Spot Bitcoin ETFs noticed one other huge influx of $493.3 million on Monday, the third-largest internet influx so far, as BTC value breaks above $50,000. Specialists consider BTC value rally will proceed amid demand build-up from Bitcoin ETFs and derivatives merchants.

Spot Bitcoin ETF Noticed $493.3 Million Internet Influx

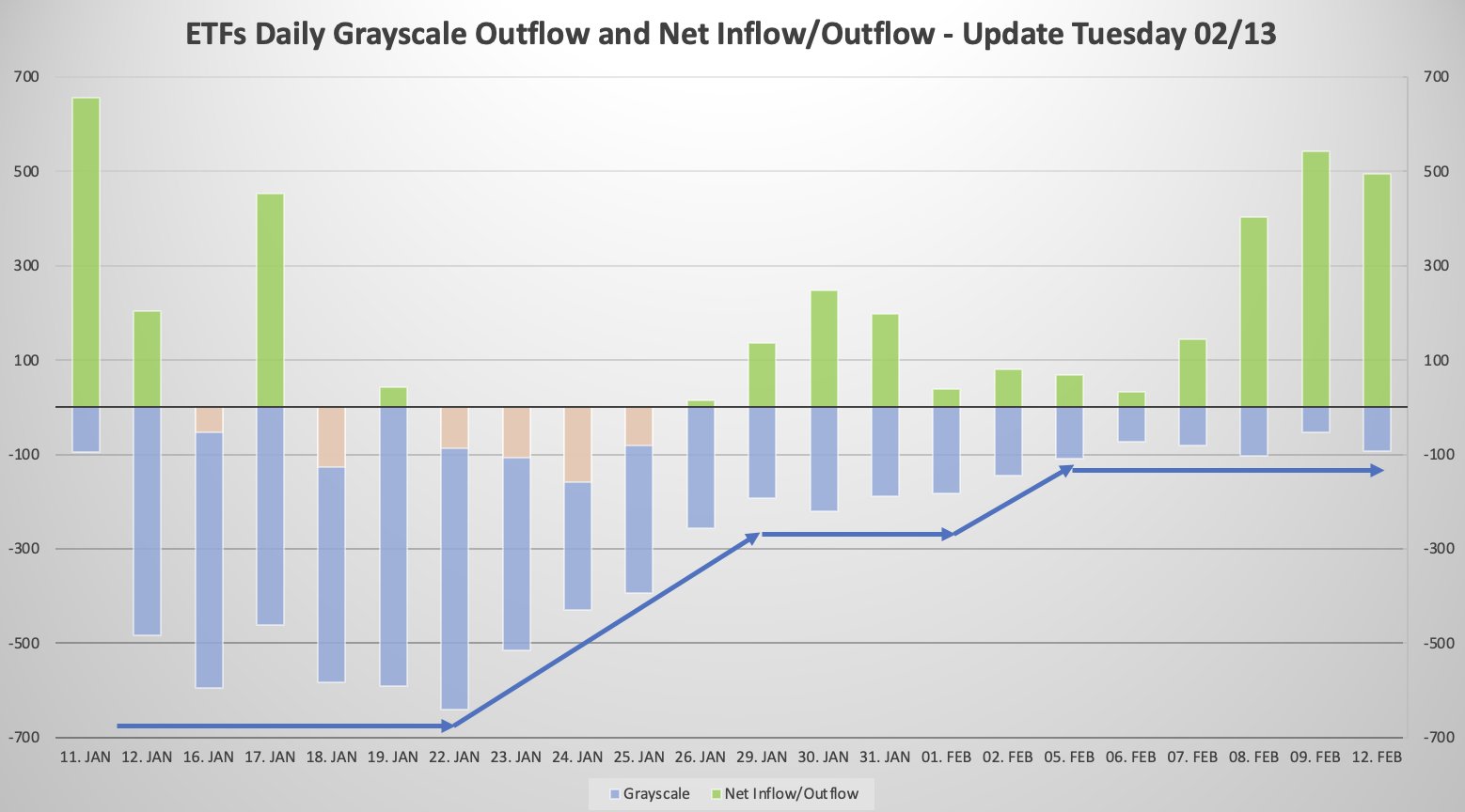

The brand new 9 and Grayscale’s GBTC spot Bitcoin ETF began the week strongly with a $493.3 million internet influx on February 12, in line with the most recent Bitcoin ETF circulate knowledge.

BlackRock (IBIT) recorded a document influx of $374.7 million, with whole influx reaching over $4.126 billion. BlackRock Bitcoin ETF now has asset holdings price $4.76 billion.

Constancy (FBTC) and Ark 21Shares (ARKB) Bitcoin ETF inflows have been $151.9 million and $40 million, respectively. Bitwise (BITB), VanEck (HODL), and others additionally noticed important inflows. Nonetheless, Invesco Galaxy Bitcoin ETF (BTCO) witnessed one other outflow of $20.8 million.

Furthermore, GBTC noticed a $95 million outflow, a rise from Friday’s 51.8 million outflow, however it’s aligned with final week’s vary.

Thus, the online influx for spot Bitcoin ETFs, excluding GBTC, was $589 million. The overall inflows for BlackRock and Constancy Smart Origin Bitcoin ETFs are $4.12 billion and $3.15 billion, respectively. The ETFs are shopping for 10k Bitcoin per day on high of the usual equilibrium and that is mirrored within the value appreciation.

Additionally Learn: Key Reasons Why BTC Soars Past $50K

Bitcoin Worth Outlook

BTC price rose past $50,000, with excessive odds of breaking $55,000, which corresponds with a notable circulate into Bitcoin ETFs. Crypto Concern & Greed Index hit “excessive greed” with a worth of 79, the very best since November 2021.

Bitcoin ETF noticed a internet influx of $542 million on Friday as traders FOMO the transfer in the direction of all-time excessive. The demand from Bitcoin ETFs and derivatives merchants continues to rise, however the provide from miners stays low. The paradigm shift in provide dynamics are inflicting institutional traders to be tremendous bullish on Bitcoin.

Bitcoin derivatives merchants are even making name bets for as excessive as $70,000 by the month finish. Specialists consider new consumers could not get the chance to purchase BTC beneath the $50K value if demand stays greater in pre-Bitcoin halving trades.

Learn Extra: Wall Street Estimates for US CPI and Core CPI, Bitcoin (BTC) Price To $45K or $55K?

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: