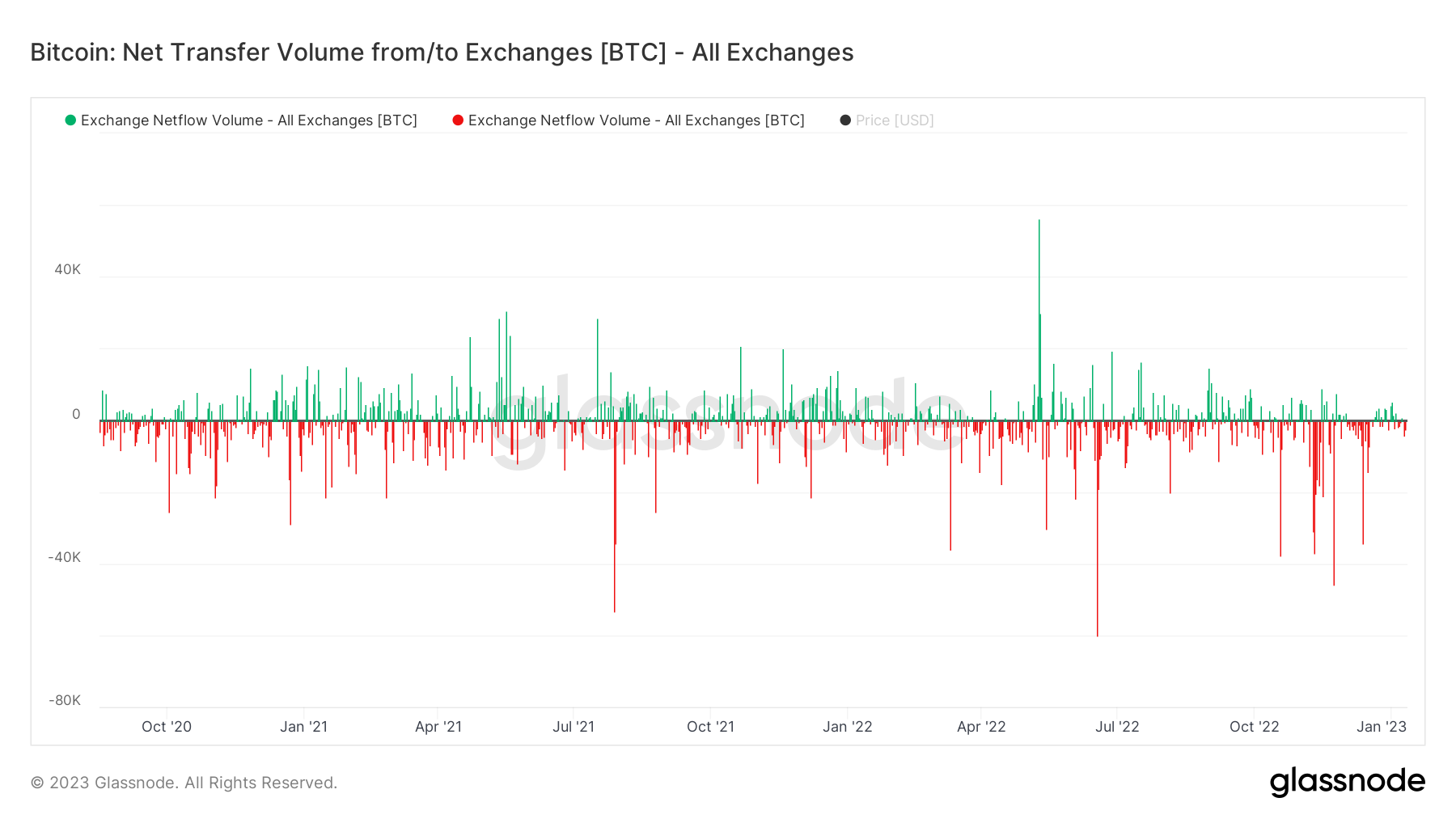

The under snapshot exhibits the online switch quantity out and in of exchanges. Because the begin of the yr, the motion has been tepid, having spiked to excessive ranges in November and December as first FTX collapsed after which the questions spiked concerning the health of Binance.

This notion that exercise has returned to regular is strengthened when wanting a the volatility of Bitcoin. The world’s largest cryptocurrency has been buying and selling sideways for some time now, and the 30-Day Pearson measure of volatility exhibits how there was a perceptible drop again all the way down to pre-FTX ranges in December.

Macro local weather wanting extra optimistic

It hasn’t simply been a respite from inside crypto circles. The broader macro surroundings is wanting not less than a bit brighter immediately than it did final month. Inflation continues to be rampant, however there have been two consecutive readings under expectation, and there may be renewed hope that it might have peaked.

The newest spherical of rate of interest hikes kicked charges up 50 bps versus 75 bps within the two prior months, and whereas Fed chair Jerome Powell and different central financial institution chiefs have affirmed that charges will proceed to rise till inflation is conquered, the market has moved cautiously upward after European inflation got here in at 9.2%, in comparison with 10.1% final month.

Subsequent up is the US CPI studying on Thursday, which is able to – as at all times – be a vitally vital day in markets. Anticipate volatility in crypto markets as cash stare on the quantity to attempt to assess what Jerome Powell could do with regard to rate of interest coverage.

In spite of everything, we all know by now that crypto could be very a lot holding the inventory market’s hand – aside from when, you realize, high-profile executives are revealed to be fraudulent (FTX), or prime 10 cash stop to exist (LUNA).

By no means a boring second for lengthy in crypto

Again in late October, Bitcoin was seemingly locked in crab movement round $20,000. With merchants getting impatient, I warned how crypto may very well be one event away from a nasty downward wick. T

Three weeks later, FTX collapsed. I by no means imagined this could occur, and the timing was coincidental, however the premise of the piece jogs my memory of how I really feel now. It’s superb how quick recollections are in markets, however we have now been right here earlier than.

Crypto received’t keep silent for lengthy, and the asset class is way from out of the woods but. The aforementioned ongoings round DCG, GBTC, Genesis and Gemini are just some of the million issues that might flip south at any second.

There’s additionally the story round Binance chief Changpeng Zhao being below investigation for cash laundering offences by the SEC, there may be Coinbase shedding 20% of its workforce following a 905 drawdown in its share worth, and God is aware of what’s going to come out of testimonies within the Sam Bankman-Fried court docket proceedings.

After which there may be macro, the place something might occur to inflation, the Russian conflict in Ukraine or myriad different variables. It’s been a quiet couple of weeks however don’t fear – the insanity will return quickly.