On-chain reveals Bitcoin miner outflows have been elevated not too long ago, suggesting miners have been concerned within the current selloff that took the value of the crypto under $42k.

Bitcoin Miner Outflows Spiked Up Earlier than The Crash Under $42k

As identified by an analyst in a CryptoQuant post, BTC miners appear to have been one of many sellers behind the value drop to $42k.

The related indicator right here is the “miner outflow,” which measures the full quantity of Bitcoin exiting wallets of all miners.

When the worth of this metric spikes up, it means miners are shifting numerous cash out of their wallets proper now. Such a development will be bearish for the value of the crypto as it could be an indication of dumping from these authentic whales.

Associated Studying | Ark CEO Cathie Wood Is As Bullish As Ever, Sees Bitcoin Hitting $1 Million By 2030

Then again, low values of those outflows counsel a standard or wholesome quantity of promoting from miners. This development, when sustained, can show to be bullish for the BTC value.

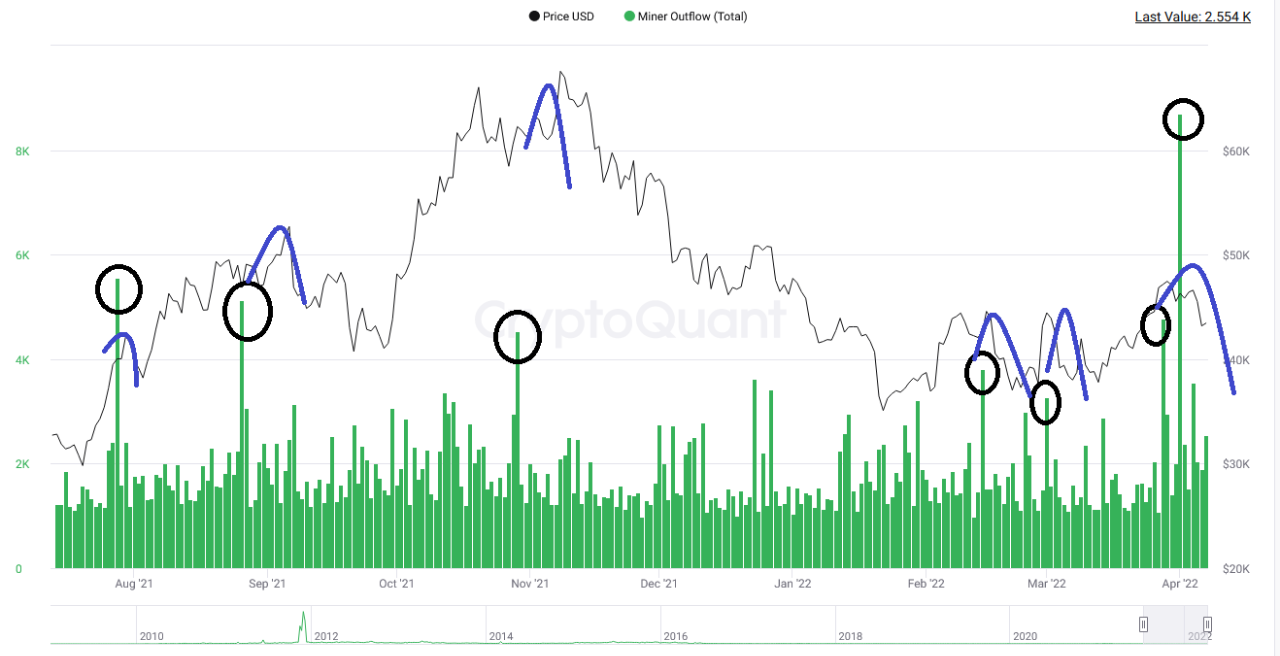

Now, here’s a chart that reveals the development within the Bitcoin miner outflows over the previous a number of months:

Seems to be like the worth of the indicator has shot up not too long ago | Supply: CryptoQuant

As you possibly can see within the above graph, the Bitcoin miner outflows appear to have proven spikes in current weeks, simply earlier than the selloff.

This is able to counsel that miners look to have performed a job within the dump not too long ago, sending the value of the coin diving under the $42k stage.

A development like this has been noticed a couple of occasions up to now a number of months already, because the quant has marked within the chart.

Associated Studying | Mexico’s Third Richest Man Says No To Bonds, Yes To Bitcoin

Presently, it’s unclear whether or not Bitcoin miners have already calmed down or if extra promoting is coming within the subsequent few days.

BTC Value

After round twenty days of holding strongly above the extent, Bitcoin’s price is now as soon as once more revisiting the $41k mark.

On the time of writing, the coin’s value floats round $41.1k, down 11% within the final seven days. Over the previous month, the crypto has gained 4% in worth.

The under chart reveals the development within the value of BTC during the last 5 days.

The worth of BTC appears to have taken a plunge over the previous twenty-four hours | Supply: BTCUSD on TradingView

On account of this sharp downtrend within the value of the coin in addition to the broader market, crypto futures has collected an enormous quantity of liquidations at present. Within the final 24 hours, liquidations have amounted to greater than $322 million, $175 million of which occurred up to now 4 hours alone.

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com