Based on Ray Dalio, the debt disaster might crash US development, and occur occur as shortly or as delayed as provide and demand dictate.

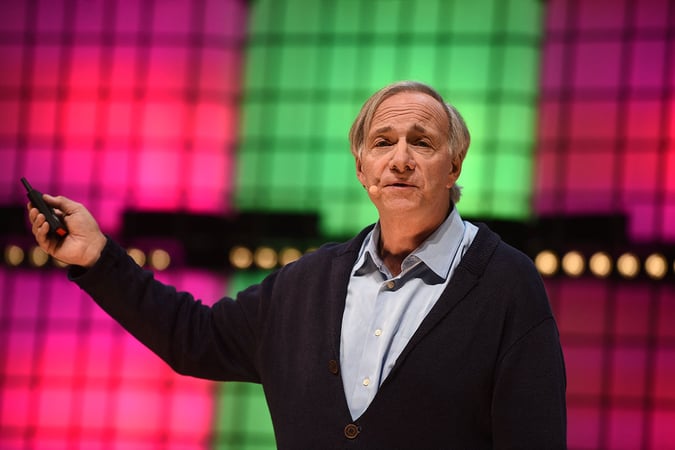

American hedge fund supervisor and billionaire investor Ray Dalio believes that the US is in a precarious fiscal state of affairs. Based on Dalio, a debt disaster is looming.

Talking to CNBC’s Sara Eisen, Dalio said:

“We’re going to have a debt disaster on this nation. How briskly it transpires, I believe, goes to be a operate of that supply-demand challenge, so I’m watching that very carefully.”

The US debt ranges have elevated considerably in the previous couple of years. Based on the US Division of Treasury, federal spending elevated about 50% between fiscal 2019 and financial 2021. Dalio believes that financial development might additionally fall to zero.

Final week, the US nationwide debt crossed the $33 trillion benchmark for the primary time ever. The Treasury Division introduced that debt ranges hit $33.04 trillion, suggesting that the federal authorities has been borrowing closely to fund its operations. As of Tuesday, the debt had elevated by another $100 billion, including greater than $14 billion day-after-day.

Based on The Kobeissi Letter publication, the nationwide debt has risen by $1 trillion each month because the debt ceiling disaster. The publication additionally notes that debt has elevated by $11.5 trillion over 5 years. In the intervening time, there isn’t any pointer of a discount in borrowing and spending. Estimates already posit that the nation’s nationwide debt will spike to $45 trillion inside 4 years.

US inflation is a really robust issue potent sufficient to have an effect on the nation’s nationwide debt. Happily, the US Federal Reserve not too long ago determined to maintain rates of interest unchanged. Nevertheless, the July increase put these charges at a variety of 5.25 to five.55, the best since 2001.

US Nationwide Debt Disaster and Curiosity Charges

On the one hand, the Fed expects one other enhance in rates of interest. Indications recommend that the apex financial institution will once more elevate charges by 25 foundation factors. Nevertheless, the Fed additionally believes inflation will possible decelerate with out severe financial issues.

Though this looks like excellent news, the high-interest charges could not disappear anytime quickly. US policymakers predict that the benchmark short-term rate of interest will nonetheless be over 5% subsequent yr and close to 4% in 2025. That is nonetheless increased than the determine in 2019.

As of Might, the US was $31.4 trillion in debt, the highest in the world. The second-highest was China at $14 trillion, adopted by Japan’s $10.2 trillion, France’s $3.1 trillion, and Italy’s $2.9 trillion.

Looming Authorities Shutdown

White Home officers and congressional leaders have now warned of the potential of a authorities shutdown. By all accounts, the US authorities is simply two days from a attainable shutdown if lawmakers don’t attain a deal on authorities funding by midnight on October 1st. Based on ranking company Moody’s, a shutdown can be detrimental to the US debt ranking.

“[A shutdown would reveal] the numerous constraints that intensifying political polarization placed on fiscal policymaking at a time of declining fiscal power, pushed by widening fiscal deficits and deteriorating debt affordability,” stated the company.

Tolu is a cryptocurrency and blockchain fanatic based mostly in Lagos. He likes to demystify crypto tales to the naked fundamentals in order that anybody anyplace can perceive with out an excessive amount of background data.

When he is not neck-deep in crypto tales, Tolu enjoys music, likes to sing and is an avid film lover.

Subscribe to our telegram channel.

Join