Kyrgyzstan has taken a concrete step towards making a state-held reserve of crypto property—centered, in apply, on Bitcoin—alongside government-backed mining operations.

Kyrgyzstan Targets Bitcoin Reserve And State Mining

At a September 9 hearing of the Zhogorku Kenesh (parliament) Committee on Price range, Financial and Fiscal Coverage, Minister of Financial system and Commerce Bakyt Sydykov mentioned draft amendments to the Regulation “On Digital Belongings” would introduce the ideas of “state mining” and a “state cryptocurrency reserve.”

He argued the reserve could be constructed via a number of channels—“mining, tokenization of actual property and the issuance of stablecoins backed by the nationwide forex”—and that the mechanism would “strengthen the nation’s monetary stability and supply new accumulation instruments.”

The minister anchored the dialogue in arduous numbers concerning the sector’s scale. From January via July 2025, turnover throughout firms working in Kyrgyzstan’s crypto financial system “exceeded 1 trillion soms,” producing “900 million to 1 billion soms” in tax income. Official registries now record 169 crypto exchangers, 13 crypto exchanges and 11 mining corporations, Sydykov mentioned.

Power safety—and what asset the state would really mine—dominated the committee change. MP Dastan Bekeshev warned that “about 800 thousand kilowatts are required to mine one bitcoin. That is sufficient power to energy about 1,200 residences for a month. Winter is coming—is it definitely worth the danger?”

In reply, Sydykov mentioned Kyrgyzstan applies separate energy tariffs to mining and that the state would adhere to them. He pressured no mining farms could be sited at thermal energy vegetation (TPPs) or on the under-construction Kambar-Ata-1 hydro facility. “The principle objective of thermal energy vegetation and hydroelectric energy vegetation, together with the Kambar-Ata-1 underneath building, isn’t associated to mining. The capability of small hydroelectric energy vegetation is used for this space: 17 of them are presently working, and one other 15 tasks are underneath implementation,” the minister mentioned.

The draft overhauls market guidelines as nicely. Sydykov mentioned that starting January 1, 2026, any crypto change searching for to function domestically should maintain not less than 10 billion soms in approved capital—a prudential bar the federal government says is designed to “strengthen confidence out there and develop the crypto trade within the nation.”

Native media monitoring the invoice’s progress notice that “state mining” is outlined because the extraction of digital property utilizing state power, infrastructure and technological sources, with the reserve to be shaped not solely from mining proceeds but additionally from token issuance and acquisitions of digital property owned by the state.

Whereas the invoice’s language persistently makes use of “cryptocurrency reserve,” the committee change and danger framing centered on Bitcoin. Bekeshev’s power-use comparability explicitly referenced “one bitcoin,” and the federal government’s most well-liked provide supply—mining—factors to BTC first.

Kyrgyzstan Races Kazakhstan In Central Asia’s Crypto Push

That sensible emphasis additionally aligns with prior coverage signaling. In mid-April, Kyrgyzstan’s Nationwide Funding Company signed a strategic memorandum with Binance co-founder Changpeng Zhao, formally appointing him as an advisor on nationwide blockchain coverage and Web3 technique. In early Could, throughout a go to to Bishkek, Zhao publicly instructed that the nation use Bitcoin—alongside BNB—because the preliminary property for a nationwide crypto reserve.

The push comes as Kyrgyzstan’s crypto sector has grow to be each a price range contributor and a geopolitical flashpoint. The surge in home platform exercise has coincided with Western sanctions scrutiny, together with British and US measures in August concentrating on entities linked to a rouble-pegged stablecoin community and Kyrgyz corporations alleged to have aided Russian sanctions evasion—strain that prompted President Sadyr Japarov to publicly attraction to Washington and London. The federal government has rejected wrongdoing claims and emphasised that crypto-related banking operations are underneath state oversight.

Regional context is shifting in parallel. Neighboring Kazakhstan has simply proposed making a nationwide “crypto reserve fund” underneath its State of the Nation blueprint, a part of a broader digital-assets agenda that features a pilot “CryptoCity” and new laws by 2026.

Analyst Daniel Batten highlighted a key distinction with different Bitcoin-curious states, noting on X that, “Not like El Salvador, Pakistan, Argentina, CAR, Kazakhstan does not have an IMF loan—so this order is more likely to undergo unimpeded.” If Astana proceeds, it will mark a second Central Asian sovereign constructing a proper digital-asset buffer, intensifying regulatory and aggressive dynamics within the area.

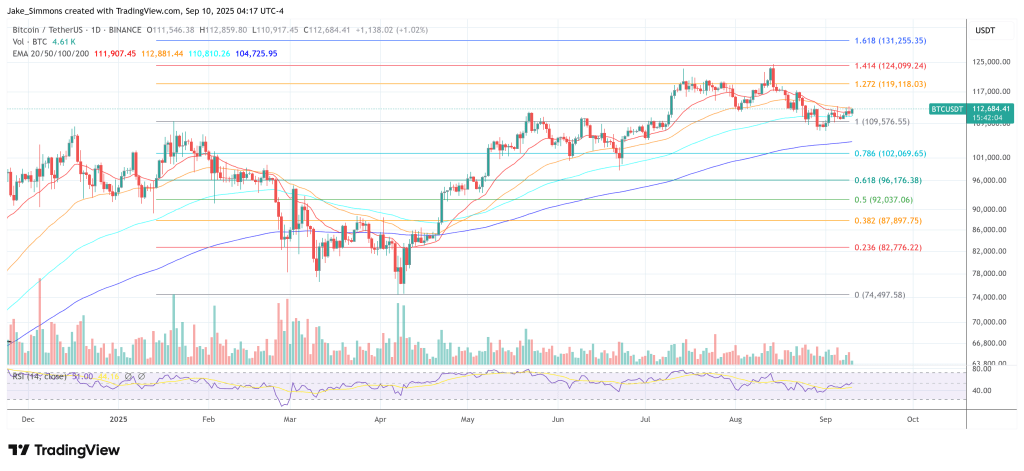

At press time, Bitcoin traded at $112,684.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.