The present development of the Bitcoin realized cap has fashioned a sample that has traditionally been a bullish sign for the crypto’s worth.

Bitcoin Realized Cap 30-Day Fee Of Change Has Turned Optimistic

As identified by an analyst in a CryptoQuant post, the BTC realized cap 30-day fee of change has simply turned optimistic in worth.

There are two very fashionable varieties of capitalizations for any asset: the market cap and the realized cap. The previous is calculated by merely multiplying the provision of Bitcoin by its present worth in USD.

The latter, alternatively, is a little more sophisticated. As a substitute of the present worth, this cover multiplies every coin within the complete BTC provide by the worth it final moved at.

Associated Studying | There Are Only 2 Million Units Of Bitcoin Left To Mine – Why Does It Matter?

For instance, if 1 BTC moved at $60k 5 months in the past, then its contribution to the realized cap can be 1*60,000. Whereas below market cap, its worth can be 1*46,000 as a substitute (taking $46k as present worth).

The benefit of the realized cap over the market cap is that some quantity of the Bitcoin provide could be misplaced without end resulting from varied causes like misplaced keys, and so their contribution to the realized cap can be small (assuming the worth has been growing for the reason that cash went dormant), whereas the market cap will take their worth equal to another coin, despite the fact that the misplaced BTC won’t ever go into buying and selling once more.

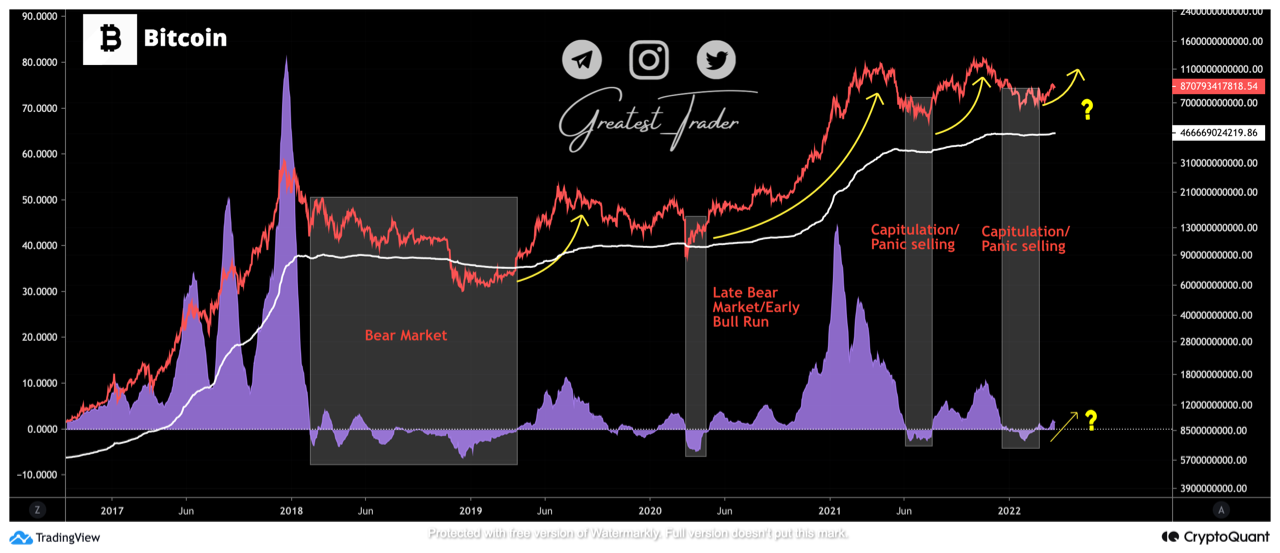

Now, here’s a chart that reveals the tendencies within the realized cap in addition to its fee of change over 30 days:

Appears like the worth of the speed of change has turned optimistic just lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin realized cap RoC appears to have adopted a sample over the previous few years.

It appears like every time the indicator has assumed damaging values, the worth of the crypto has noticed a bearish development.

Associated Studying | Bitcoin Vs. Ethereum: TIME’s “Prince of Crypto” And Why Satoshi Is King

Quite the opposite, optimistic values have traditionally marked an uptrend for the BTC worth. Not too long ago, the realized cap RoC appears to have shifted into such values once more.

If the sample from the previous couple of years follows this time as effectively, then the development proper now could level in direction of a bullish final result for Bitcoin at the least for the quick time period.

BTC Value

On the time of writing, Bitcoin’s price floats round $45.9k, down 3% previously week. The under chart reveals the development within the worth of the coin during the last 5 days.

BTC's worth appears to have moved sideways over the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com