Peter Schiff has questioned Bitcoin’s position as a hedge towards inflation, stating that its latest buying and selling patterns don’t help the declare. Schiff, identified for his robust stance on gold, argued that Bitcoin continues to behave extra like a tech inventory than a retailer of worth.

Peter Schiff Criticizes Bitcoin’s Inflation Hedge Narrative

Amid ongoing financial uncertainty within the US, Peter Schiff has renewed his skepticism towards Bitcoin’s utility as a hedge towards inflation. In response to Schiff, latest worth motion reveals that Bitcoin nonetheless mirrors the conduct of tech shares slightly than that of gold.

“Bitcoin has not decoupled from the NASDAQ,” Schiff stated in a recent post, including that buyers involved about inflation ought to deal with gold as an alternative. He argued that Bitcoin lacks the steadiness wanted to function a dependable retailer of worth and stays inclined to broader market swings.

Peter Schiff additionally famous that the rise in Bitcoin’s worth seems extra associated to investor hypothesis and macroeconomic developments than to intrinsic financial properties. He continued to warn that Bitcoin might not provide the identical long-term safety for wealth as traditional safe-haven assets.

Senator Lummis Hyperlinks Bitcoin to Nationwide Debt Aid

Senator Cynthia Lummis has additionally entered the dialogue by connecting Bitcoin adoption to broader financial coverage. In a public assertion, she endorsed the BITCOIN Act as a attainable answer to deal with the USA’ $36 trillion nationwide debt.

In response to Lummis, the current administration has proven willingness to think about digital property, and thus passing the BITCOIN Act is “the one answer to our nation’s $36T debt.” Even with restricted particulars, the proposal marks rising curiosity by policymakers in exploring various monetary programs.

Lummis, identified for her pro-Bitcoin stance, has persistently supported legislative efforts that encourage adoption and regulatory readability. Nonetheless, whereas MicroStrategy (MSTR) announced a primary quarter 2025 lack of $16.49 per share stemming from a $5.9 billion writedown from the drop in worth in Bitcoin earlier this 12 months.

Nonetheless, MicroStrategy stays one of many largest company holders of Bitcoin and says it’s keen to develop its holdings. To level to long run worth within the asset, Saylor stated he meant to boost as much as $84 billion to accumulate extra Bitcoin.

Market Situations Increase Bitcoin’s Momentum

Bitcoin worth rose over 14% in April, benefiting from easing inflation information and rising expectations of rate of interest cuts. The PCE inflation charge got here in at 2.3% 12 months over 12 months, reinforcing the view that the Federal Reserve might contemplate reducing rates of interest in upcoming conferences.

Furthermore, US President Donald Trump lately urged Federal Reserve Chair Jerome Powell to chop rates of interest forward of the following Federal Open Market Committee (FOMC) assembly. Trump claimed that there’s “no inflation” and that present financial circumstances warrant a looser financial stance.

Analysts famous that Bitcoin’s efficiency continues to outpace conventional fairness markets. Whereas the S&P 500 has remained largely flat, Bitcoin’s rise has been supported by easing commerce tensions, favorable macro information, and renewed institutional curiosity.

Totally different Views from Peter Schiff’s on Bitcoin Function

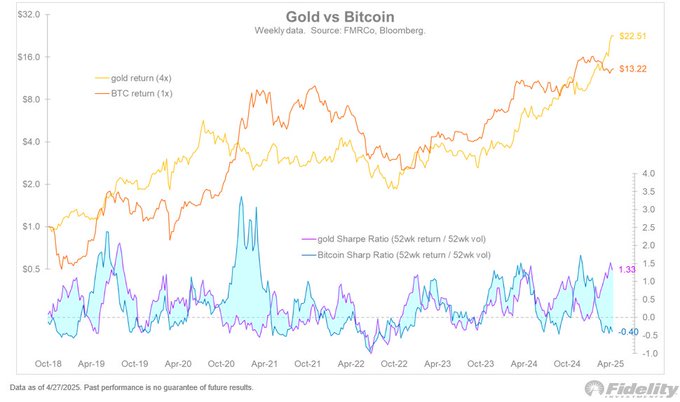

Jurrien Timmer, Director of International Macro at Constancy, commented on Bitcoin’s twin traits, evaluating it to each gold and speculative know-how property. In contrast to Peter Schiff, he famous that Bitcoin can behave otherwise relying on broader monetary circumstances.

“Bitcoin has a Dr. Jekyll and Mr. Hyde persona,” Timmer stated, explaining that it typically acts as exhausting cash but in addition trades like a danger asset. He added that Bitcoin’s efficiency has traditionally been tied to progress within the international cash provide and fairness markets.

Timmer additionally shared information displaying a latest divergence between gold and Bitcoin based mostly on their Sharpe ratios. He identified that gold at the moment holds the next Sharpe ratio, indicating extra constant risk-adjusted returns, however recommended that Bitcoin might outperform once more if liquidity circumstances turn into extra favorable.

In response to Glassnode long-term holders continued including over 254,000 BTC in latest months, demonstrating confidence. Nonetheless, as BTC costs strategy $99,900, the chance of elevated sell-side strain might rise.

The put up Peter Schiff Warns Bitcoin Is No Hedge Against Inflation Despite Recent Price Surge appeared first on CoinGape.