The U.S. Home of Representatives votes on the Monetary Innovation and Expertise for the twenty first Century Act (FIT21), step one of a U.S. regulatory framework to realize regulatory readability for digital property. Ripple vs SEC lawsuit, Choose Torres’ abstract judgment, and help from XRP military together with legal professionals have performed a vital function in making ready for the landmark bipartisan crypto invoice.

FIT21 Crypto Invoice Passes

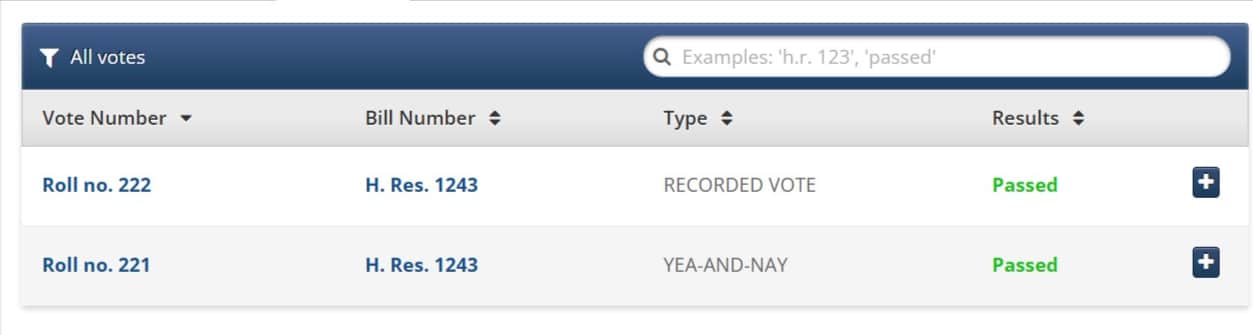

US Home the Monetary Innovation and Expertise for the twenty first Century Act (FIT21), H.R. 4763, will present regulatory readability over the regulation of digital property and defend shoppers, turning into a very powerful crypto invoice thus far. The Republican-favored crypto invoice has develop into a key dialogue affair amid the upcoming election this 12 months.

Some Democrats have additionally supported the crypto invoice that can present readability relating to which regulator both the SEC or CFTC has jurisdiction over digital property. Together with offering shopper and traders safety, it should assist distinguish which digital property are commodities and securities.

US Home Rating Member Maxine Waters says the invoice is just not match for objective and may create huge loopholes. Democrats spoke towards the crypto invoice. In the meantime, the White Home stated it won’t subject a veto menace towards FIT for the twenty first Century Act, if handed in Home.

The #NotFIT4PurposeActis laws would create an enormous loophole that might enable fraud to proliferate, & lead to devastating losses for:

❌crypto shoppers

❌traders attempting to avoid wasting for retirement, faculty & different targetsOur shoppers deserve higher, NO on #FIT21.

— U.S. Home Committee on Monetary Providers (@FSCDems) May 22, 2024

Additionally Learn: Ethereum ETF Approval Date: Is Thursday D-Day for SEC’s Decision?

Mentions of Ripple Vs SEC in A part of FIT21

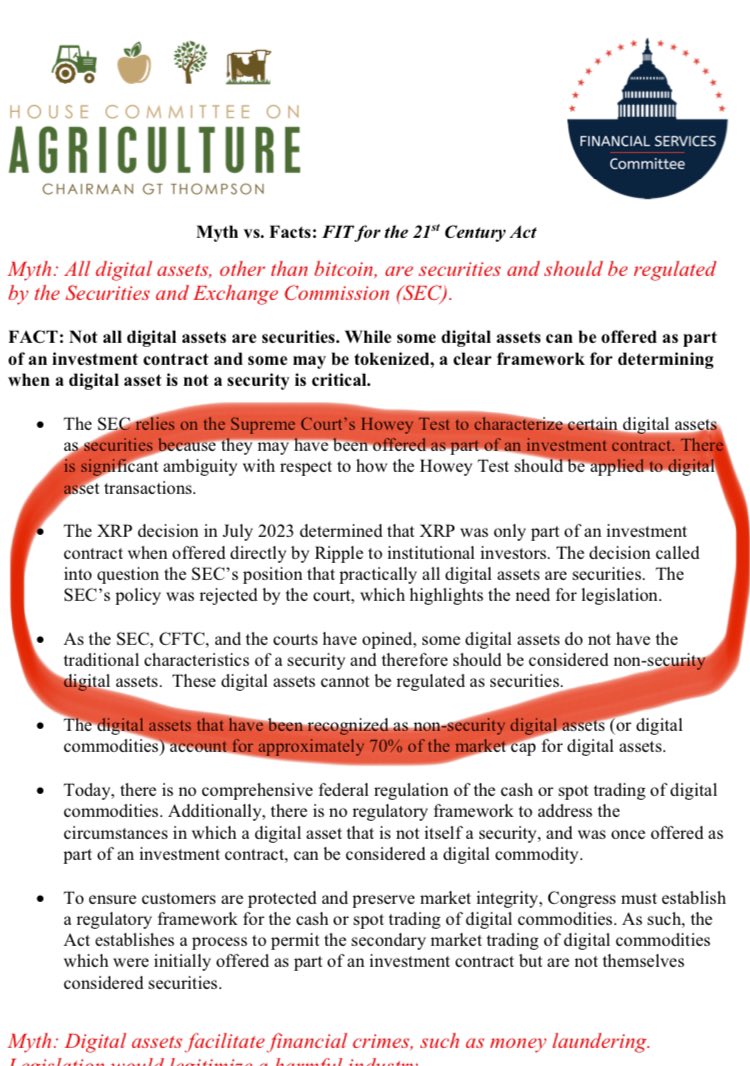

CryptoLaw, based by Deaton Legislation Agency, stated Ripple vs SEC lawsuit, Choose Torres’ resolution within the case, and XRP Military’s relentless strain to hunt readability have helped in addressing the creation of the invoice.

A bit within the crypto bill goals to make clear therapy of digital property offered pursuant to an funding contract. “A digital asset offered or transferred or supposed to be offered or transferred pursuant to an funding contract is just not and doesn’t develop into a safety because of being offered or in any other case transferred pursuant to that funding contract,” it reads.

Choose Torres affirmed this within the Ripple Vs SEC lawsuit that the token itself is just not a safety akin to programmatic gross sales by exchanges, however affords and gross sales of the token to establishments are securities. The XRP neighborhood known as for amendments within the present securities legislation for practicality to new applied sciences.

CryptoLaw said that SEC Chair Gary Gensler opposes the FIT21 as he needs to proceed arguing towards Choose Torres’ abstract judgment.

Home Committee on Agriculture has criticized Gary Gensler and the SEC for the political nature of their place. It additionally highlighted that the XRP resolution in July 2023 was key growth in making a regulatory framework.

Additionally Learn: US SEC Faces Probe Over Prometheum’s Plans to Custody ETH

The offered content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty to your private monetary loss.

✓ Share: