Crypto analyst Miles Deutscher has outlined what he calls the “apparent winners” heading into the ultimate quarter (This fall) of 2025.

Deutscher argued that three distinct narratives, stablecoins, decentralized exchanges (DEXs), and synthetic intelligence (AI), are positioned to outperform, warning that merchants who ignore them might face “a really robust time.”

Stablecoin Performs: XPL Leads the Cost

Deutscher highlights stablecoins as the primary sector, a market he describes as coming into a “parabolic” progress section.

Sponsored

Sponsored

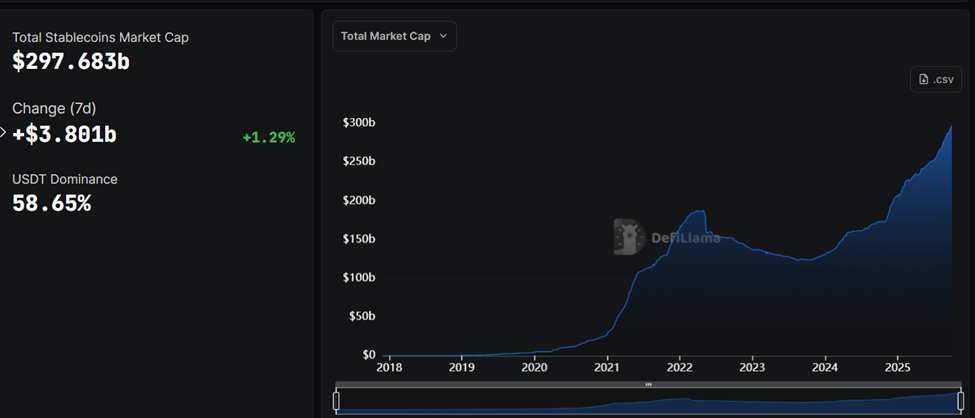

International stablecoin provide has surged previous $297 billion, and expectations are that it’s going to ultimately cross the $1 trillion mark as adoption spreads to establishments and even sovereign actors.

Towards this backdrop, Deutscher singled out XPL (Plasma) as his highest-conviction play. Backed by Tether’s founder and boasting low charges for stablecoin transfers, XPL is attracting each speculative capital and actual utilization.

“XPL is the closest factor to investing in Tether pre-IPO,” Deutscher stated in a current video.

He additionally pointed to Ethena (ENA), whose USDE progress stays sturdy regardless of current sell-offs, and Clearpool (CPOOL), which companions with Plasma to supply stablecoin yield merchandise.

Deutscher argues that these initiatives symbolize the strongest on-ramps into essentially the most worthwhile nook of the crypto market.

Sponsored

Sponsored

DEX Narrative: Governance and Farming

The second narrative facilities on decentralized exchanges, significantly perpetual DEXs which have dominated market discussions all through 2025.

Whereas acknowledging that the commerce seems “saturated within the brief time period,” Deutscher stays assured in two approaches:

- Longing governance tokens

He famous Apex because the extra enticing risk-reward play than Automata (ATA), citing Bybit exchange’s backing and ongoing buyback applications as bullish catalysts.

Sponsored

Sponsored

Past holding tokens, Deutscher sees profitable alternatives in farming rewards throughout platforms like Lighter, Osteium, and Paradex, the place factors and crypto airdrops may rival the features seen in earlier sector rotations.

“Even when token valuations look stretched, the farming alternatives on this area are nonetheless large,” he mentioned.

AI Momentum: From Hype to Income

Lastly, Deutscher articulated that AI tokens are the third pillar of his thesis, framing the sector as a bridge between crypto and traditional finance (TradFi).

With Nvidia and other AI-linked stocks fueling equity rallies, crypto analogs may benefit from renewed speculative flows.

His high watchlist consists of Aethir (ATH), which not too long ago introduced a $344 million digital asset treasury to again GPU infrastructure.

Sponsored

Sponsored

In keeping with Deutscher, this transfer by Predictive Oncology positions Aethir as a uncommon crypto-native proxy for enterprise-level compute demand.

He additionally talked about Cookie DAO (COOKIE) as a “pick-and-shovel” play that facilitates analytics and campaigns throughout the AI sector.

Though some AI initiatives stay beneath stress, Deutscher argued that the sector’s fundamentals make it unavoidable for This fall positioning.

“…rising income streams, sturdy TradFi curiosity, and favorable long-term developments in GPUs and robotics,” Deutscher highlighted the basics.

Deutscher confused that whereas Bitcoin’s construction stays in flux, altcoin alternatives can be formed by narrative rotations moderately than broad market drift.

“The cycles are shifting quick. It’s worthwhile to know the place capital is flowing,” he concluded.

In his opinion, that circulate seems more and more destined for stablecoins, DEX ecosystems, and AI-driven tokens in This fall.