Bitcoin value has unexpectedly confronted a big surge in promoting strain within the aftermath of June’s United States Federal Open Market Committee (FOMC) assembly minutes.

The consensus amongst officers through the assembly leaned in the direction of sustaining the present rates of interest, although just a few steered a slight increment of 25 foundation factors. Within the foreseeable future, significantly in 2023, the overwhelming majority of the committee anticipates additional escalations in charge hikes.

The most important cryptocurrency is down 1.1% to $30,500 on Thursday, while the second-largest crypto, Ethereum, has, within the final 24 hours, misplaced 1.4% to commerce at $1,913. This strain will not be distinctive to BTC and ETH, contemplating a 1.2% dip within the whole crypto market cap to $1.23 trillion.

Regardless of the slight drop, Bitcoin price is comfortably perching above the speedy help at $30,500, with a lot stronger help anticipated at $30,000. BTC exploded, reclaiming resistance at $31,000 in June, bolstered by a number of filings by corporations wishing to supply a spot Bitcoin ETF.

Bitcoin Value Extends Breather as FOMC Mud Settles

Buyers are prone to spend the subsequent few days digesting the FOMC minutes, particularly as “virtually all members famous of their financial projections that they judged that further will increase within the goal federal funds charge throughout 2023 can be applicable.”

In the meantime, it stays of nice significance that Bitcoin maintains its place above $30,000. A confirmed slip beneath this degree would open a can of worms. Bear in mind, market sentiment has been enhancing over the previous few weeks, held collectively by the surge in curiosity amongst institutional traders like Blackrock and Constancy Investments.

A slight disruption of the improved market sentiment might set off a sell-off amid widespread discontentment amongst retail traders, who’re recognized for following the pattern.

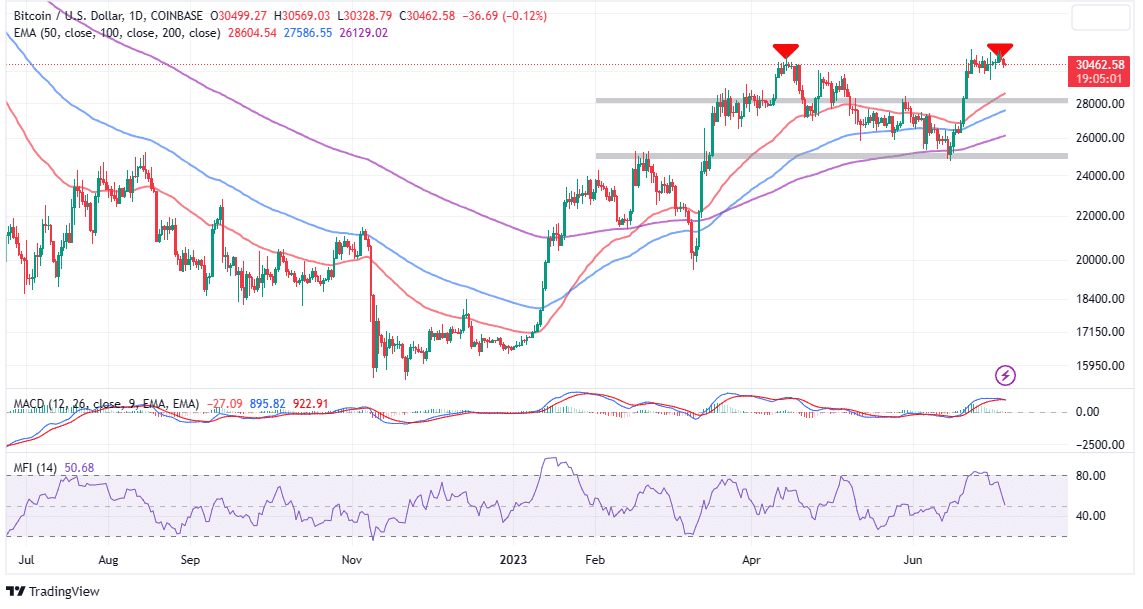

That stated, there’s a enormous chance of the Shifting Common Convergence Divergence (MACD) indicator flashing a promote sign within the coming periods – maybe forward of the weekend.

The decision to promote BTC would manifest because the MACD line in blue crosses above the sign line in pink. A double high sample on the identical each day chart might improve the possibilities of Bitcoin retracing below $30,000.

One other bearish sign stems from the Cash Movement Index (MFI), which tracks the amount of funds getting into and exiting BTC markets. A pointy stoop, because the one noticed beneath the chart, implies that outflow quantity considerably dwarfs influx quantity.

In different phrases, there may be extra promoting quantity in comparison with the prevailing shopping for quantity – a state of affairs prone to preserve Bitcoin value depressed and unable to take down resistance at $31,000.

In Different Information: Crypto is Digital Gold – Blackrock CEO

Blackrock CEO Larry Fink has, in his newest interview with Fox Enterprise, expounded on the spot BTC ETF submitting with the SEC in June. In line with Fink, the main international asset supervisor is open and able to work with regulators to handle points which can be prone to come up with the proposal.

“What we’re attempting to do with crypto is make it extra democratized and make it less expensive for traders,” Fink advised Fox Enterprise.

Whereas speaking particularly about Bitcoin, the CEO referred to the most important crypto as “a world asset.” In his opinion, Blackrock is “a believer within the digitization of merchandise.”

Regardless of his constructive remarks, Bitcoin price slipped, testing help at $30,500 weighed down by the FOMC minutes, which counsel the potential for a ‘gentle’ recession within the US.

Associated Articles

The offered content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.