Blockchain analysis platform Arkham Intelligence has revealed the on-chain addresses of a number of Bitcoin Spot Change-Traded Funds (ETFs), within the pursuit of transparency inside the crypto group.

Bitcoin ETF Addresses Unveiled By Arkham

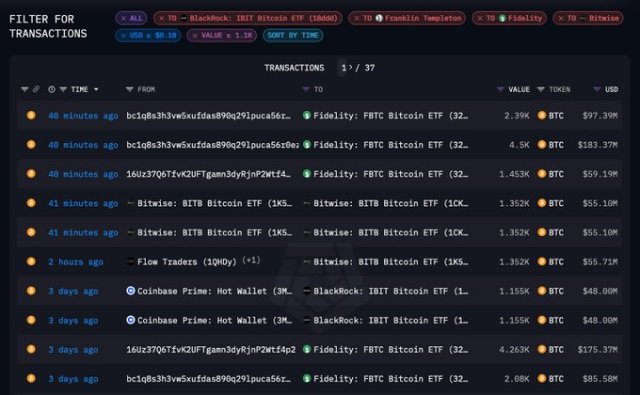

Marcel Knobloch, often known as Collin Brown, an XRP fanatic, shared the data with the group on the social media platform X (previously Twitter). In keeping with Brown, the blockchain analytics agency launched on-chain areas for 4 distinct Bitcoin ETFs resembling Blackrock, Fidelity, Bitwise, and Franklin Templeton.

Within the X publish, Brown highlighted a breakdown of every firm’s present Bitcoin holdings and worth. His publish was additionally accompanied by a screenshot and hyperlinks from Arkham for additional particulars.

In keeping with Brown, the IBIT iShares Bitcoin Belief has about 28,620 BTC, which is estimated to be price $1.16 billion. He additionally asserted that the Constancy Smart Origin Fund has about 29,910 BTC holdings, valued at roughly $1.21 billion.

He recognized the BITB Bitwise Bitcoin ETF with a holding of 10,150 BTC, valued at roughly $422.68 million. In the meantime, the EZBC Franklin Bitcoin ETF holds 1,160 BTC, which is price about $47.09 million.

The newest disclosures happen some months after Arkham asserted in September final yr to have the addresses of the Grayscale Bitcoin Trust (GBTC) recognized. GBTC stands as the biggest holder of BTC amongst ETF issuers, with 558,280 BTC, valued at $29 billion.

This data from Arkham Intelligence is important for all the crypto area. It’s because it gives a transparent overview of those institutional agency’s on-chain operations for each particular person traders and market watchers.

The true market affect and holdings of those monetary companies have at all times been tough to find out as a result of their conventional secrecy. With such disclosure, there will likely be an intensive information of the institutional crypto actions and their impression available on the market.

With its motion, Arkham has signaled a shift within the crypto investments trade towards elevated transparency and accountability. The necessity for such openness is anticipated to rise because the sector develops, making a path for extra educated and data-driven funding decisions.

Want For Extra On-Chain BTC ETF Tackle Revelation

The latest growth tends to place Arkham within the highlight, because the agency turns into the “first to publicly identify these addresses.” The revelation has sparked pleasure inside the crypto group, with members expressing gratitude to the platform for its actions.

Loads of crypto fanatics have been urging Bitcoin ETF suppliers to reveal the addresses supporting their merchandise to ensure the safety of BTC. A number of trade watchers even proposed that to extend competitors, ETF suppliers will finally must reveal these addresses.

Nonetheless, safety considerations have been raised by some executives concerning the disclosure of Bitcoin ETF’s on-chain addresses.

Featured picture from iStock, chart from Tradingview.com