Bitcoin NUPL information means that the crypto’s cycles are getting much less sharper with time as revenue tops and loss bottoms aren’t following a horizontal line.

Bitcoin NUPL Didn’t Exceed The 0.75 “Greed” Mark Throughout This Cycle

As defined by an analyst in a CryptoQuant post, the BTC revenue and loss cycles shouldn’t be handled with horizontal traces.

The “Net Unrealized Profit and Loss” (or the NUPL briefly) is an indicator that tells us whether or not the market as an entire is holding a internet revenue or a internet loss proper now.

The metric’s worth is calculated by taking the distinction between the market cap and the realized cap, and dividing it by the market cap.

NUPL = (Market Cap – Realized Cap) ÷ Market Cap

When the worth of this indicator is larger than zero, it means the typical investor is at the moment holding some earnings.

However, adverse NUPL values indicate the general market is holding a internet quantity of unrealized loss in the mean time.

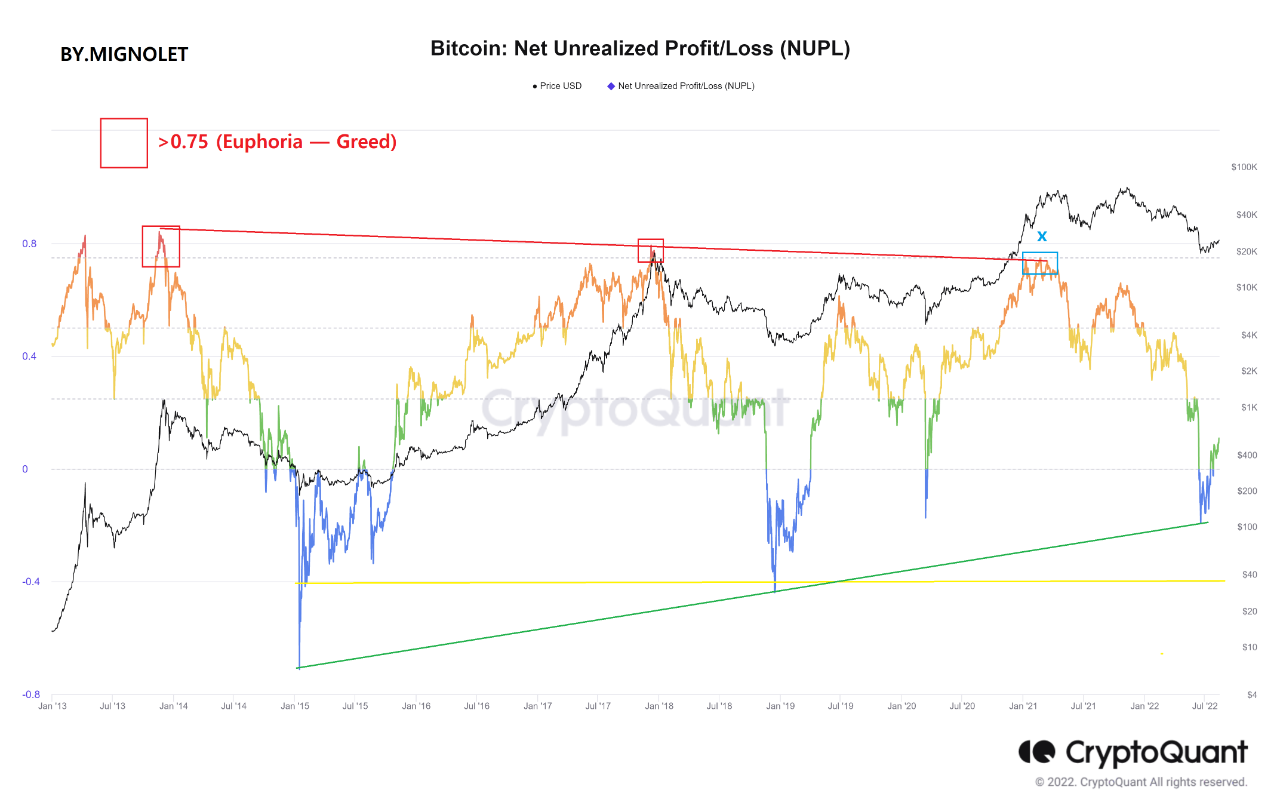

Now, here’s a chart that exhibits the pattern within the Bitcoin NUPL over the course of the historical past of the crypto:

Seems like the worth of the metric has surged up and turned optimistic once more lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, the quant has marked the related zones of pattern for the Bitcoin NUPL indicator.

Up to now, many merchants used to consider that cycle tops kind every time the metric’s worth surges above 0.75, getting into into the “greed” zone.

Equally, bottoms had been thought to happen when the indicator went beneath the -0.4 mark, reaching into the “worry” area.

Nevertheless, the analyst from the put up argues that horizontal traces like these shouldn’t be used to mark these cycle tops and bottoms.

In the course of the earlier two cycles, the highest that got here after was decrease than the one earlier than. Within the present cycle, the metric by no means crossed into the greed zone and topped out simply across the 0.75 degree. This might imply that tops are getting decrease and decrease with every cycle.

Equally, the final two bottoms additionally had descending loss quantities. Only a whereas in the past, the NUPL’s worth sharply dropped off into adverse and subsequently rebounded again up into optimistic values after forming a possible backside. Nevertheless, this low was removed from the traditional 0.4 mark.

If this low was actually the underside for this cycle, then it might add additional credence to the concept revenue and loss fluctuations available in the market are getting much less drastic with time.

BTC Worth

On the time of writing, Bitcoin’s price floats round $24.4k, up 5% up to now week.

The worth of the crypto appears to have been shifting sideways lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com