MicroStrategy, now referred to as Technique, didn’t make any Bitcoin purchases. The corporate didn’t additionally promote any shares, a transfer that normally precedes its BTC purchases. In consequence, the software program firm nonetheless holds 499,096 BTC, with the 500k BTC milestone but to be hit.

MicroStrategy Did Not Make Any Bitcoin Buy Final Week

In an SEC filing, MicroStrategy revealed that it made no Bitcoin purchases between February 24 and March 2 final week. The firm additionally revealed that it didn’t promote any shares of sophistication A typical inventory beneath its at-the-market fairness providing program.

It’s price mentioning that Strategy acquired 20,356 BTC for $1.99B at $97,514 per BTC two weeks in the past. This got here following a $2B zero-coupon convertible notes providing, during which it was capable of increase the funds for this BTC buy.

In the meantime, following its failure to purchase any Bitcoin final week, MicroStrategy nonetheless holds 499,096 BTC, which it acquired for $33.1 billion at a median worth of $66,357 per BTC. Technique stays the general public firm with the most important Bitcoin holdings, properly forward of MARA holdings, which is second on the record.

The corporate’s failure to purchase any BTC final week can be notable contemplating that the Bitcoin price dropped beneath $80,000 final week following a significant crypto crash. As such, the corporate didn’t benefit from a significant dip which may have lowered its common value worth.

MSTR Inventory Recovers

MicroStrategy’s inventory has crashed final week following the Bitcoin worth decline, as each belongings share a constructive correlation. The MSTR stock price has now recovered following BTC’s rebound above $90,000 over the weekend.

Nasdaq information exhibits that the inventory worth is up over 14% in premarket, buying and selling at round $292. MSTR closed final week at round $255 following the Bitcoin worth crash. Nevertheless, following final week’s crash, MSTR now boasts a year-to-date (YTD) lack of over 11%.

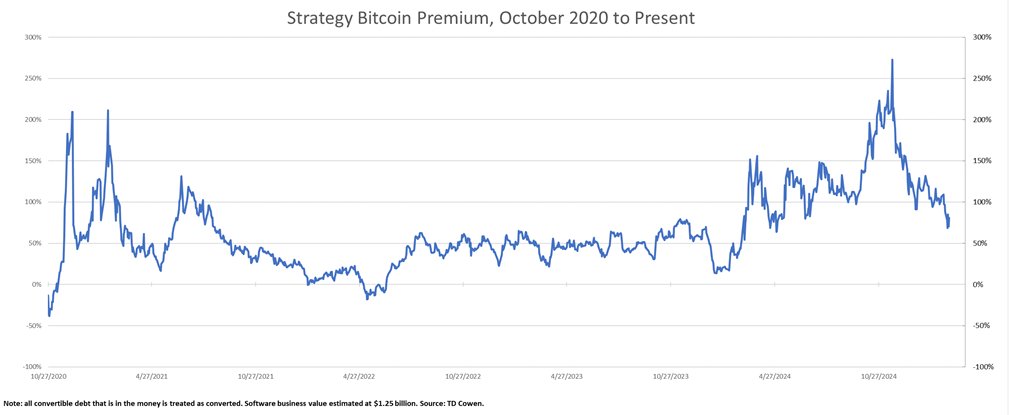

VanECK’s chief additionally revealed that MicroStrategy’s Bitcoin premium has dropped again to April 2024, which can be one thing for market individuals to keep watch over.

Disclaimer: The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: