Crypto analysts have noticed a big shift in investor sentiment over the previous a number of weeks, suggesting a extra educated investor base, even among the many retail holders.

Beforehand dominated by speculative meme cash, the market is now more and more centered on high-tech altcoin tasks with real-world utility and novel blockchain options.

Investor Curiosity Shifts to RWA and DeFi

Web3 data platform Kaito AI and insights from crypto analysts counsel that investor mindshare is more and more shifting towards Real-World Assets (RWAs), decentralized finance (DeFi), and superior blockchain protocols.

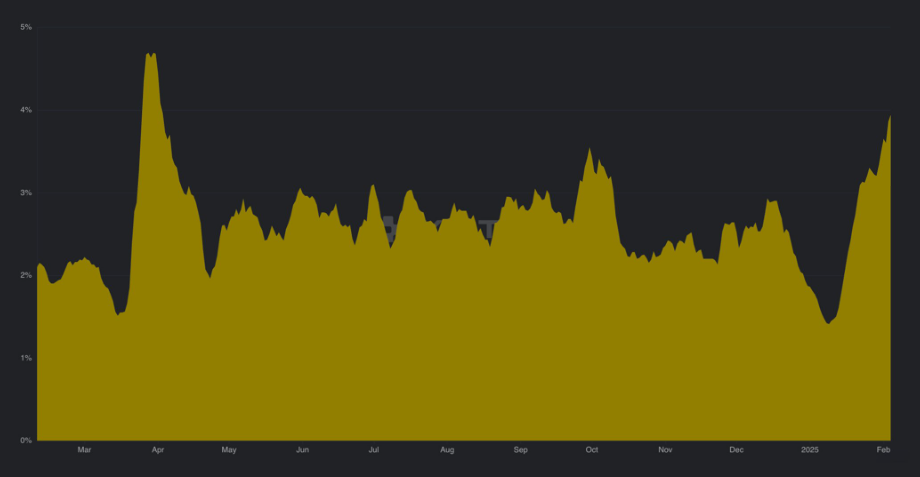

In line with Kaito AI, RWA mindshare has surged after reaching a 12-month low in January. This resurgence indicators renewed curiosity in tokenizing real-world financial assets, which has attracted institutional gamers.

Equally, DeFi has regained prominence, overtaking AI tokens in market curiosity. The resurgence of DeFi suggests a shift in the direction of extra sustainable monetary mechanisms, in distinction to the speculative nature of meme coins.

A number of blockchain tasks have emerged as main beneficiaries of this sentiment shift. Berachain (BERA) and MegaETH (WETH) have gained traction. Kaito AI’s evaluation highlights these as prime mindshare gainers.

Nonetheless, for Berachain, social dominance or client consciousness is probably going ascribed to its recent airdrop and the following listing on Binance and Bitrue. In a press release shared with BeInCrypto, Bitrue dedicated to supporting the builders on Berachain, a blockchain that introduces a singular Proof-of-Liquidity (PoL) consensus mechanism, believed to be superior to Proof-of-Stake (PoS).

“To rejoice this milestone, Bitrue is rolling out two particular occasions for the change’s customers. First, Energy Piggy Itemizing: BERA shall be obtainable in Energy Piggy, Bitrue’s versatile funding product, at 10% APR beginning February sixth at 14:00 UTC. Secondly, Deposit Contest: Customers who deposit BERA on Bitrue can win rewards primarily based on their deposit quantities,” Bitrue advised BeInCrypto.

Nonetheless, regardless of the thrill, Berachain’s token worth has seen downward strain because of post-airdrop selling, demonstrating that speculative dynamics are nonetheless at play.

Past Berachain, MegaETH, Initia, and Monad have captured the market’s consideration. These tasks deal with technical developments in scalability, DeFi, and blockchain effectivity. DeFi professional Ignas stated this renewed enthusiasm mirrors the early 2020/21 cycle. Then, tasks with substantial technical innovation garnered important hype.

“Technically modern launches are getting hype once more…It’s not simply your Degen monkey mind blindly aping into meme cash or simping for a brand new Celeb Coin – your analytical & analysis expertise might be put to motion once more,” Ignas wrote.

Traders are actually diving deeper into protocol mechanisms, farming strategies, and long-term sustainability quite than unquestioningly speculating on short-lived tendencies.

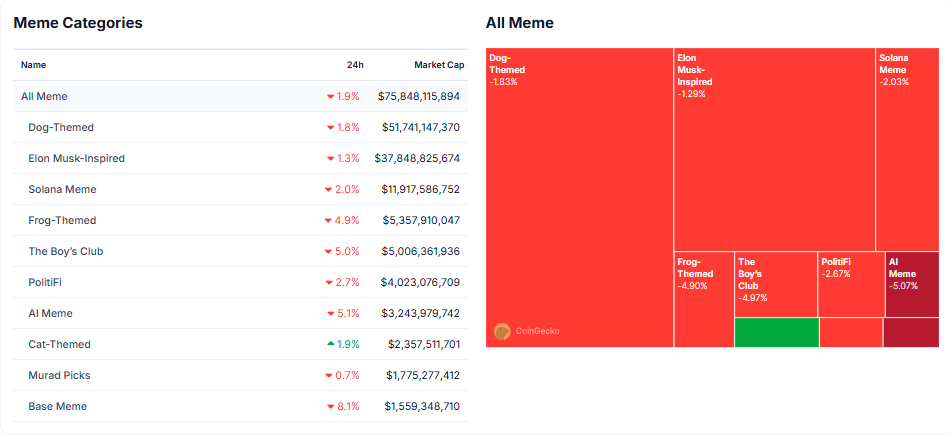

Meme Cash Lose Floor as Traders Search Fundamentals

Amid buyers’ shifting focus, the meme coin market cap is declining, with consideration shifting in the direction of tasks with technical worth. Beforehand, the speculative fervor round meme cash would drive short-term rallies. Now, their lack of elementary innovation has resulted in diminishing investor confidence.

Crypto government Tarun Gupta acknowledges the cultural shift. He cites actual development and innovation in protocols like Fluid, Balancer V3, Uniswap, and Ondo Finance.

This maturation of the crypto market signifies that buyers are starting to prioritize real-world purposes and monetary sustainability over short-term speculative buying and selling. It aligns with current insights from Glassnode, suggesting that this shift isn’t unintentional however quite a mirrored image of a extra sophisticated investor base.

Retail holders right this moment exhibit a higher understanding of blockchain technology and market adjustments than in earlier market cycles. Reasonably than chasing meme cash for fast income, buyers are conducting in-depth analysis on rising protocols. In addition they interact with tasks by governance and community-building initiatives.

Furthermore, trade observers like Ignas spotlight that tasks rewarding neighborhood engagement—corresponding to MegaETH and Berachain—are gaining traction. Then again, meme coin merchants are sometimes excluded from such incentives.

“Is it simply me? We have now all the time realized a number of classes on the right way to reward the neighborhood: Each Bera and MegaETH rewarded value-adding neighborhood members. It pays to assist tasks at an early stage through testnet or just yapping on X. Discover how Meme coin merchants didn’t make it into the whitelist/airdrop for both? I additionally really feel that those that burnt badly with altcoins are both already bought what’s left to stablecoins or consolidating in cash they really consider in,” Ignas added.

Regardless of these constructive developments, the shift towards technically novel altcoins doesn’t assure sustained market stability. Whereas many buyers are shifting towards high-tech tasks, the crypto market stays risky and sentiment-driven. The market might pivot again to meme coin hypothesis at any second, notably if broader macroeconomic conditions flip unfavorable.

Moreover, whereas DeFi and RWA tokenization are gaining traction, challenges stay concerning regulation, security, and scalability. Traders should conduct their analysis.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.