Crypto alternate Kraken’s subsidiary is a serious beneficiary of the spot Bitcoin exchange-traded funds (ETF) in the US and Hong Kong, as per a modern report by Bloomberg. The corporate predicts $1 billion of property beneath administration (AUM) in spot Bitcoin and Ether ETFs in Hong Kong, in addition to different markets to see the itemizing of spot crypto ETFs.

Kraken’s CF Benchmarks Good points 50% of Crypto Benchmarking Market

CF Benchmarks, a subsidiary of crypto alternate Kraken, noticed a large improve in demand for its indices amid a boon in spot Bitcoin ETFs. America and Hong Kong are main monetary hubs bringing publicity of already established institutional traders base to Bitcoin.

The corporate mentioned it represents virtually 50% market share within the crypto benchmarking market because of launch of spot Bitcoin ETFs within the U.S. in January and in Hong Kong final yr. It offers information for about $24 billion in crypto ETFs, primarily BlackRock’s iShares Bitcoin ETF with $16.2 billion AUM.

CF Benchmarks expects its income to virtually double this yr, as per the rising demand for spot Bitcoin ETF. The final out there income information signifies it reached £6 million ($7.5 million) in 2022. As well as, the agency plans to develop headcount by round a 3rd to greater than 40. Kraken acquired CF Benchmarks in 2019.

South Korea and Israel Are Subsequent in Crypto ETFs Race

CF Benchmarks chief government officer Sui Chung sees them working with crypto ETFs issuers in South Korea and Israel subsequent. South Korea has one of many largest crypto customers, with excessive buying and selling volumes impacting crypto costs.

“South Korea is a market the place ETFs have develop into the wrapper of alternative for long-term financial savings. Additionally it is a market the place digital property have gained a excessive diploma of adoption,” mentioned Sui Chung.

The corporate expects Hong Kong-based spot Bitcoin and Ether ETFs to witness $1 billion in funds beneath administration by year-end.

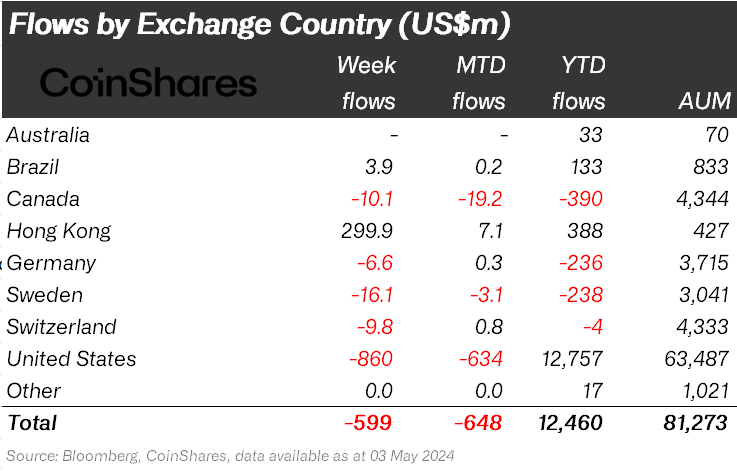

CoinShares head of analysis James Butterfill revealed Hong whereas different markets endure outflows from digital asset merchandise, Hong Kong noticed $300 million in inflows to date this week.

Additionally Learn:

The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: