Bitcoin might be heading down a tough path, in response to a crypto knowledgeable. As President Donald Trump enters his second week in workplace, a brand new coverage buzzword has shocked many: tariffs.

As White Home press secretary Karoline Leavitt shared, a 25% tariff will likely be imposed on Canada and Mexico, and one other 10% obligation in China, in response to the nation’s fentanyl trade.

Associated Studying

Inventory markets responded negatively, and some observers instantly supplied their take, together with Robert Kiyosaki, who speculated that Bitcoin’s price might crash quickly.

In a shared publish, Kiyosaki warned that Bitcoin, gold, and silver might crash as this triggers volatility. Bitcoin is buying and selling above $101k, down by 2.7% from yesterday’s shut.

BTC, Collectively With Gold And Silver, Could Crash Following Tariff Announcement

Writer and veteran investor Robert Kiyosaki shared his ideas on the Trump administration’s plan to impose tariffs on a number of nations. Kiyosaki predicts that this new rule might set off a slide in costs for high property, together with Bitcoin, gold, and silver.

TRUMP TARRIFS BEGIN: Gold, silver, Bitcoin might crash. GOOD. Will purchase extra after costs crash. Actual downside is DEBT….which can solely worsen. CRASHES imply property are on sale. Time to get richer.

— Robert Kiyosaki (@theRealKiyosaki) January 31, 2025

In a Twitter/X publish, Kiyosaki admitted that the brand new coverage might trigger excessive volatility. Nonetheless, he additionally famous that it may be the proper alternative for traders and different consumers to purchase these property and enhance their holdings. For Kiyosaki, market crashes translate to low-cost property on the market, which may profit these seeking to revenue.

Dense Bitcoin Provide

Glassnode, a blockchain analytics firm, supplied its tackle potential Bitcoin worth clusters. Based on its research, a substantial quantity of Bitcoins was traded in $94k to $101k over the previous 45 days.

The agency added that this growth created a dense provide, with $98k potential assist. It additional added that if this Bitcoin assist holds, then the asset’s worth will seemingly surge.

Tariff Information, Different Macroeconic Components Could Influence BTC, Different Property

With the brand new tariffs taking impact on February 1st, analysts warn of utmost market volatility beginning subsequent week. The diploma of crypto volatility might depend upon the US jobs knowledge launched subsequent week.

Trump admitted that whereas these new tariffs might trigger short-term market disruptions, he isn’t involved. As an alternative, he’s wanting ahead to the coverage’s long-term financial advantages. Additionally, China’s DeepSeek has disrupted the nation’s AI and tech sector, and Trump is able to impose tariffs on exports from China.

Reversing the order of my tryptic essay collection.

The Ugly will likely be printed tomorrow morning. I’m calling for a $70k to $75k correction in $BTC, a mini monetary disaster, and a resumption of cash printing that may ship us to $250k by the tip of the 12 months. pic.twitter.com/XxT4VFyzu4

— Arthur Hayes (@CryptoHayes) January 27, 2025

Associated Studying

Analyst Affords Worth Targets For Bitcoin

In the meantime, Arthur Hayes, one other common crypto analyst, echoed Kiyosaki’s sentiments. Hayes predicted {that a} mini monetary disaster might happen, with Bitcoin crashing to $70,000. He additional shared that Bitcoin might begin one other surge to $250k after hitting this backside.

On the time of writing, Bitcoin was trading at $100,262, down 2.5% and a couple of.4% within the each day and weekly timeframes.

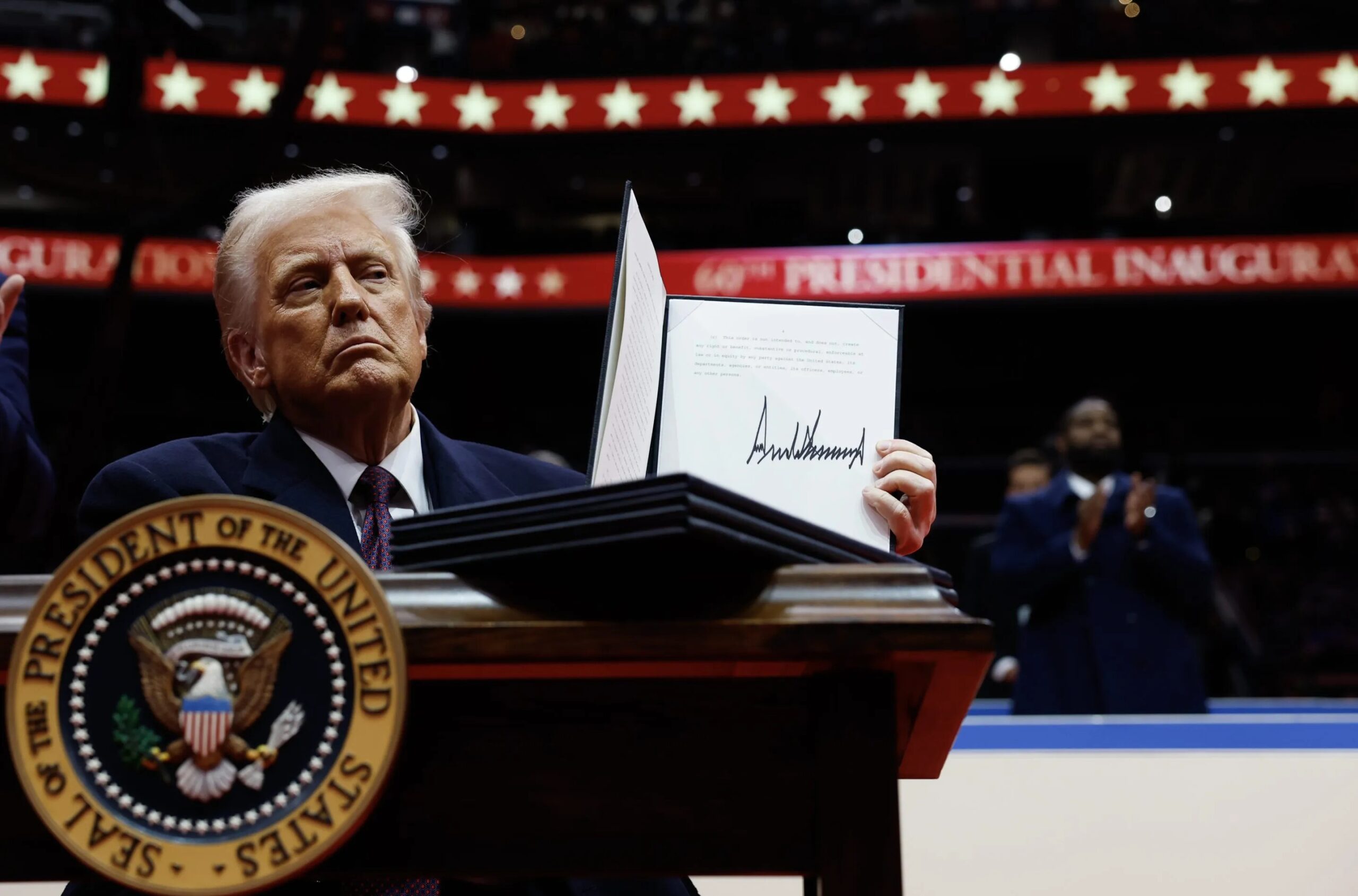

Featured picture from Fortune, chart from TradingView