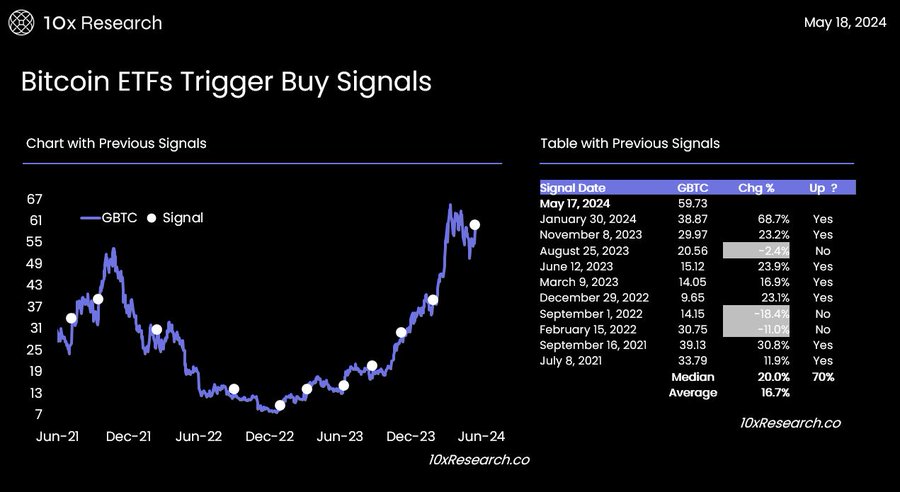

Widespread analyst Markus Thielen, who precisely predicted BTC value ATH timeline and crash beneath $60K, has forecasted one other key occasion, this time for Bitcoin ETFs. In a brand new analysis report, he revealed {that a} new buying and selling alert for Bitcoin ETFs has been triggered. Thielen, who can also be the CEO of institutional crypto analysis 10x Analysis, mentioned Bitcoin value to rally sooner quickly amid huge shopping for by institutional and retail buyers.

Markus Thielen Says Bitcoin ETF Alerts About BTC Worth Rally

Markus Thielen, CEO of 10x Research, on Could 18 revealed {that a} new buying and selling alert for Bitcoin ETFs has been triggered. The final time the mannequin was triggered on January 30 this 12 months, following which spot Bitcoin ETFs within the U.S. noticed huge influx. The truth is, Bitcoin holdings of BlackRock ETF surpassed Grayscale’s GBTC.

“Many have requested us to run our buying and selling indicators for crypto-related shares, reminiscent of Bitcoin miners, and diversified crypto shares, reminiscent of Coinbase. Not each buying and selling sign shall be profitable, however typically, with a 70-80% chance, they supply us with well timed reminders when a boring buying and selling vary may finish” he added.

GBTC flashed a purchase sign on Friday, much like previous occasions that noticed huge shopping for. After the GBTC noticed inflows this week, it has renewed bullish sentiment for Bitcoin value, coupled with cooling CPI inflation within the U.S. Furthermore, the buying and selling indicators for GBTC also needs to be efficient for the newer ETFs reminiscent of BlackRock’s IBIT. This might give institutional buyers and analysts a clue as to the place the value of Bitcoin may be going.

Additionally Learn: Binance Pushes For SHIB, USTC, AGIX Liquidity and Trading Boost

Bitcoin Worth to Rally?

BTC price surpassed $67,000 this week amid bullish sentiment, with a weekly run of greater than 10%. The 24-hour high and low are $66,289 and $67,459, respectively. Furthermore, the upsurge amid low buying and selling volumes signifies whales and massive buyers turned bullish on Bitcoin, together with the quick liquidation of high-leveraged positions.

CME Bitcoin futures open curiosity noticed a 5% improve within the final 24 hours, indicating big shopping for from futures merchants. The whole BTC futures open curiosity soared by 2% up to now 24 hours.

One other fashionable analyst Rekt Capital predicts Bitcoin value solely must drop 1% to carry out the post-Bull Flag breakout retest try in an effort to safe pattern continuation to the upside.

Additionally Learn: BlackRock CIO Hints At Fed Rate Hike But There’s A Positive Note

The introduced content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: