The latest surge in Bitcoin worth has left buyers intently watching its efficiency because it decouples from conventional markets. For context, because the U.S. heads towards the upcoming crypto-focused election, the flagship asset seems to have discovered independence from the S&P 500 and is making waves. This co-relation, as highlighted by MicroStrategy’s Michael Saylor and fueled by the latest strong efficiency of BTC, has sparked discussions within the broader market.

Michael Saylor Reacts As Bitcoin Decouples From S&P 500

Just lately, Bitcoin broke its long-standing correlation with the S&P 500, gaining consideration from buyers. Traditionally, the crypto moved in tandem with main US indices, however this pattern has shifted over the previous few days.

On Wednesday, studies surfaced that the U.S. administration is contemplating a international direct product rule to manage chip tools exports to China. This improvement, coupled with Donald Trump’s remarks on Taiwan’s cost for U.S. safety, induced turbulence in monetary markets.

Then again, main shares, together with CrowdStrike, skilled disruptions, affecting banks, airways, and hospitals. Nonetheless, Bitcoin has proven sturdy resilience gaining sturdy inflows from ETFs and Trump’s feedback on probably utilizing BTC as U.S. strategic reserves.

In the meantime, the U.S. authorities holds round 213,000 BTC, based on studies. These elements created an ideal storm for the crypto to interrupt free from conventional market developments. If the most important crypto by market cap continues to rise whereas US markets falter, it could be seen as a brand new safe-haven asset, doubtlessly resulting in average good points.

Additionally Learn: Bitcoin Mining Stocks May Soon Outperform BTC In Near Term, Here’s Why

What’s Subsequent?

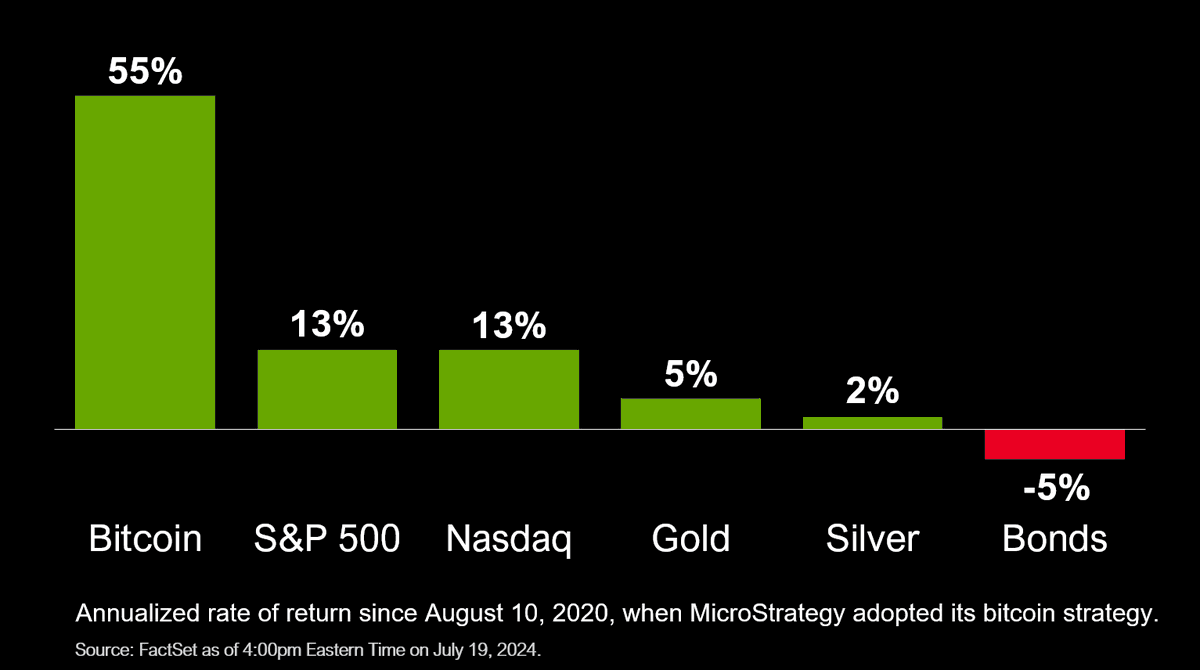

Sharing a chart on the X platform not too long ago, MicroStrategy Founder Michael Saylor has lauded Bitcoin’s rally since 2020. For context, the chart that he shared confirmed the precise returns of BTC and different conventional markets since August 10, 2020, when MicroStrategy adopted its BTC Technique.

In keeping with the report, BTC has proven good points of 55% since then, whereas the S&P 500 and Nasdaq returned 13% good points every. Then again, Gold and Silver noticed a surge of solely 5% and a couple of%, respectively, in the identical time hole.

The sustainability of the crypto decoupling from the S&P 500 shall be intently monitored. The subsequent week shall be important in figuring out whether or not this pattern holds and the way it impacts the broader cryptocurrency market.

In the meantime, Bitcoin’s decoupling from the S&P 500 amid market turbulence and potential pro-crypto insurance policies has positioned it as a attainable new safe-haven asset. This shift has important implications for the way forward for crypto investments and the broader monetary panorama. Because the election approaches, BTC’s efficiency shall be a key indicator to observe.

Throughout writing, BTC price was up over 1% and exchanged fingers at $67,554.22, after touching an intraday excessive of $68,480.06. Moreover, its buying and selling quantity additionally rose 90% to $34.39 billion from yesterday, hinting at growing buying and selling exercise.

Additionally Learn: TON Blockchain Partners Mocaverse & MOCA Foundation, Here’s Why

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: