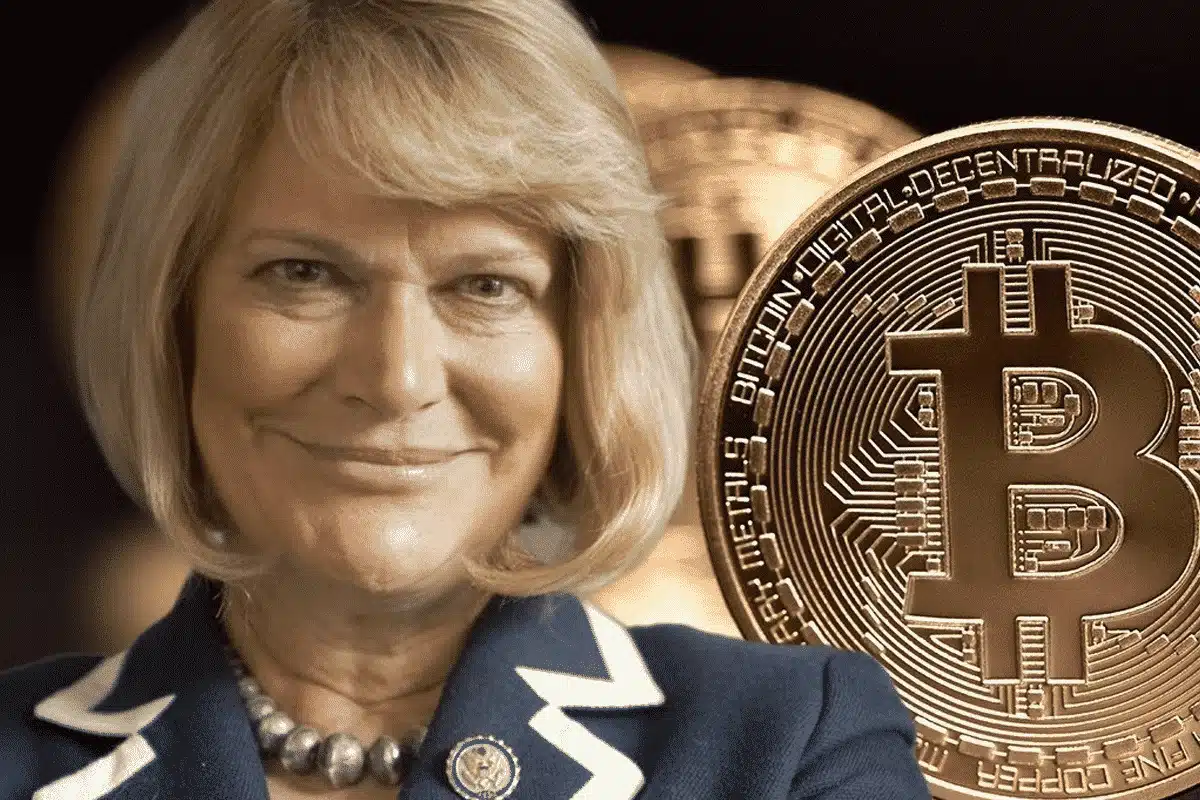

Senator Cynthia Lummis of Wyoming is about to make waves within the crypto neighborhood together with her anticipated announcement on the upcoming Bitcoin Convention. Based on a report, she plans to introduce laws that might see Bitcoin held as a strategic reserve by the US Federal Reserve. This transfer may revolutionize the best way digital currencies are perceived and built-in into the mainstream monetary system.

Sen Cynthia Lummis To Make Main Announcement

Based on Fox Enterprise’ senior correspondent Charles Gasparino, Sen. Cynthia Lummis goals to unveil laws on the Bitcoin Conference 2024. This invoice would set up a pathway for the US Federal Reserve to carry Bitcoin as a strategic reserve asset.

In addition to, Gasparino reported that the Senator hopes to realize help from former President Donald Trump, who can also be talking on the occasion. Notably, rumors have already gained traction available in the market currently that Donald Trump is about to announce Bitcoin as a US Strategic Reserve on the upcoming Bitcoin Convention.

Notably, an unique report from Fox Enterprise elaborates on Lummis’ plan. It states that the senator has been quietly engaged on this laws, which may considerably alter the crypto business by positioning Bitcoin as a mainstream monetary asset. As well as, the report signifies that the Senator may announce her intentions through the convention, probably earlier than Trump’s speech, aiming to safe his endorsement.

In the meantime, the invoice’s specifics stay beneath wraps, however its major purpose is to direct the Federal Reserve to accumulate and maintain Bitcoin equally to gold and foreign currency echange. In the meantime, this strategic transfer would assist stabilize the US greenback and combine Bitcoin into the nation’s monetary framework. Notably, the report states that Cynthia Lummis has been discussing the invoice together with her colleagues on the Senate Banking Committee to garner help.

Additionally Learn: Coinbase To List This New Gaming Token, Price Rallies 160%

Why It Issues?

Alex Chizhik, Chief Business Officer at HarrisX, highlighted the potential significance of the invoice. He famous that having the Federal Reserve maintain Bitcoin as a strategic reserve asset can be a groundbreaking transfer, signaling the central financial institution’s embrace of innovation. This motion may stabilize the U.S. greenback and produce legitimacy to Bitcoin as a monetary asset, the report added.

Nevertheless, regardless of the joy, the invoice faces potential hurdles. Implementing Bitcoin as a reserve asset would require backing from the president and Congress. Given the skepticism amongst political and financial circles about digital currencies, this could possibly be difficult.

In the meantime, critics argue that the unstable nature of Bitcoin may complicate its use as a hedge in opposition to financial uncertainties. Nonetheless, introducing such laws would acknowledge Bitcoin’s legitimacy as a monetary asset.

Notably, the US govt. already holds round 213K Bitcoins, valued at over $65,860 every, principally seized from illicit actors. Contemplating that, Cynthia Lummis believes that incorporating Bitcoin into the Federal Reserve’s property may help the power of the U.S. greenback.

In the meantime, the invoice’s reception in Congress stays unsure, however its introduction signifies a big step in the direction of mainstreaming Bitcoin. With endorsements and potential backing from Donald Trump, the cryptocurrency business may see a considerable increase within the BTC value.

Additionally Learn: USDC Issuer Circle Reveals Major Update To Drive Web3 Adoption

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: