The crypto market braces for impression as Bitcoin and Ethereum choices value $1.4 billion are set to run out at the moment, CME BTC futures shut, and PPI knowledge. Merchants search for cues of market restoration as CPI inflation falls to a 12 months low, anticipating Fed price cuts to start out in September. Let’s test particulars about the explanation why Bitcoin worth is dropping regardless of increased odds of a Fed price cuts beginning in September.

Bitcoin And Ethereum Choices Value $1.4 Billion to Expire

Virtually $1.4 billion in Bitcoin and Ethereum choices will expire on July 12, based on knowledge from the biggest crypto derivatives trade Deribit. BTC price has dropped to a 24-hour low of $56,561, with no help from buying and selling volumes for Bitcoin worth restoration.

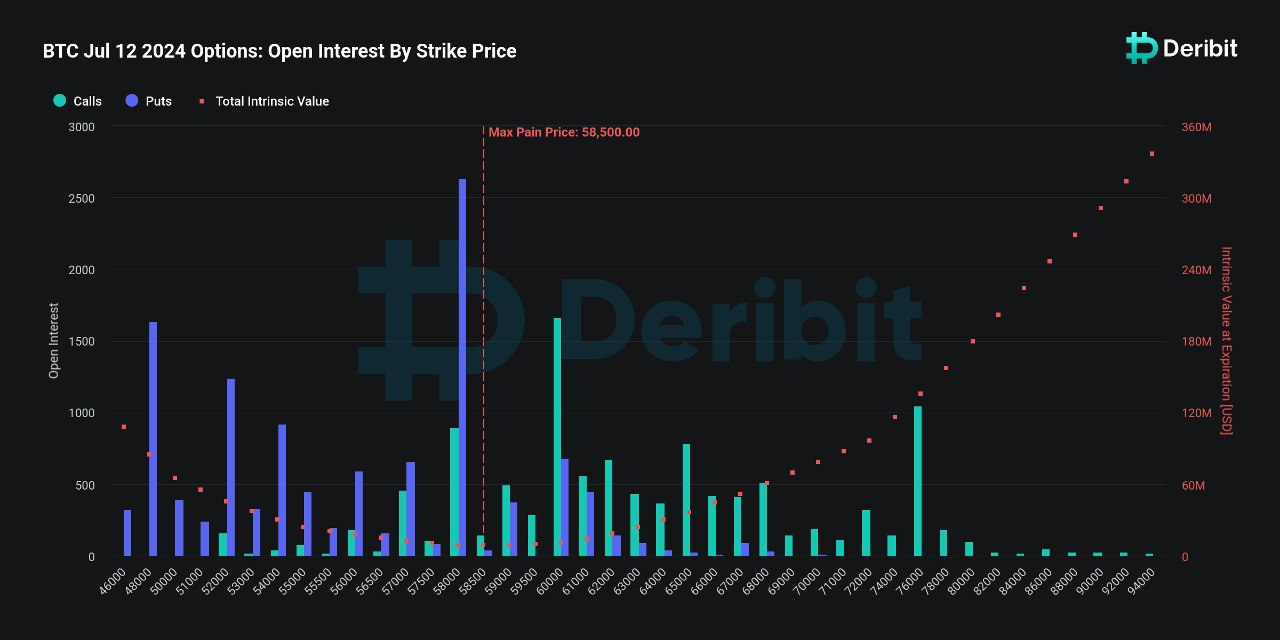

Over 23,722 BTC choices with a notional worth of $1.36 billion expire at the moment on Deribit. The put-call ratio is extraordinarily excessive at 1.08 as put open pursuits are 12,328.50 in opposition to 11,393.50 name open pursuits, elevating skepticism over restoration within the coming days.

Furthermore, the max ache is at $58,500 strike worth, with put choices greater than name choices on the strike worth. At present, the max ache level is increased than Bitcoin worth. It signifies bearishness amongst merchants continues to persist and Bitcoin stays beneath promoting stress.

Historic Volatility has continued to surge whereas BTC Volatility Index (DVOL) exhibits indicators of drop. Choices merchants proceed to stay cautious amid German government Bitcoin selloff.

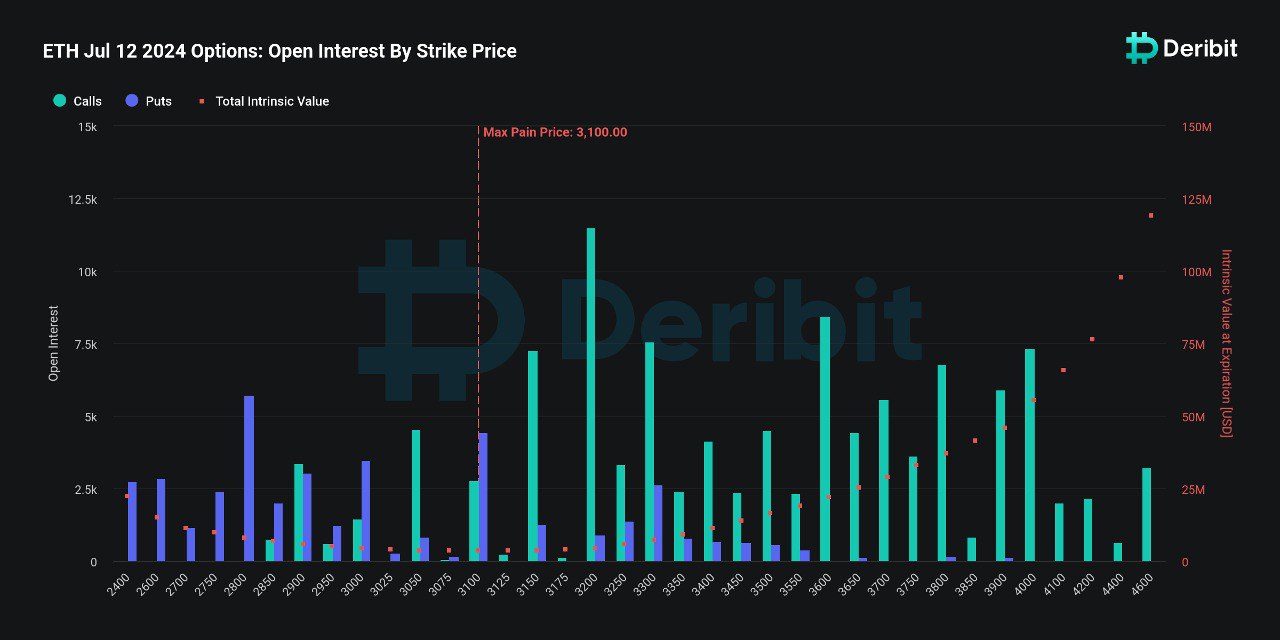

In the meantime, ETH choices of notional worth $0.48 billion are set expire. The put-call ratio is 0.37 and the max ache worth is $3,100. ETH price is at present buying and selling beneath the max ache level, implying that merchants nonetheless have some room to get well amid the spot Ether ETF sentiment.

PPI Inflation Information Looms

Producer costs index (PPI) annual inflation knowledge within the US is anticipated to come back in at 2.3%, increased than 2.2% in Could. The month-to-month studying is anticipated at 0.1% in opposition to -0.2% final month.

In the meantime, economists count on Core PPI YoY for June at 2.5%, a 0.2% improve as in comparison with final month. Additionally, Core PPI MoM is anticipated to come back in at 0.2%, increased than the earlier month’s core PPI knowledge.

Not too long ago, US CPI cooled to three%, inflicting odds of Fed price cuts to extend above 90%. Bitcoin additionally rebounded above $58,000 amid market optimism. Nonetheless, the value has dropped amid adverse sentiment.

Additionally Learn: Crypto Market Crash Fails To Dent VanEck CEO’s Bullish Outlook

Bitcoin Worth Falls As CME Futures Closes

Merchants bought BTC futures as CME closed futures buying and selling for the week, inflicting Bicoin worth to fall beneath $57,000. CME BTC futures buying and selling will open on Sunday.

The crypto market rebounded barely this week, with volatility falling sharply to a brand new low since March. The quarterly supply and enormous fluctuations created an ideal entry alternative for sellers. This week, choice sellers opened giant variety of positions, which additionally turned a driving drive to decrease the IV of main maturities.

Coinglass knowledge signifies CME BTC futures open curiosity fell over 1% within the final 24 hours. The BTC futures OI has dropped to $8.26 billion.

Additionally Learn: Bitcoin Enters Extreme Fear Zone For The First Time In 18 Months: Market To Crash?

The introduced content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: