Is Michael Saylor’s facet of the story the truth of the state of affairs? Or is he on a injury management tour? The ex-MicroStrategy CEO spent the entire day as a visitor in what looks like each US monetary present in existence, letting everybody know that this complete factor was his concept. Saylor picked his successor for the CEO seat and declared himself Government Chairman, to concentrate on the corporate’s bitcoin technique. Because it often occurs, mainstream media framed it in a different way.

Since bitcoin’s worth remains to be down compared with the highs of yesteryear, mainstream media doesn’t miss a chance to dunk on the asset class. This time was no exception, since MicroStrategy common bitcoin buy stands at round $30K, and bitcoin’s present worth is round $24K, most mainstream sources reported that the corporate had one way or the other misplaced $1B and recommended that may be the explanation behind Saylor’s outing.

Even Bitcoinist joined in on the party. Moreover the bitcoin facet of issues, we mentioned:

“In keeping with a Bloomberg article citing information from monetary analytics agency S3 Companions, a report 51 % of the corporate’s excellent shares are being offered quick at a notional worth of $1.35 billion.

The analytics firm mentioned that the all-time excessive of 4.73 million shares shorted elevated by 1.2 million shares within the final 30 days alone.”

Quite the opposite, for the reason that Saylor information hit the Web, MSTR shares are up by round $40. And that’s not even the juicy a part of MicroStrategy’s bitcoin story.

MSTR worth chart on NASDAQ | Supply: TradingView.com

Michael Saylor’s Tv Tour

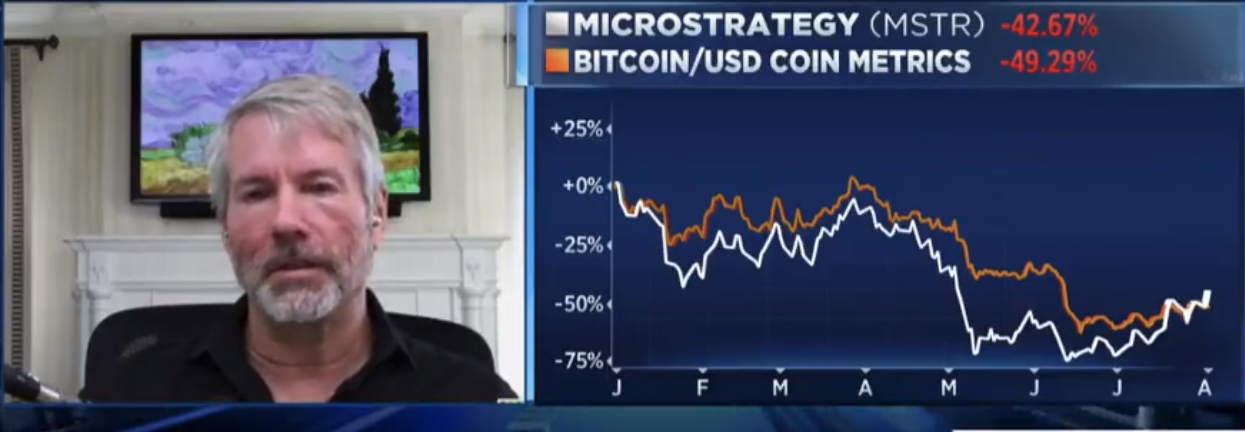

The ex-CEO began the day tweeting, “In my subsequent job, I intend to focus extra on Bitcoin.” A humorous one-liner that incorporates a lot fact. However the day and Saylor’s tour was simply getting began. His first cease was on CNBC’s Squawk on The Avenue, and on the tweet selling his efficiency Saylor wrote, “Since adopting a Bitcoin Technique, $MSTR has outperformed each asset class & large tech inventory. With my ascension to Government Chairman, the promotion of Phong Le to CEO & arrival of CFO Andrew Kang, our staff is stronger than ever & we’re full velocity forward.”

Since adopting a #Bitcoin Technique, $MSTR has outperformed each asset class & large tech inventory. With my ascension to Government Chairman, the promotion of Phong Le to CEO & arrival of CFO Andrew Kang, our staff is stronger than ever & we’re full velocity forward.pic.twitter.com/HSBjEgpizc

— Michael Saylor⚡️ (@saylor) August 3, 2022

In keeping with Saylor, the MSTR inventory is up “123% by August 1st,” outperforming bitcoin itself, which is 94% up in the identical time interval. Not solely that, but it surely additionally outperformed the S&P 500 and Nasdaq, that are solely barely up; and gold, silver, and bonds, that are down. Moreover that, it dubled Google’s progress and outperformed Apple in the identical interval. And Amazon, Meta, and Netflix are down.

MicroStrategy is a hybrid firm, Saylor continues. Their enterprise intelligence and enterprise software program companies have secure income and good money stream. Bitcoin is simply their treasury reserve asset, and contemplating the inflation charges on nearly each nation on Earth, it’s an outstanding one. In keeping with Saylor, the asset is accountable for getting the corporate by this “tough monetary interval” wherein “most currencies are crashing and most belongings are struggling.”

About The Supposed Loses

Clearly, all the TV hosts Saylor visited requested him in regards to the $1B that MicroStrategy supposedly misplaced. MicroStrategy has not offered one BTC to date, how can that be certified as a loss? In keeping with the CEO, it was only a “non-GAAP impairment cost for the quarter” and all the stockholders knew it was coming. Within the Bloomberg interview, Saylor described it as “a non-cash indefinite intangible loss.”

Michael Saylor on Bloomberg:#bitcoinpic.twitter.com/SZJXa2X4j8

— Neil Jacobs (@NeilJacobs) August 3, 2022

In accordance to Investopedia, “a non-cash cost is a write-down or accounting expense that doesn’t contain a money cost. They’ll symbolize significant adjustments to an organization’s monetary standing, weighing on earnings with out affecting short-term capital in any manner.” And people “scale back earnings however not money flows.”

In any case, Saylor mentioned “volatility is vitality” and MicroStrategy embraces the volatility.

Saylor On The Firm’s Bitcoin Technique

The title recognition that bitcoin delivered to MicroStrategy can’t be purchased. They “can’t actually ignore us,” Saylor mentioned. Bitcoin has been a “profit on advertising and marketing and gross sales” and a “internet constructive” for the corporate. Actually, he qualifies it as “a screaming homerun for the shareholders.”

Lastly, the host asks him what everybody was pondering. Does he stepping down as CEO imply that MicroStrategy may be promoting a few of their BTC? Saylor’s reply, “Our officers and our administrators are unanimously dedicated to the bitcoin technique.”

Different TV Appearances

By our rely, Saylor was a visitor on three mayor TV reveals right this moment alone. In all of them, he advised the same story. Nevertheless, he dropped new nuggets of knowledge right here and there. Sharing the video of his FOX go to, Saylor wrote, “At the moment Charles Payne and I shared amusing as we mentioned the advantages of a Bitcoin Technique, the outperformance of $MSTR vs different shares & asset courses, and my resolution to tackle the Government Chairman position at MicroStrategy.”

At the moment @cvpayne and I shared amusing as we mentioned the advantages of a #Bitcoin Technique, the outperformance of $MSTR vs different shares & asset courses, and my resolution to tackle the Government Chairman position at @MicroStrategy. pic.twitter.com/OsxyWhBtPF

— Michael Saylor⚡️ (@saylor) August 3, 2022

The brand new data is that MicroStrategy adopted bitcoin solely 2 years in the past. On the time, the corporate was valued at $666 million. Since then, they’ve “added 5 billion to that quantity.” That implies that it has grown 730% in 24 months. Bear in mind, that is the worth of the corporate as an entire. The 123% progress we quoted earlier than refers back to the MSTR inventory.

Since @MicroStrategy adopted a #Bitcoin Technique, its enterprise worth is up +730% (+$5 billion) and $MSTR is up +123%. Efficiency of BTC is +94%, S&P 500 +23%, Nasdaq +13%, Gold -13%, Bonds -14%, Silver -29%. GOOG +54%, AAPL +43%, MSFT +34%, AMZN -14%, META -39%, NFLX -53%. pic.twitter.com/BWHPhbOg0d

— Michael Saylor⚡️ (@saylor) August 3, 2022

Within the Bloomberg interview, they requested Saylor about Tesla selling 75% of their bitcoin. He answered it was a tragic day for Tesla, however instantly took it again and mentioned it’s not his place to touch upon different individuals’s enterprise. Nevertheless, Saylor mentioned, “buying and holding high-quality property eternally is an efficient funding technique. And bitcoin, for my part, is the highest-quality property on the planet.”

Featured Picture: The ex-CEO, screenshot from this video | Charts by TradingView