Polygon (MATIC) value is among the many best-perming property available in the market, up 5% during the last 24 hours bolstered by information that the US Securities and Exchange Commission (SEC) had determined to drop costs in opposition to Ripple’s high executives.

The event is an enormous deal for MATIC, an Ethereum layer 2 scaling protocol, because the company claimed that it’s a safety token together with different tokens like Solana (SOL) and Cardano (ADA) in June.

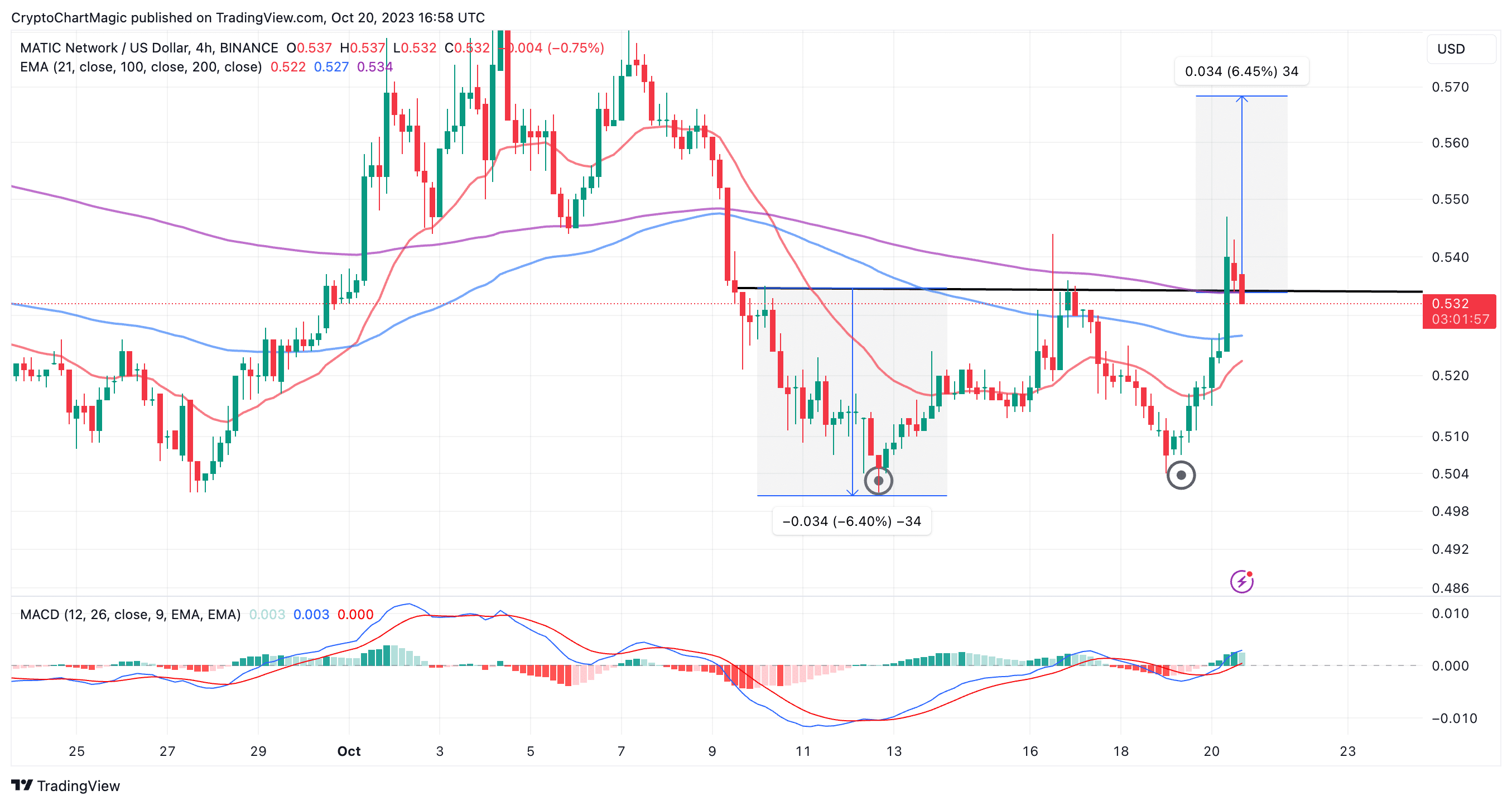

Polygon Value Sprouts 5% To $0.547

Ripple’s executives consider that the event is an indication of give up for the company following a courtroom battle that has dragged on since December 2020. The courtroom dominated in early July that XRP was partially not a safety as lengthy gross sales have been programmatic. In different phrases, performed through third-party platforms like exchanges.

In the meantime, gross sales of XRP made on to institutional buyers equivalent to hedge funds constituted safety tokens, with the SEC intending to sit down down with Ripple relating to “Part 5 violations with respect to its institutional Gross sales of XRP.”

A win for XRP and Ripple may set priority for the greater than 60 tokens implicated by the SEC, together with MATIC. This might additionally clarify the transient rally to $0.547, though the token has retreated to commerce at $0.533 on Saturday.

If bulls heed the decision to purchase MATIC as strengthened by the Transferring Common Convergence Divergence (MACD) indicator, the trail with the least resistance is certain to stay to the upside.

Polygon value additionally retesting help on the double-bottom sample neckline help, which after an preliminary breakout, pointed MATIC to a 6.4% goal of $0.568.

Merchants can not ignore the potential for the declines overwhelming the bullish outlook, particularly with MATIC value buying and selling under the 200 Exponential Transferring Common (EMA) on the four-hour chart.

Revenue reserving will seemingly take priority with Polygon value displaying weak spot under the 200 EMA and should set off a sell-off if help on the neckline—$0.534 breaks with the primary help anticipated on the 100 EMA —$0.527 and the second at $0.52.

Associated Articles

The offered content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: