Bitcoin worth has rallied 170% this 12 months as bulls strongly push costs above key help ranges. Merchants are actually anticipating one other upside transfer and shutting the 12 months close to $50,000. A number of main components verify that Bitcoin and the crypto market will attain a brand new all-time excessive (ATH) in a number of months.

Bitcoin Worth Set For New ATH

Firstly, Merchants, retail traders and institutional traders are actually assured about their subsequent transfer because the U.S. Federal Reserve stored rates of interest unchanged within the FOMC meeting on Wednesday. Fed Chair Jerome Powell made it clear that they plan to announce three charge cuts in 2024, as inflation cools.

Crypto knowledgeable and BitMEX co-founder Arthur Hayes suggests there isn’t a excuse to not be long on crypto. He reiterates that Bitcoin worth will hit $1 million and cited a Bloomberg report on merchants going all in ressponse to the financial coverage pivot in 2024.

“What number of extra instances should they inform you that the fiat in your pocket is a grimy piece of trash. Consider within the Lord, and he shall set you free,” mentioned Arthur Hayes.

Secondly, 10-year US Treasuries yield fell beneath 4% for the primary time since August, renewing the bullish sentiment. Furthermore, US greenback index (DXY) fell to 102.28 because the central financial institution turns dovish regardless of inflation nonetheless above the two% goal.

Bitcoin halving is now simply few month away and traders are bullish sufficient to take each shopping for alternative. In accordance with NiceHash countdown, the Bitcoin halving is estimated to occur on April 12, 2024. The mining reward will probably be lowered to three.125 BTC.

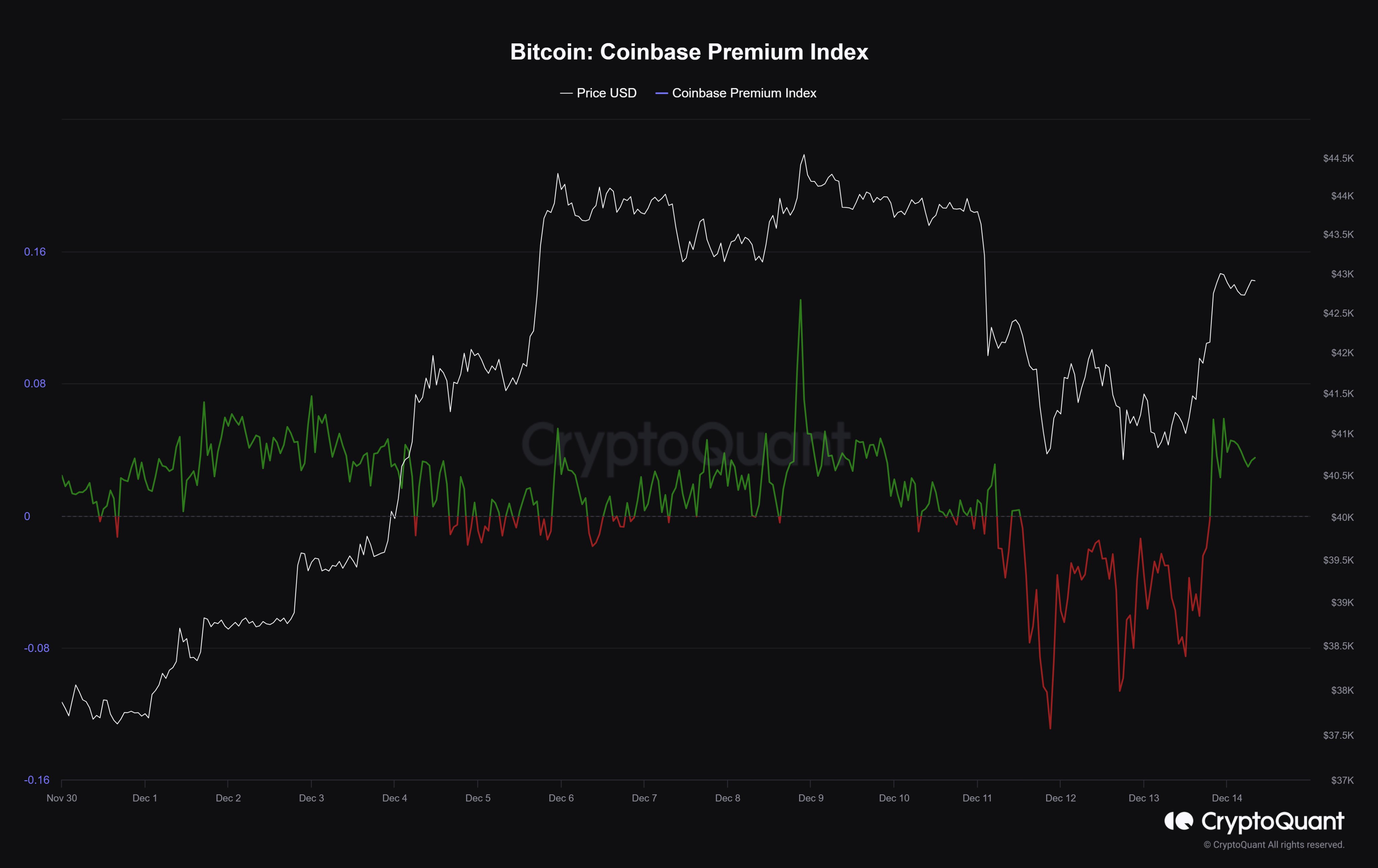

On-chain information is bullish and crypto alternate volumes are growing. Bitcoin Coinbase Premium Index signifies sturdy shopping for stress on Coinbase. Additionally, Bitcoin open interest (OI) on prime derivatives exchanges CME and Binance are rising once more. Merchants are going lengthy on cryptocurrencies. Nevertheless, merchants can anticipate volatility within the coming days.

Excessive anticipation of Spot Bitcoin ETF approval by the US SEC in January and rising digital asset inflows confirms a large rally in Bitcoin worth. Matrixport Analysis predicted BTC price hitting $60,000 earlier than Bitcoin halving.

The crypto market might additionally see enhancing regulatory readability, lawsuits and different battle will fade regularly.

Additionally Learn:

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: