Following the current worth spike that introduced Ethereum (ETH) near the $4,000 mark, the second-largest cryptocurrency has skilled inflows and renewed market enthusiasm. This is available in response to the US Securities and Change Fee’s (SEC) approval of Ethereum ETF purposes by main asset managers.

Greatest Week For Ethereum Since March

In line with a report by CoinShares, digital asset funding merchandise have witnessed a complete of $2 billion inflows, contributing to a five-week consecutive run of inflows amounting to $4.3 billion.

Moreover, buying and selling volumes in exchange-traded products (ETPs) have risen to $12.8 billion for the week, a 55% enhance from the earlier week.

Notably, inflows have been noticed throughout varied suppliers, indicating a turnaround in sentiment. Incumbent suppliers have additionally skilled a slowdown in outflows, reinforcing the optimistic market sentiment.

Associated Studying

As seen within the picture above, Bitcoin (BTC) continues to dominate the market, with inflows totaling $1.97 billion for the week. Alternatively, brief Bitcoin merchandise noticed outflows of $5.3 million for the third consecutive week.

Equally, Ethereum has additionally seen a notable surge in inflows, recording its greatest week since March with a complete of $69 million, which for CoinShares is probably going a response to the sudden SEC determination to permit spot-based ETFs on Ethereum.

Differing Views On ETH’s Value

Regardless of the optimistic developments, Ethereum’s worth has struggled to keep up bullish momentum, failing to retest its yearly excessive of $4,100 reached in March. On Friday, the worth dropped as little as $3,577.

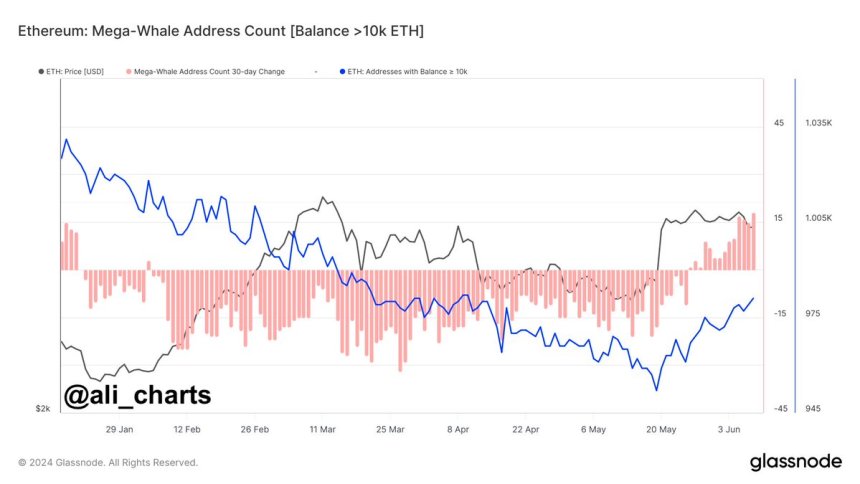

Nonetheless, Ethereum addresses holding greater than 10,000 ETH have elevated by 3% previously three weeks, indicating a major spike in shopping for stress.

Associated Studying

Market analysts have supplied differing views on Ethereum’s future worth motion. “Dealer Tank” predicts that ETH might drop to $3,500 whereas acknowledging the potential for a bullish reversal upon reclaiming the $3,700 degree.

Alternatively, crypto analyst Lark Davis highlights that Ethereum’s provide on exchanges is at an eight-year low, suggesting that the upcoming ETFs might trigger a “large provide shock” and doubtlessly result in a considerable enhance in ETH’s worth.

In the end, as Ethereum’s worth stays unsure, market members eagerly await the subsequent actions within the cryptocurrency. As traders and analysts carefully monitor the market dynamics, the query of whether or not a breakout above $4,000 or a retest of decrease help ranges at $3,500 awaits a solution.

The second-largest cryptocurrency in the marketplace is at present buying and selling at $3,690, down 6.5% previously two weeks.

Featured picture from DALL-E, chart from TradingView.com