The price of Ethereum has not precisely lived as much as its promise because the month has gone on, regardless of a stellar begin to the month. Whereas this bearish stress has been widespread within the common cryptocurrency market, regulation uncertainty has been a further concern for ETH, igniting a adverse sentiment across the “king of altcoins.”

Curiously, the most recent on-chain revelation reveals a considerable quantity of Ethereum has made its solution to exchanges to this point in March, suggesting that traders could be shedding confidence within the long-term promise of the cryptocurrency.

Are Traders Shedding Confidence In Ethereum?

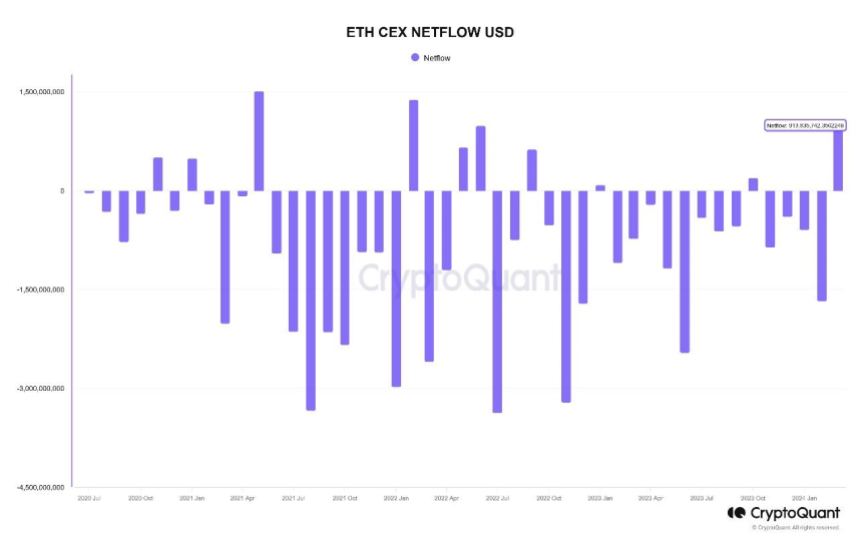

In line with knowledge from CryptoQuant, greater than $913 million has been recorded in web ETH transfers to centralized exchanges to this point in March. This on-chain data was revealed by way of a quicktake post on the information analytics platform.

This web fund motion represents the most important quantity of Ethereum transferred to centralized exchanges in a single month since June 2022. Regardless that March continues to be every week from being over, this trade influx seems to be an entire deviation from the sample noticed over the previous few months.

Chart exhibiting whole month-to-month netflow of ETH on centralized exchanges | Sources: CryptoQuant

As proven within the chart above, October 2023 was the final time cryptocurrency exchanges witnessed a constructive web stream. It’s value noting that there was vital motion of Ethereum tokens out of the centralized platforms in subsequent months up till this month.

In the meantime, a separate knowledge level that helps the huge exodus of ETH to centralized exchanges has come to mild. Fashionable crypto analyst Ali Martinez revealed on X almost 420,000 Ethereum tokens (equal to $1.47 billion) have been transferred to cryptocurrency exchanges previously three weeks.

The stream of large amounts of cryptocurrency to centralized exchanges is usually thought-about a bearish signal, as it may be a sign that traders could also be prepared to promote their belongings. In the end, this may put downward stress on the cryptocurrency’s value.

Substantial fund actions to buying and selling platforms might additionally characterize a shift in investor sentiment. It might be an indication that traders are shedding religion in a specific asset (ETH, on this case).

Furthermore, the latest regulatory headwind surrounding Ethereum particularly accentuates this speculation. In line with the latest report, america Securities and Trade Fee is contemplating a probe to categorise the ETH token as a safety.

ETH Value

As of this writing, the Ethereum token is valued at $3,343, reflecting a 4% value decline over the previous /4 hours. In line with knowledge from CoinGecko, ETH is down by 11% previously week.

Ethereum loses the $3,400 stage once more on the each day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data supplied on this web site solely at your personal threat.