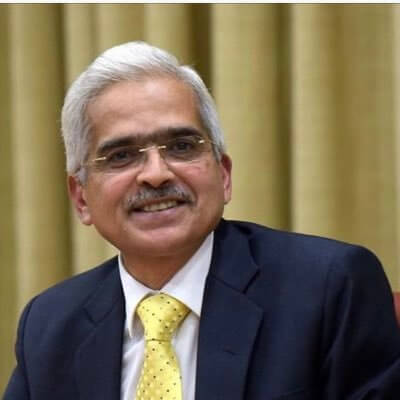

Whereas world consideration is clinging to India’s upcoming Crypto regulations, Reserve Financial institution of India (RBI) Governor, Shaktikanta Das simply highlighted the issues across the nation’s Central Financial institution Digital Foreign money (CBDC). One of many greatest targets behind launching CBDCs is pushed by client safety in lieu of the centralised nature of presidency backed digital forex.

Nonetheless, Das famous that the RBI has its doubts about cyber safety and digital fraud points, referring to the CBDC launch. Das has in contrast the menace to cyber safety and potential digital frauds by way of CBDC to that of the previous downside of faux Indian forex notes. He emphasised the should be further cautious, by constructing a strong CBDC safety system together with resilient firewalls.

“The primary concern comes from the angle of cyber safety and the opportunity of digital frauds. So, we now have to be very cautious about that simply as a number of years in the past we had a serious concern was on pretend Indian forex notes. Related issues may occur when you find yourself launching CBDC…In a CBDC universe, we now have to be that rather more cautious with regard to making sure cyber safety and taking preventive steps to stop any sorts of frauds as a result of there can be makes an attempt. We have now to have strong programs and firewalls.”, Das instructed Business Today.

RBI Expects to Launch CBDC by Q1 2022

Final month, the RBI confirmed that they count on to launch its CBDC pilot, newest by the primary quarter of subsequent 12 months. Based on feedback by the central financial institution’s senior official on the State Financial institution of India’s Banking and Financial Conclave, RBI is searching for to have a functioning CBDC pilot by early 2022.

Nonetheless, the authorities highlighted that they are going to be thorough within the course of, provided that RBI’s CBDC might information India into Web3. Moreover, for the reason that Chinese language CBDC fraud controversy, Central Banks the world over, have develop into extra cautious.

“I believe someplace it was mentioned that at the very least by the primary quarter of subsequent 12 months a pilot might be launched. So we’re bullish on that…We’re on the job and we’re trying into the varied points and nuances associated to CBDC. It’s not a easy factor to simply say that CBDC could be a behavior from tomorrow on”, the chief basic supervisor on the Division of Fee & Settlement of the RBI, P. Vasudevan instructed the Enterprise Customary newspaper.

Disclaimer

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.