The Bitcoin value has been below vital bearish stress prior to now few weeks, and this crypto researcher has defined the role of demand available in the market correction.

BTC Obvious Demand Is Falling – Trigger For Alarm?

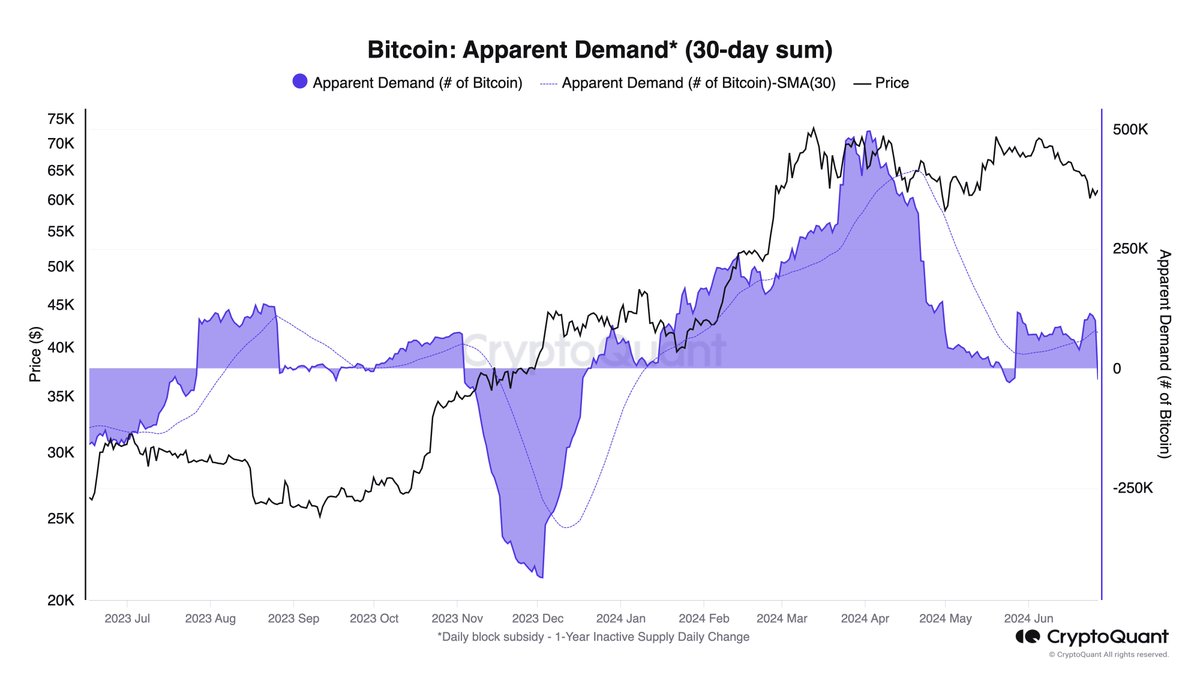

In a latest put up on the X platform, CryptoQuant’s head of analysis Julio Moreno explained how the newest Bitcoin value correction is linked to the falling Bitcoin demand. This evaluation is predicated on the Bitcoin obvious demand metric on the CryptoQuant platform.

Obvious demand calculation is commonly utilized in monetary markets to judge demand by evaluating manufacturing ranges and stock modifications. Principally, this metric supplies a transparent image of whether or not demand is rising or falling.

Within the case of cryptocurrencies, like Bitcoin, obvious demand is calculated by using the idea of inactive provide. This idea tracks the quantity of Bitcoin that has not been moved or transferred over a sure interval.

As Moreno highlighted, the chart beneath makes use of the 1-year inactive provide as a “proxy for stock.” This suggests that it screens the quantity of BTC that has not been moved or transacted for over a 12 months.

Chart displaying BTC obvious demand and value | Supply: jjcmoreno/X

In response to knowledge from CryptoQuant, roughly 23,000 BTC have flowed out of the 1-year inactive provide within the final 30 days. This means a decline in Bitcoin demand, because it appears long-term investors are opting to dump and transfer their Bitcoin.

This lower in demand has a number of implications, particularly on the worth of the premier cryptocurrency. As an example, the CryptoQuant head of analysis famous that the low demand is likely one of the catalysts of the latest value correction.

The inflow of serious BTC quantities from long-term holders to the market will increase the accessible provide, thereby placing downward stress on the costs. Furthermore, value dips may end up when the market’s shopping for stress is inadequate to absorb the extra provide.

CryptoQuant revealed in a weekly report that the Bitcoin demand has considerably declined in comparison with Q1 — following the launch of the US spot exchange-traded funds. As costs are at the moment down, it seems that a rise in BTC demand can potentiate the resumption of the present bull run.

Bitcoin Worth At A Look

As of this writing, the Bitcoin value stands round $60,790, reflecting a 1.6% decline prior to now week. In response to knowledge from CoinGecko, the market chief is down by practically 6% prior to now week.

The value of BTC thickens across the $60,000 mark on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView