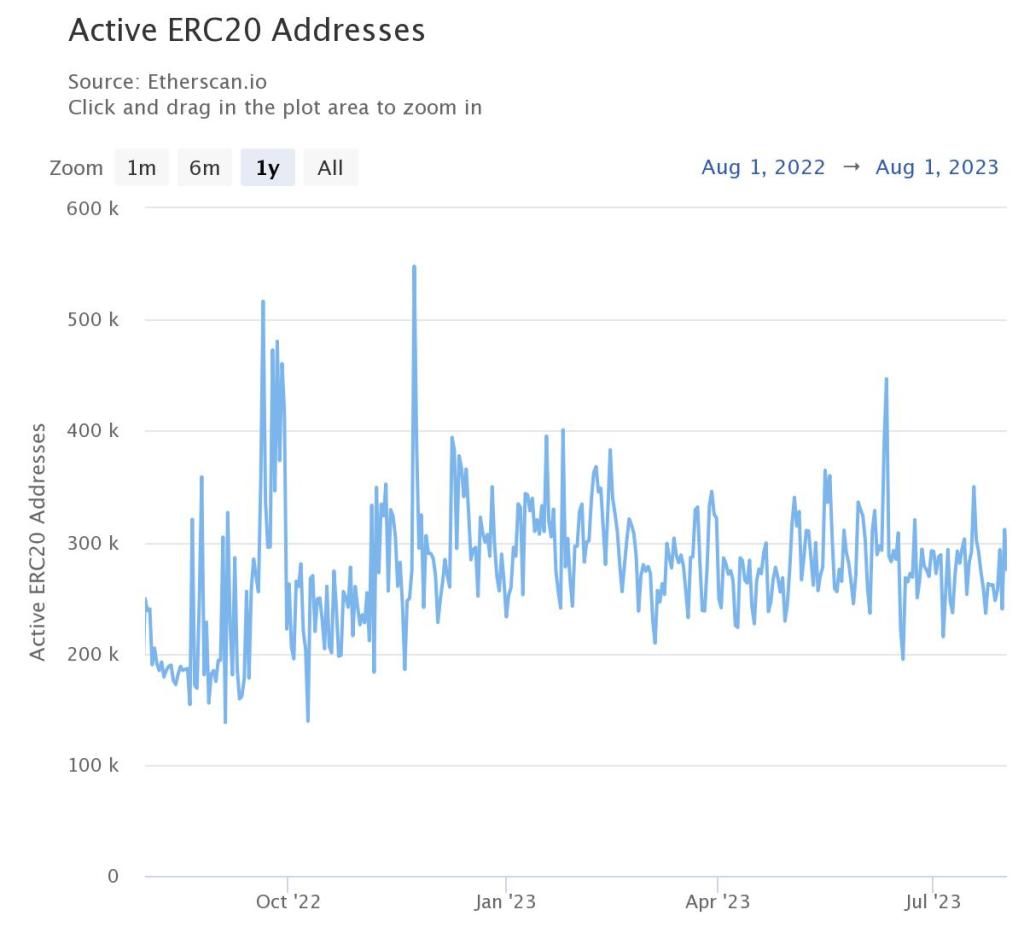

In keeping with Etherscan data, the variety of energetic ERC-20 addresses has not modified a lot in 2023. It has stayed between 200,000 and 300,000 whereas Ethereum costs stagnate under July 2023 highs. As of August 2, there have been about 275,000 energetic ERC-20 addresses, up from 156,000 on June 18. Though exercise has been low total, there was a major improve on June 11, with over 446,000 energetic ERC-20 addresses.

Ethereum’s worth trajectory has been tumultuous in tandem with this exercise sample, wanting on the charts. As an example, Ethereum bulls have didn’t breach the $2,100 liquidation stage posted within the latter phases of H1 2023.

Ethereum Costs Risky, Few Cash Burned

In the mean time, ETH costs hover across the $1,800 vary, teetering precariously and prone to drop, taking a look at candlestick preparations within the day by day chart. Though Ethereum has been bullish up to now two months, bulls have been tamed, and a drop under the $1,800 stage could sign a shift from bullish to bearish within the medium time period.

With ETH underneath strain, the variety of energetic ERC-20 addresses stays fixed and comparatively decrease than the 2021 peaks. This implies there’s much less demand for ETH, which is used to pay transaction charges. Because of this, gasoline charges are decrease as a result of there’s much less competitors for block area. Usually, this might encourage extra individuals to take part and even deploy advanced contracts in decentralized finance (DeFi).

With EIP-1559 within the equation, low exercise means fewer cash are taken out of circulation. Regardless of low community exercise, the protocol continues to challenge 2 ETH after every validated block, watering down deflationary results enforced by EIP-1559.

DeFi Actions Falling

Falling exercise might be attributed to the waning curiosity in decentralized finance (DeFi) actions over current months. As of August 2, the overall worth locked (TVL) remains under $50 billion, with a good portion of belongings tied in Ethereum. DeFi initiatives like LidoDAO, Curve, and Uniswap facilitate the buying and selling of ERC-20 tokens.

Moreover, on-chain information highlights USDT as essentially the most actively transacted token. Given its place because the third-largest coin by market cap, with substantial circulation in Ethereum and Tron networks, such a pattern is anticipated.

Trying again at ERC-20 transactions from June and July, it’s evident that transfers stayed fixed regardless of non permanent worth will increase. Ethereum costs rose from $1,630 to $2,000 between mid-June and mid-July 2023, however ETH is now decrease.

On-chain ERC-20 exercise has remained secure regardless of worth volatility. It’s unclear whether or not there will probably be a change in exercise as costs proceed to drop. Nevertheless, decrease costs could drive token holders to attend and see, resulting in much less exercise.

Function picture from Canva, chart from TradingView