Enterprise Capital Nascent made a big transfer within the crypto area by buying 447.67 billion PEPE tokens for $5.48 million, seizing the chance offered by the latest market downturn. This substantial buy exemplifies the “purchase the dip” technique, enabling Nascent to capitalize on the decrease costs whereas bolstering PEPE’s place inside their portfolio.

By leveraging this strategic acquisition, Nascent has not solely secured a probably profitable funding however has additionally elevated PEPE to a distinguished place inside their portfolio, signaling confidence within the token’s future prospects regardless of the present market situations.

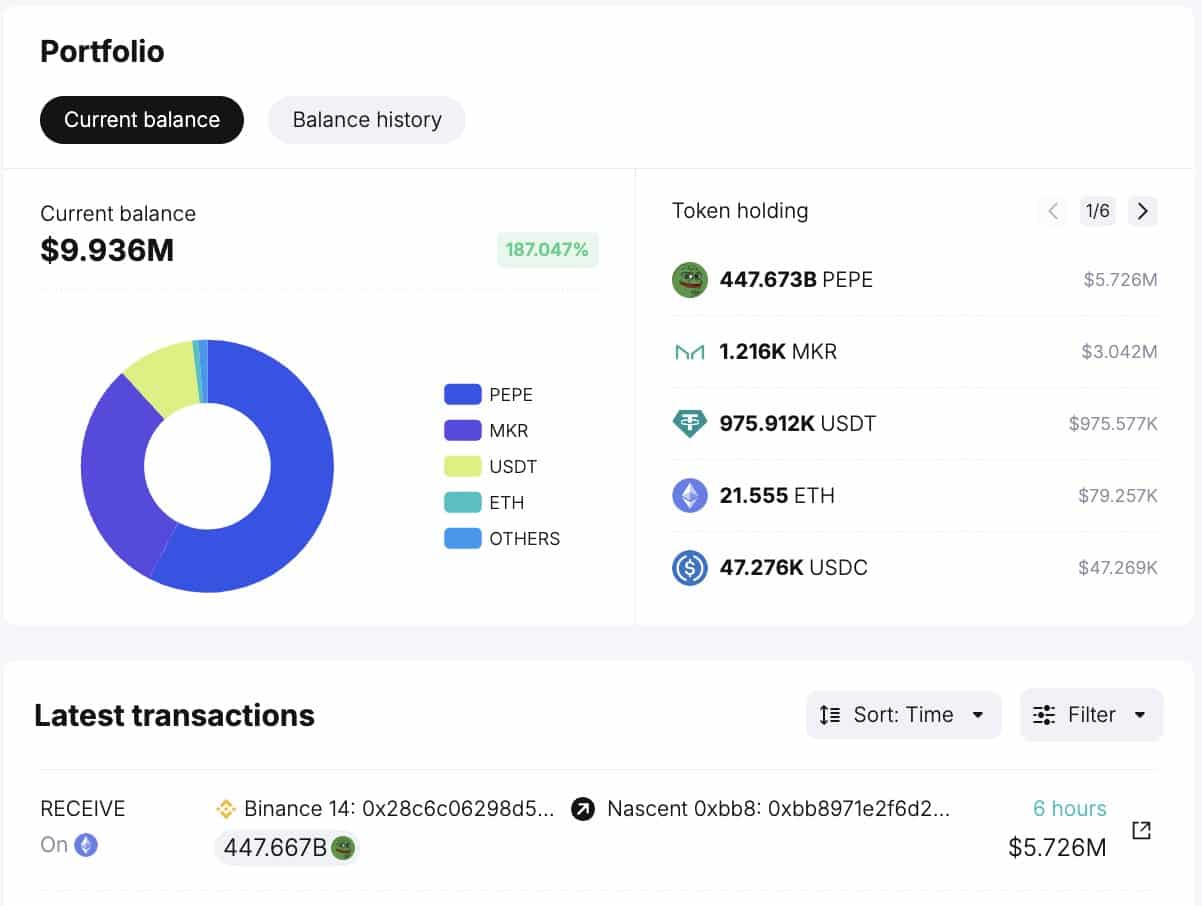

Nascent’s Acquisition Particulars and Portfolio Efficiency

Spot On Chain monitoring reveals that Nascent executed the acquisition of 447.67 billion PEPE tokens ($5.48 million) from Binance, marking their preliminary foray into PEPE funding. With the present worth of the tokens exhibiting a floating revenue of $262,000 (+4.8%), Nascent’s strategic transfer seems to be yielding early returns.

PEPE now holds the highest place in Nascent’s portfolio, surpassing MKR, with the overall revenue from their investments standing at a powerful $2.45 million (+248%).

This sturdy efficiency reveals the success of Nascent’s funding technique and reinforces their confidence within the potential progress of PEPE inside the crypto market panorama.

Additionally Learn: Bitcoin Fees Soar Again, Unrelated to Runes or Ordinals Impact

Evaluation of PEPE’s Worth Motion and Market Dynamics

Regardless of Nascent’s bullish funding, PEPE’s price has skilled a downturn, with the token presently buying and selling at $0.00001309 and a 24-hour buying and selling quantity of $1,358,976,503.13. This represents a notable -8.59% worth decline inside the previous 24 hours and a -14.26% lower during the last 7 days. Moreover, PEPE’s Open Interest has seen a big drop of 17.63%, reflecting a cautious sentiment amongst traders.

Regardless of these challenges, PEPE maintains a considerable circulating provide of 420 trillion tokens, contributing to a market capitalization of $5,516,806,172. This evaluation sheds gentle on the complexities of the crypto market, the place regardless of strategic investments corresponding to Nascent’s, worth fluctuations and market dynamics proceed to affect asset valuations and investor sentiment.

Additionally Learn: 3 Cathie Wood Stocks To Watch Out For Amid Market Slump

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: