Bitcoin’s value motion has turned somewhat sluggish after its unprecedented climb to a new all-time high of $122,838 on July 14. The speedy push to that degree was preceded by every week of frenzied buying and selling and heavy inflows, with BTC breaking by means of a number of resistance zones in fast succession. Nonetheless, as soon as that peak was hit, a sequence of unstable intraday actions adopted to give a pullback to $116,000 and Bitcoin is now again to buying and selling between the $117,000 and $118,500 value zone.

Associated Studying

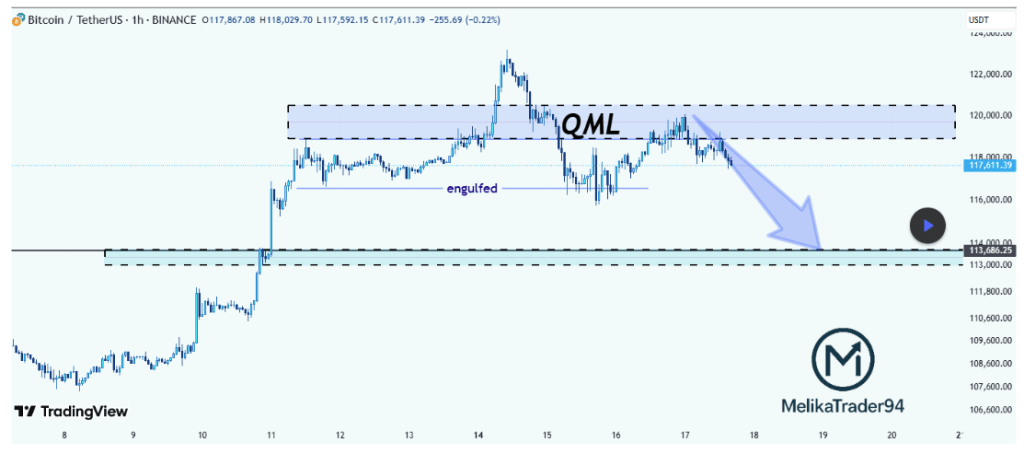

A notable bearish name got here from crypto analyst Melikatrader94, who posted a technical breakdown on the TradingView platform that may ship Bitcoin all the way down to $113,000.

QML Zone Rejection Factors To Downtrend Towards $113,600

In response to the hourly candlestick chart shared by Melikatrader94, Bitcoin is at the moment exhibiting a Quasimodo Degree (QML) construction. The Quasimodo Degree (QML) construction is characterised by three peaks in a bearish state of affairs or three troughs in a bullish state of affairs, with the center one being probably the most outstanding, figuring out the worth. The submit predicted that Bitcoin’s entry into the $119,000–$121,000 zone would draw sellers, and this was certainly the case.

The fast rejection after its all-time excessive confirms a bearish shift in construction, and now the momentum is tilted to the draw back. This rejection got here after a big value transfer that engulfed a earlier structural help degree.

“BTC rejected from QML zone and the selloff confirms bears are energetic,” the analyst famous.

The bearish outlook stays legitimate so long as Bitcoin stays beneath the QML zone, with the following essential help degree located at $113,600. This space might function a possible level for both a bounce or short-term consolidation if the worth continues downward. Nonetheless, a pullback is prone to happen round $116,000 earlier than Bitcoin falls to $113,600.

Altcoins Beneath Risk As BTC Worth Weakens

The potential Bitcoin crash to the $113,000 area might have severe implications for a lot of altcoins which might be already beginning to submit huge positive factors. Nonetheless, these altcoins, which frequently observe Bitcoin’s lead, are already exhibiting indicators of nervousness as BTC struggles to take care of upward momentum.

Among the many notable movers, XRP finally broke its eight-year-old resistance to hit a brand new all-time excessive of $3.65. Nonetheless, the rally appears to be stalling, with the token now exhibiting early indicators of a correction across the $3.45 zone. Ethereum, which additionally surged on the again of Bitcoin’s push to $122,000, climbed above $3,600 for the primary time in months however has since settled right into a consolidation section just under $3,500.

Associated Studying

Ought to the main cryptocurrency break beneath $116,000 within the coming days, it might trigger a cascade of outflows from altcoins and result in elevated promoting stress throughout the board. Nonetheless, we might see these main altcoins finally detach from Bitcoin’s motion. This could lead to an altcoin season the place main altcoins outperform Bitcoin for a while.

Featured picture from Pixabay, chart from TradingView