K33 Analysis, previously referred to as Arcane Analysis, has printed a report which suggests Bitcoin buyers ought to comply with the outdated Wall Road adage “Promote in Could and go away.” The saying means that buyers ought to promote their shares in the summertime and purchase them again on the finish of the summer season to keep away from a seasonal decline within the inventory market.

Of their Bitcoin-related report, senior analyst Vetle Lunde writes that the present drawdown and restoration cycle is strikingly much like the sample of the 2018-19 bear market when it comes to size and trajectory. If historical past repeats itself, Bitcoin might peak at $45,000 in as little as one month, round Could 20, 2023, in response to the analyst.

Similarities Of The Present Bitcoin Rally To 2018

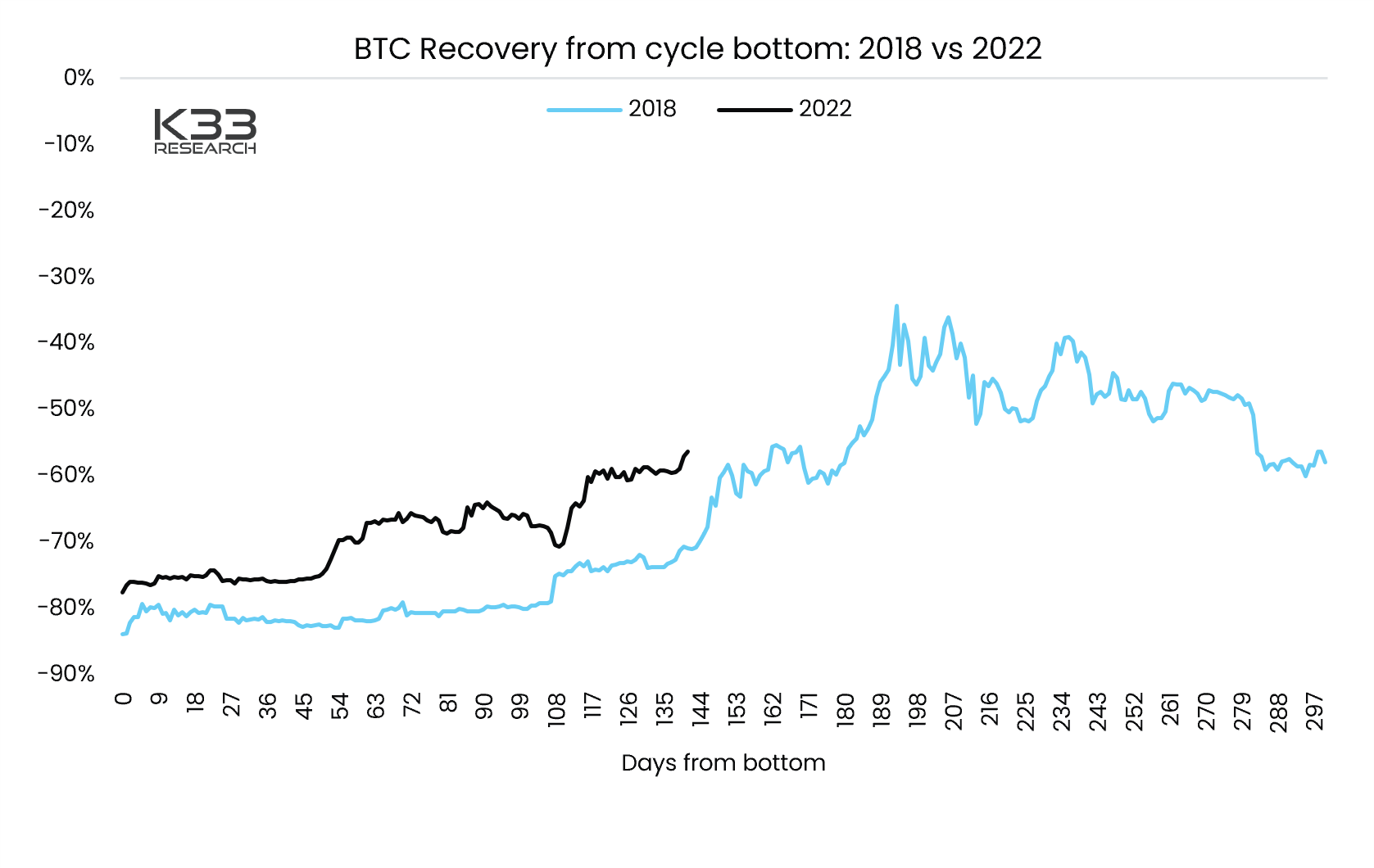

The analysis relies on an evaluation utilizing fractals of earlier drawdowns and former lows. “Whereas nobody ought to count on a 1:1 mirroring of the present drawdown to earlier drawdowns, the resemblance to the 2018 drawdown is staggering,” writes Lunde, who shared the chart beneath.

The analyst discovered similarities in each the length from peak to backside and the restoration path. The lows of the present cycle and the 2018 bear market cycle lasted each about 370 days.

The return from peak to backside can be strikingly related. After 510 days, it was 60% in each cycles. The one minor distinction is that the decline from peak to backside in 2018 was barely larger at 84% than in 2022, when BTC bottomed at 78% from the all-time excessive.

The conclusion that Bitcoin will attain its native excessive round Could 20, 2023 comes from the truth that in 2018, the bear market rally peaked 556 days after the 2017 excessive, on June 29, 2019, with a drawdown of 34% from the excessive. Lunde subsequently predicts:

Whereas historical past is way from prone to repeat in a similar way if the fractal have been to proceed – BTC would peak round Could 20 at $45,000.

As for the explanations for the robust similarities, Lunde has no “passable” rationalization. The most effective rationalization, in response to Lunde, is the pragmatic habits of long-term holders of Bitcoin, who even after the sharp drawdown show their “diamond fingers”, that means they don’t promote, and as a substitute use the part to build up.

Furthermore, in response to Lunde, the present rally has all of the hallmarks of a “hated” rally – “a rally the place holders really feel underexposed after a extremely traumatic yr, the place buyers are de-risked in anticipation of additional draw back,” as Lunde writes, discovering one other similarity on this:

The hated rally of 2019 ended with a big blow-off prime earlier than BTC resumed buying and selling at a 40-60% drawdown from its 2017 ATH.

Remarkably, K33 Analysis isn’t the one analytics agency predicting a neighborhood excessive for Bitcoin within the mid $40,000s. Glassnode co-founders Jan Happel and Yann Allemann write of their newest newsletter that the market is at the moment displaying excessive energy, which is why the subsequent huge goal is $35,000 earlier than $47,000.

“That is nonetheless the outlook simply as we count on a lot larger costs into late Q2 and Q3,” write the analysts, who focus their consideration totally on macro information and the greenback index (DXY). The latter, in response to the Glassnode co-founders, will fall into the 91-93 vary earlier than the top of the yr, which might be extraordinarily bullish for Bitcoin.

At press time, the Bitcoin value traded at $29,340.

Featured picture from iStock, chart from TradingView.com