A quant has defined how the present giant Bitcoin leverage ratio values can assist carry a turnabout to the crypto’s value.

Bitcoin Leverage Ratio Rises To Values Larger Than Throughout The ATH

As defined by an analyst in a CryptoQuant post, the huge leverage ratio proper now would possibly assist BTC’s value reverse its pattern.

The “Bitcoin leverage ratio” is an on-chain indicator that’s outlined because the open curiosity divided by the (by-product) change reserve.

Right here, the “open interest” is a measure of the quantity of futures contracts presently open within the derivatives market. Whereas the change reserve tells us how a lot BTC is saved in change wallets proper now.

The leverage ratio mainly reveals the quantity of leverage utilized by customers on common. The metric’s worth helps us know whether or not Bitcoin buyers are taking a excessive threat or a low threat.

When the worth of this ratio strikes up, it means buyers are choosing up extra leverage as they’re assured of their positions.

Alternatively, a lowering pattern of the indicator would imply buyers are lowering threat, and shutting off their positions.

Associated Studying | Growth Of Bitcoin ETFs & Other Instruments Doesn’t Support Supply Shock Narrative

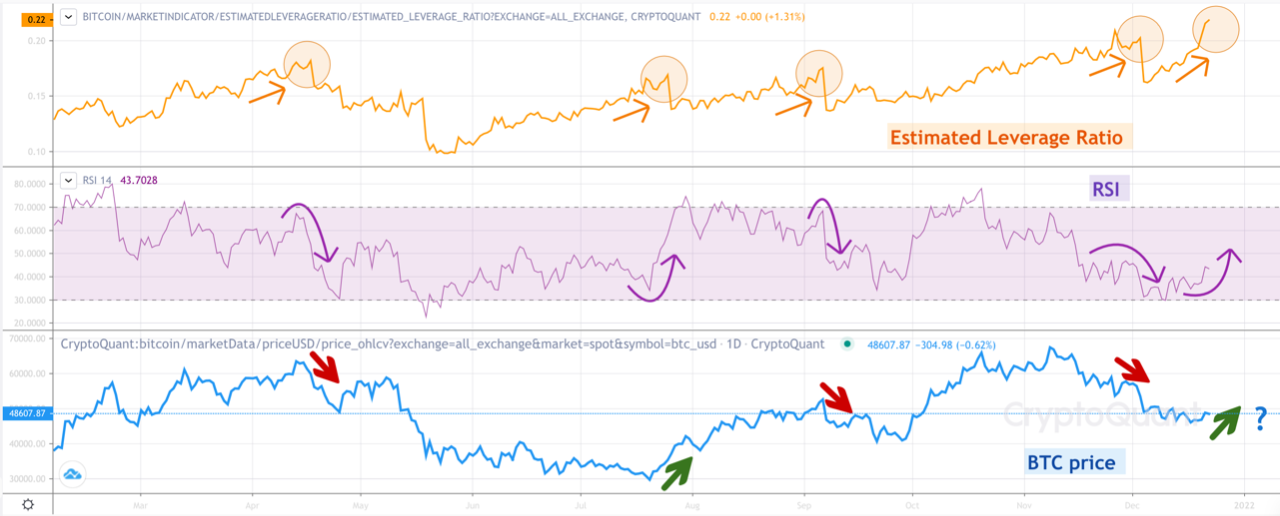

Now, here’s a chart that reveals the pattern within the Bitcoin leverage ratio over the previous couple of months:

The indicator appears to be rising in worth | Supply: CryptoQuant

As you may see within the above graph, the Bitcoin leverage ratio has been driving on an uptrend for some time, and now has values higher than these over the last value ATH.

The quant has marked peaks of the indicator on the chart and in contrast them with the BTC value. Apparently, each time the metric has reached a high, the worth of the crypto has reversed its pattern.

Associated Studying | Market Gets Cozy With Bitcoin Trapped? Why BTC Is Gearing Up For A Short Squeeze

The chart additionally reveals one other indicator, the RSI, which highlights whether or not BTC is presently overpriced or underpriced.

It looks like whichever method this metric has turned, the worth has additionally reversed in the identical route. Trying on the chart, presently the leverage ratio appears to be hitting a peak and the RSI appears to be turning up. If there’s certainly a sample right here, then the worth of Bitcoin would possibly change its route in the direction of the sky subsequent.

BTC Worth

On the time of writing, Bitcoin’s price floats round $48.7k, down 2% within the final seven days. The under chart reveals the pattern within the worth of the crypto over the previous 5 days.

BTC's value surged up a couple of days in the past, nevertheless it has since began transferring sideways once more | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com