On the time of writing, the altcoin market was buying and selling within the inexperienced owing to the king coin’s upward climb over the past 24 hours. Matic occurred to be one of many prime gainers, it had secured a staggering 30.1% improve over the previous day. The altcoin has galloped and hit a multi-month excessive after the crash that occurred on December 4 whereas the bulls may try to revisit the all-time excessive. On the time of writing, MATIC was priced at $2.34 with an overhead resistance at $2.44.

MATIC Worth Evaluation

Technicals for MATIC remained constructive in correspondence to the surge in costs, the altcoin had misplaced nearly 34% of its worth publish the crash and now it has propelled to make up for many of it. The shopping for power has additionally proven restoration since December 4.

Superior Oscillator additionally flashed inexperienced alerts, which indicated bullishness out there and one other upswing may trigger the token to interrupt previous its $2.44 resistance at contact its all-time excessive. MACD underwent a bullish crossover and pointed in the direction of constructive value motion.

Relative Energy Index was above the half-line as shopping for stress recovered, nonetheless, the indicator displayed a downtick which could sign in the direction of a value reversal. Incase of which, the coin would possibly discover assist on $2.06 after which at $1.85. Different assist strains relaxation at $1.76, $1.55 and $1.49.

Chainlink Worth Evaluation

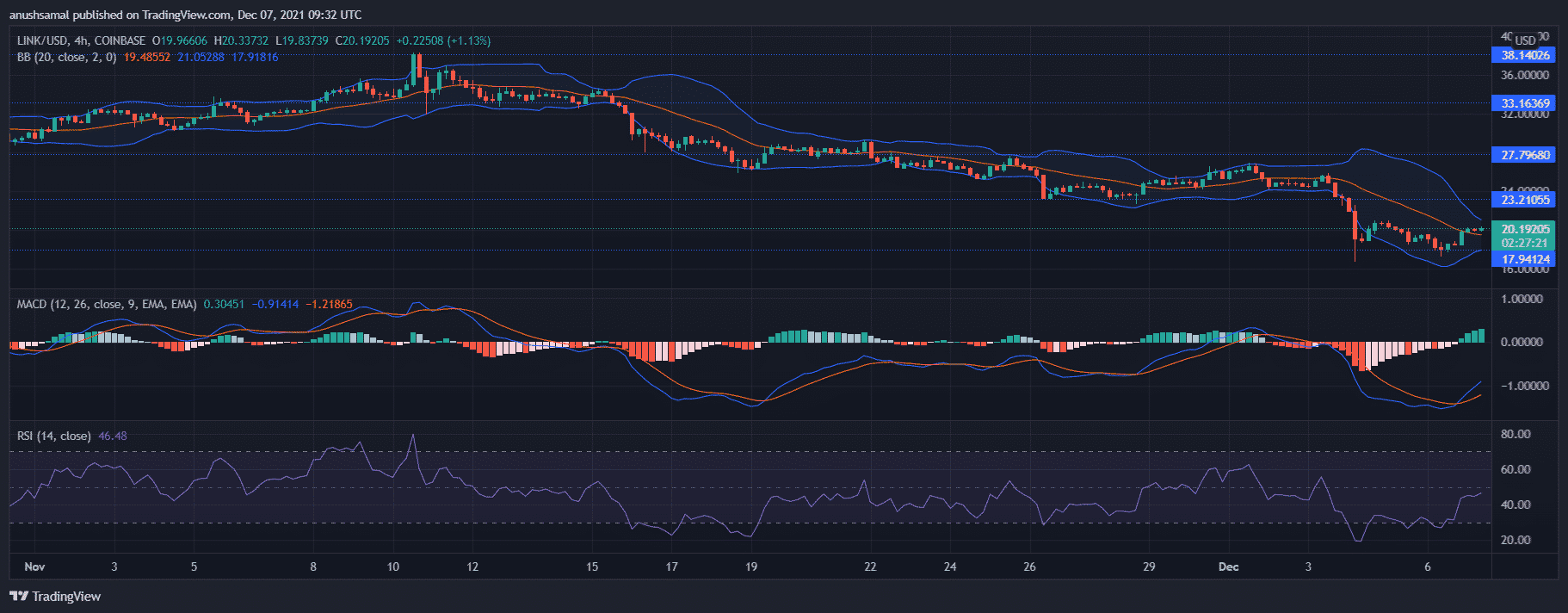

It has been a bearish run for Chainlink over the previous week, a lot to its reduction, the coin surged 13% over the past 24 hours. The outlook for the altcoin additionally displayed restoration on its 4-hour chart by registering constructive shopping for power. AT the time of writing, the coin was buying and selling at $20.19 with its overhead resistance at $23.21. Different value ceilings rested at $33.16 after which at its multi week excessive of $38.14.

MACD displayed a bullish crossover, indicating that the coin has recovered over the past 24 hours. Bollinger Bands converged closely, indicating that costs may not present volatility over the instant buying and selling periods, nonetheless, it may additionally point out probabilities of a value reversal.

Relative Energy Index displayed elevated shopping for power, though the indicator was parked throughout the bearish zone. In case of a fall from the present value ranges, the instant assist stage was at $17.94.

Algorand Worth Evaluation

Algorand was buying and selling for $1.76 and has lastly exhibited appreciable achieve of 6% over the past 24 hours . For over a month the coin has been consolidated and the value motion remained sandwiched between $2.23 and $1.60. Main resistance marks for ALGO was at $1.97 and $2.23. The technicals have indicated a restoration over the previous 24 hours.

MACD underwent bullish crossover and pointed in the direction of constructive value motion. Capital inflows have additionally recovered as indicated by the Chaikin Cash Circulation. In accordance with the identical, Relative Energy Index additionally displayed constructive shopping for stress.

Incase the bulls drag down the costs down once more, ALGO would possibly meet with its $1.60 and $1.45 assist ranges. In current information, Algorand’s TVL surpassed the $100 million mark.

Disclaimer

The offered content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.