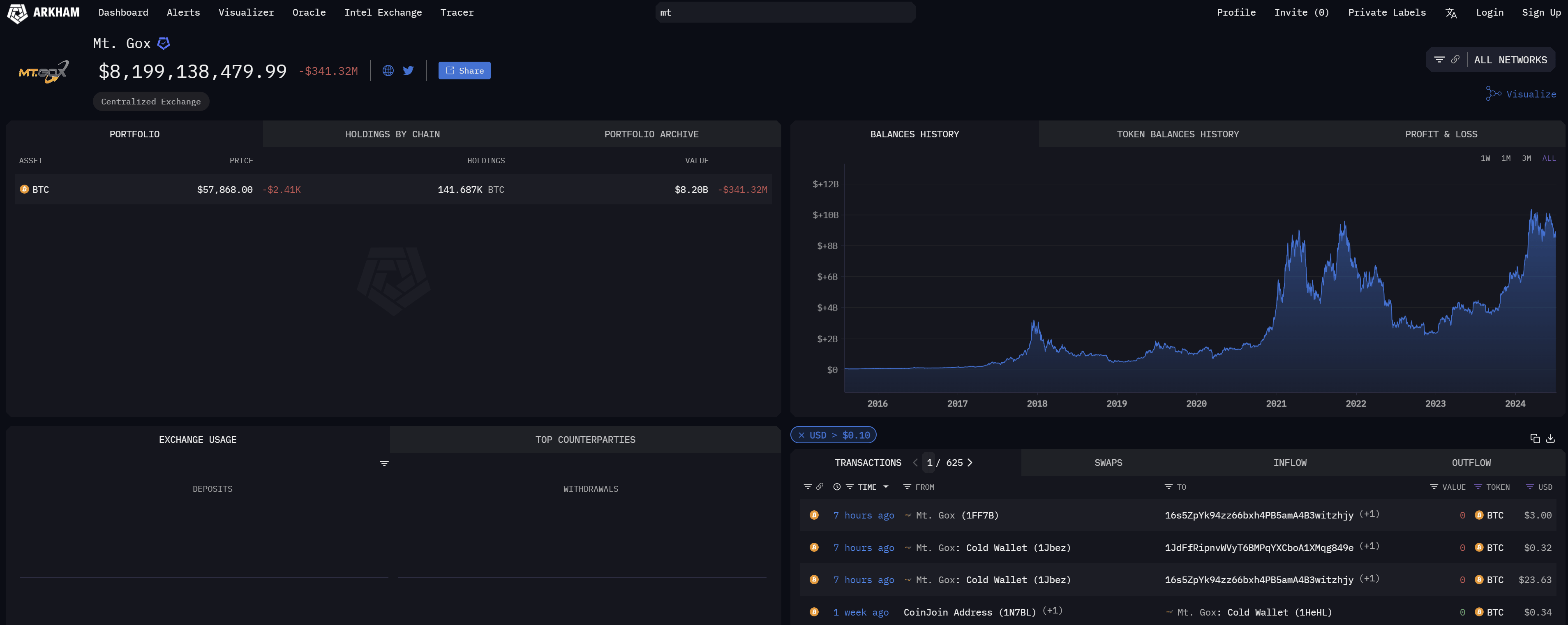

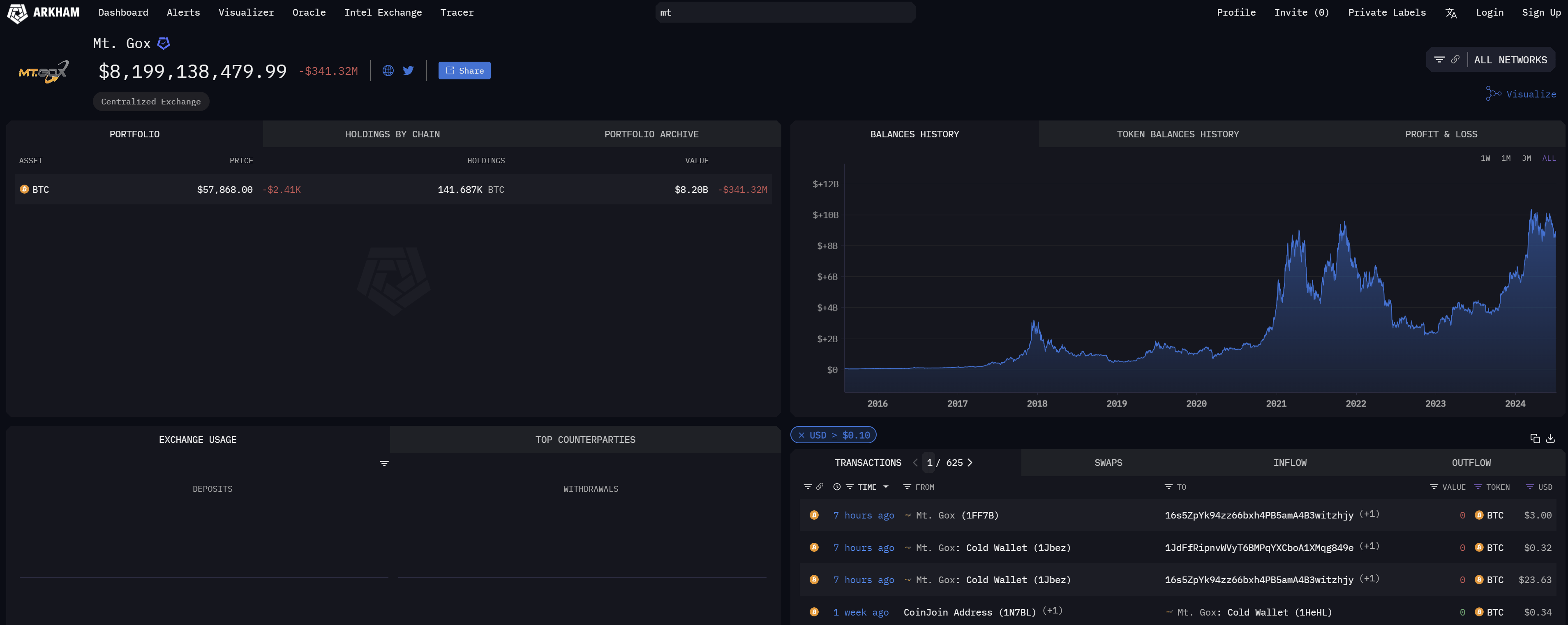

Based on knowledge from Arkham Intel, Mt. Gox has initiated the method of repaying collectors by transferring a nominal quantity of Bitcoin to one of many designated exchanges. This growth follows months of hypothesis and planning regarding the disbursement of approximately $8.2 billion in Bitcoin owed to collectors of the defunct alternate.

Are Mt. Gox Bitcoin Repayments Starting?

Early as we speak, three wallets traditionally linked to Mt. Gox executed three transactions. Probably the most vital of those concerned the switch of $24 in Bitcoin to a pockets which then proceeded to ship these funds to Bitbank’s scorching pockets. Bitbank, listed as one of many exchanges approved to facilitate repayments, alongside Kraken, Bitstamp, SBI VC Commerce, and Bitgo, is ready to make these funds accessible to its prospects inside a timeframe extending as much as 90 days from receipt.

Associated Studying

Nonetheless, there may be some uncertainty surrounding these transactions, because the funds weren’t moved instantly from the first Mt. Gox wallets. Observers speculate whether or not this exercise could possibly be a preliminary check forward of bigger transfers meant for creditor compensation. The Mt. Gox Rehabilitation Trustee has beforehand indicated that the compensation course of was scheduled to begin from the start of July, though particular dates for the transfers haven’t been disclosed publicly.

The opposite two transactions, one switch of BTC price $3.00 and one other price $0.32, was transferred to a brand new pockets.

This delicate motion of funds happens amidst a turbulent interval for Bitcoin, which has seen its value plummet by greater than 20% since reaching $72,000, now hovering round $57,700.

What To Anticipate

Peter Chung, Head of Analysis at Presto Analysis, lately provided insights into the broader implications of the Mt. Gox repayments. He outlined the anticipated dynamics between Bitcoin (BTC) and Bitcoin Money (BCH), predicting vital buying and selling alternatives.

“The Mt. Gox’s Rehabilitation Trustee plans to distribute multi-billion {dollars} price of BTCs and BCHs to the Mt. Gox collectors between July 1st and October thirty first, 2024. This may seemingly alter provide/demand dynamics in BTC and BCH throughout this four-month interval, probably opening up a pair buying and selling alternative,” he acknowledged.

Associated Studying

Chung emphasised the disparate impacts on BTC and BCH: “Our evaluation reveals that the promoting strain for BCH will probably be 4 occasions bigger than for BTC – i.e., 24% of the each day buying and selling worth for BCH vs. 6% of the each day buying and selling worth for BTC. This differential displays various investor bases, with BCH’s being significantly weaker and extra more likely to unload holdings.”

He suggested merchants on potential methods: “Lengthy BTC perpetuals paired with brief BCH perpetuals is probably the most environment friendly market-neutral option to specific this view, barring funding fee threat.” For these involved about risky funding rates, Chung really helpful exploring “different approaches, equivalent to short-term futures or borrowing BCH within the spot market.”

At press time, BTC traded at $57,727.

Featured picture created with DALL·E, chart from TradingView.com