Somebody get up Inexperienced Day, as a result of September is about to finish.

So, what occurred this month in crypto? And the way do we glance as we flip the web page to October?

Bitcoin and Ethereum lag

Nothing too main, however Bitcoin and Ethereum trended down over the month. Curiously, Bitcoin drew down greater than Ethereum, which is uncommon in comparison with the sample we’ve got seen traditionally, the place Ethereum is mostly the extra unstable of the 2.

The Merge was the large information, in fact, as Ethereum accomplished the largest blockchain improve in historical past on September 15th. The occasion got here and went and not using a hitch, though pricing didn’t do a lot – suggesting it was priced in forward of time, as many suspected.

Within the short-term, there may be not a lot the Merge has affected concerning value, however it will likely be fascinating to trace going forwards now that the pipeline underworking the Ethereum ecosystem has been utterly reworked.

I’ve written earlier than about my ideas that the staking yield might even act as a “risk-free” proxy for the world of De-Fi, serving to present a framework for valuations and laying the groundwork for ETH to mature much more.

The groundwork must also enable Ethereum to decouple from Bitcoin. I’ve lengthy considered Bitcoin as cash and Ethereum as tech, and I feel this transfer additional accentuates the dichotomy – cash wants proof of labor, however the base of a DeFi system doesn’t.

However these are long-term issues and within the medium-term, we’re nonetheless very a lot correlated.

On-chain

Let’s bounce on-chain to see any notable indicators that jumped out to me over the month.

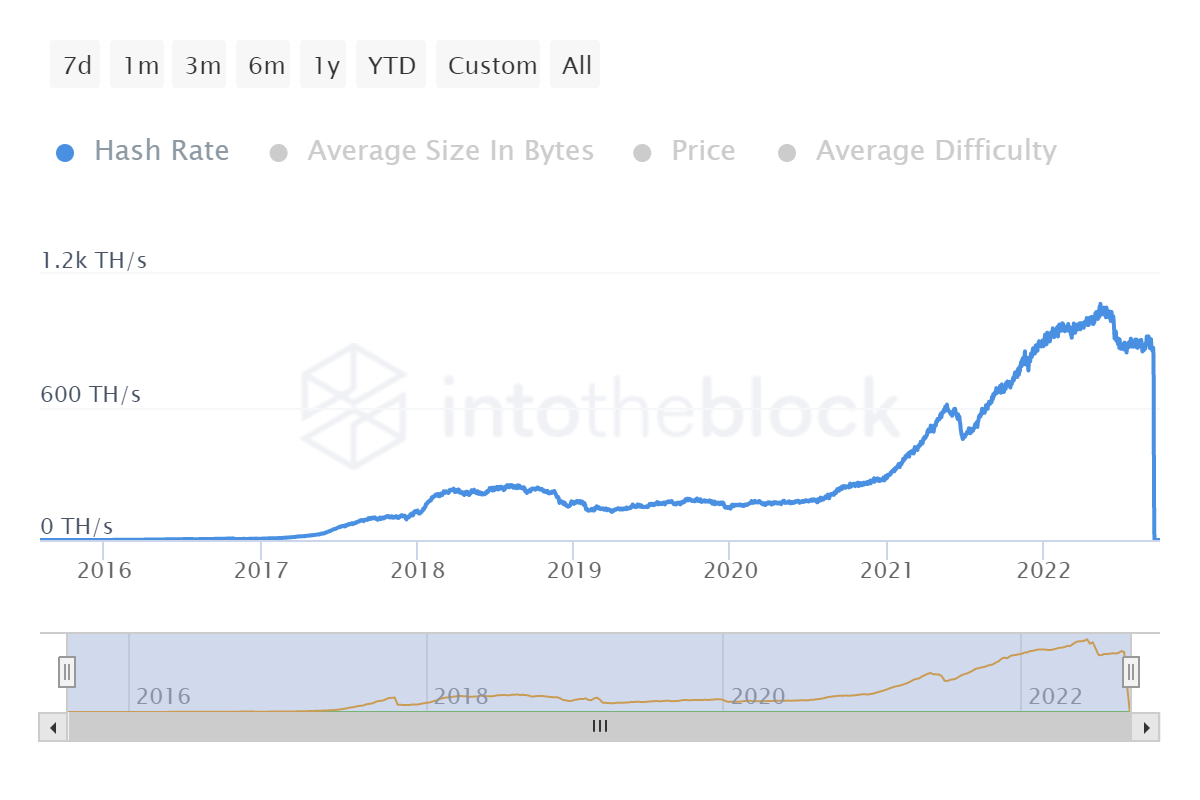

Firstly, given Ethereum accomplished the aforementioned Merge, there may be clearly no extra want for miners on the community. That is the precise reverse of ground-breaking information, however it’s nonetheless cool to see the hash price drop to zero within the beneath chart.

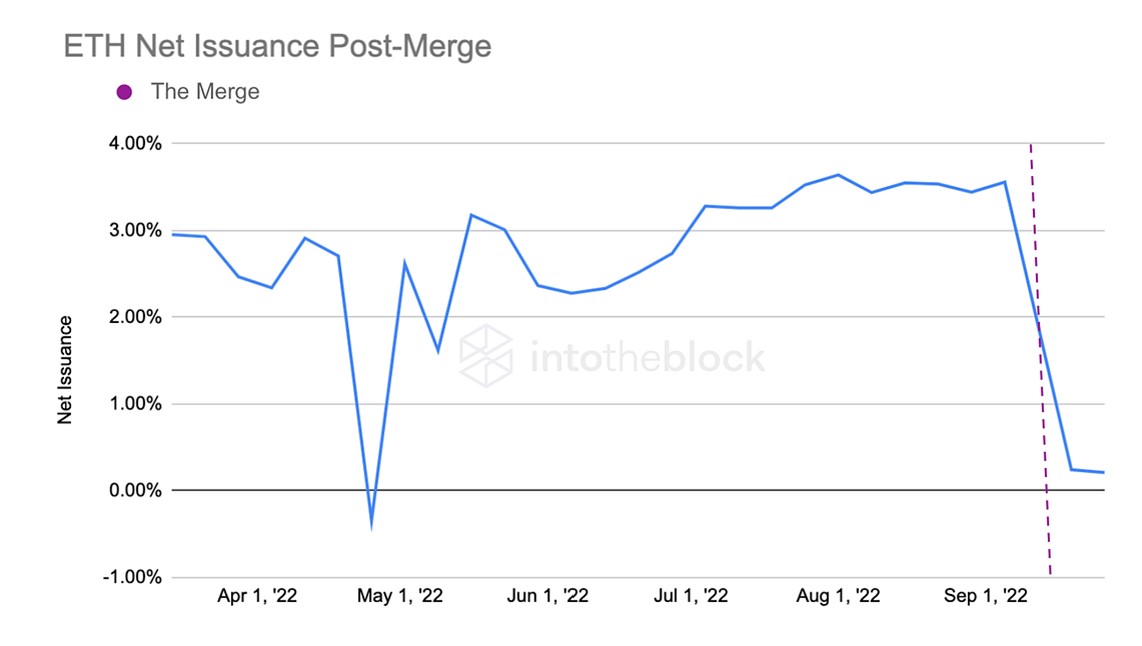

IntoTheBlock exhibits a neat graph beneath of the online issuance of ETH dropping after the Merge. It has not fallen to deflationary, which was a story many had pushed within the leadup to the Merge.

As I mentioned in earlier analyses, I consider this was extra a case of naively following a “deflationary means value go up and I need value to go up so I’ll say ETH can be deflationary” form of logic. However once more, Merge went completely and it’s cool seeing the issuance price drop so drastically.

Nevertheless, maybe extra sombrely is Ethereum charges dropping 80% quarter over quarter. That is for no different purpose than a very good old school fall in demand. The macro scenario stays completely abhorrent and it follows that demand for the community is down (I’m doubtless being a bit of harsh as Layer 2’s are partially exacerbating this fall in charges however it’s largely resulting from an general fall in demand).

Nevertheless, maybe extra sombrely is Ethereum charges dropping 80% quarter over quarter. That is for no different purpose than a very good old school fall in demand. The macro scenario stays completely abhorrent and it follows that demand for the community is down (I’m doubtless being a bit of harsh as Layer 2’s are partially exacerbating this fall in charges however it’s largely resulting from an general fall in demand).

Flicking over to Bitcoin, the proportion of long-term holders – aka diamond handers – continues to creep again up in the direction of its all-time excessive of near 64%, set this time final yr. The information exhibits that this demographic – defines as these holding Bitcoin for longer than a yr – stay unmoved, and this newest bearish month is not any completely different.

Mining

I used to be curious as as to if there could be a rise within the hash price on Bitcoin following the Ethereum merge.

Wanting on the graph beneath, displaying the final three months, there doesn’t look like a lot motion. This is smart, I suppose – there are different cash which miners are capable of flick over to simpler with their tools quite than Bitcoin.

Prime of that listing is nice previous Ethereum Traditional – a coin which I had largely forgotten about till I seen its hash price had ballooned to an all-time excessive on the date of the Merge, almost 4Xing in a single day.

Prime of that listing is nice previous Ethereum Traditional – a coin which I had largely forgotten about till I seen its hash price had ballooned to an all-time excessive on the date of the Merge, almost 4Xing in a single day.

Conclusion

In fact, this month was in regards to the Merge and nothing extra. We are able to speak about on-chain indicators all we like, and as a blockchain junkie myself, I’m very happy to take action.

However the actuality is that within the brief time period, the one factor that issues for crypto is the macro scenario. The shortage of exercise on value across the Merge proves this.

Crypto has been, and can proceed to, commerce like leveraged bets on the S&P 500 going ahead. So strap in and tune in to the phrases of Jerome Powell, as a result of that’s all that basically issues till we get some macro momentum once more and issues can begin to transfer.

Welcome again, Inexperienced Day.