Famend economist Peter Schiff has in contrast Michael Saylor’s MicroStrategy with gold mining corporations. This comes amid a surge within the MSTR inventory, which is on track for its highest shut since March 2020.

Peter Schiff Compares MicroStrategy To Gold Shares As MSTR Worth Surges

Schiff in contrast MicroStrategy to gold mining corporations, noting that the software program firm “earns nothing and virtually produces nothing” however remains to be price greater than each gold mining firm besides Newmont.

The economist requested his followers in the event that they suppose MSTR’s market cap will surpass Newmont’s NEM. MarketWatch data exhibits that the MSTR worth at present has a market cap of $43.34 billion, whereas the NEM worth has a market cap of $55.12 billion.

Nevertheless, Peter Schiff, a gold proponent, believes that the MSTR inventory is probably the most overvalued within the Morgan Stanley Capital Worldwide (MSCI) World Index and has even predicted a price crash.

Nevertheless, regardless of his reservations, MicroStrategy’s inventory continues to succeed in new highs. The inventory is at present up over 6% at the moment and is on track for its highest shut since March 2020, when it hit an all-time excessive (ATH) closing worth of $313. At this time’s MSTR worth surge is believed to correlate to the Bitcoin price surge, with the flagship crypto reclaiming $69,000. In the meantime, it’s price mentioning that MicroStrategy’s inventory is up over 293% because the begin of the 12 months, outperforming even Bitcoin.

Michael Saylor Highlights The Inventory’s Efficiency

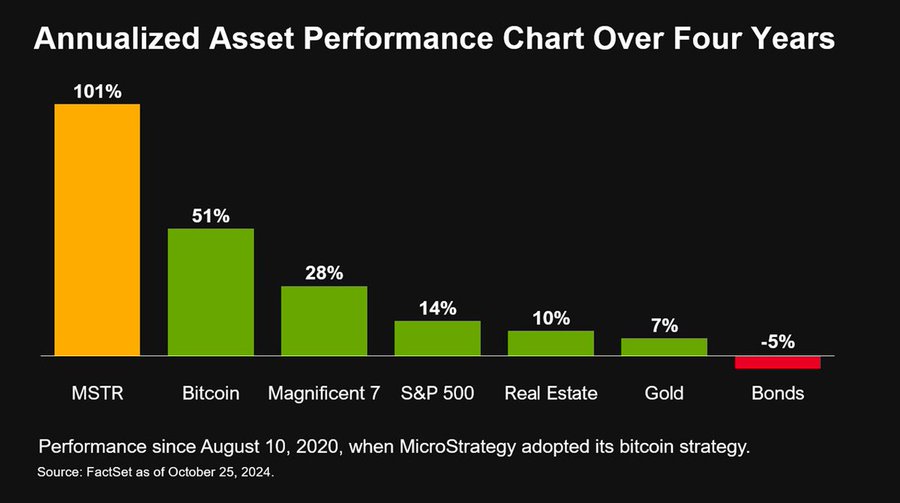

MicroStrategy co-founder Michael Saylor not too long ago highlighted how properly the MSTR stock has carried out during the last 4 years. In an X post, Saylor shared information exhibiting that his firm’s inventory has loved extra annualized returns than Bitcoin, the Magnificent Seven shares, the S&P 500, and even Gold throughout this era.

The corporate’s inventory has loved an annual return of 101% over 4 years because the software program firm adopted its Bitcoin technique. The inventory is believed to have outperformed the remainder of the worldwide market due to its publicity to the flagship crypto.

MicroStrategy at present holds 252,220 BTC on its stability sheet, with its bitcoin holdings accounting for 1.2% of the crypto’s whole provide. In his submit, Saylor acknowledged Bitcoin contributed to MicroStrategy’s inventory attaining this feat.

In the meantime, Saylor has promised that MicroStrategy has no plans to promote its BTC holdings. Apparently, he instructed Bitcoin skeptics that MSTR was the “excellent instrument” to brief in the event that they actually hated the crypto asset.

Disclaimer: The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: