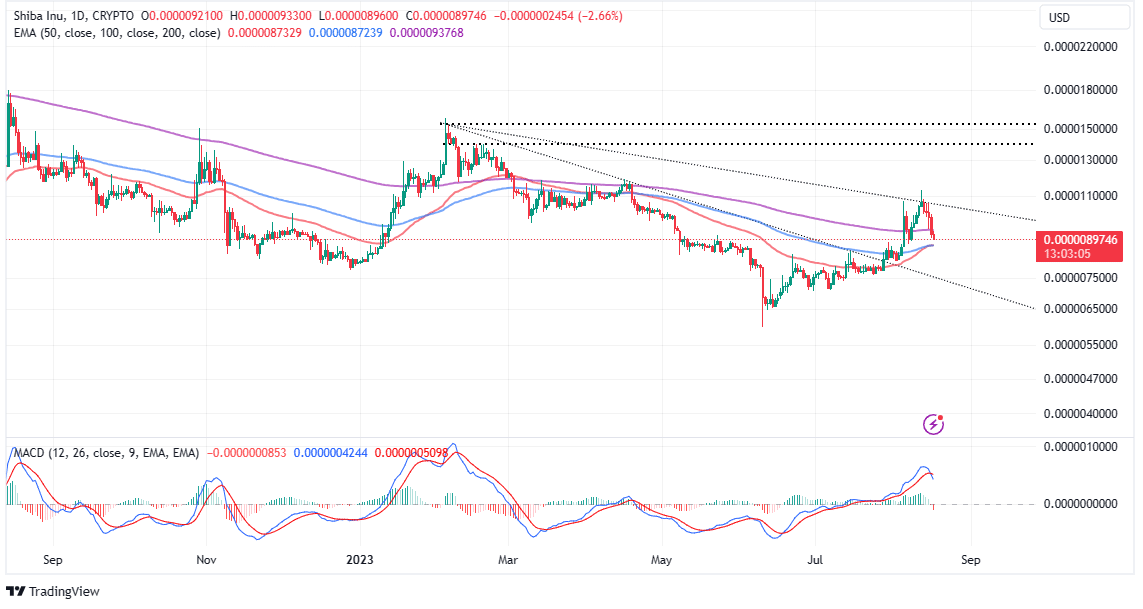

Shiba Inu is sinking additional under $0.00001, opposite to investor expectations of a rally brewing following the launch of the anticipated Ethereum Layer 2 protocol, Shibarium. Down 8%, SHIB is buying and selling at $0.00000908 on Thursday, with the opportunity of revisiting decrease help ranges at $0.0000075 and $0.0000065, respectively.

Shibarium Mainnet Launch Fails to Set off Shiba Inu Rally

Shiba Inu has since mid-June sustained a optimistic outlook, with the value climbing from $0.000006 to August highs of $0.00001130. Because the launch of the Shibarium mainnet protocol approached, buyers booked positions propping SHIB for a rally.

With declines characterizing Shibarium’s launch, it may be deduced that the occasion had been priced and with revenue taking ready to occur.

The state of affairs was made worse by technical points that emerged following the protocol’s launch. Data shared by Colin Wu, a Chinese language crypto reporter indicated that the Layer 2 options protocol had abruptly stopped producing blocks and was pending. Citing knowledge from Beosin monitoring, Wu mentioned that “$1.7 million in ETH is locked on the Shibarium cross-chain bridge.”

In keeping with Beosin monitoring, the transaction on Shibarium, Shiba Inu’s Layer 2 resolution, is in a pending state. Presently, $1.7 million in ETH is locked on the Shibarium cross-chain bridge. Customers are suggested to briefly cease utilizing Shibarium. Throughout the Shibarium testnet,…

— Wu Blockchain (@WuBlockchain) August 17, 2023

The SHIB neighborhood was notably perturbed by the information, particularly following a profitable take a look at run that noticed testnet obtain a powerful milestone of 21 million pockets addresses.

In keeping with a CoinGape report, Shibarium went back online, though briefly. Blocks count data reveals that the protocol’s final transaction occurred roughly 5 hours in the past. In the meantime, builders are engaged on a restoration course of for the belongings caught on the bridge.

The neighborhood fears that the challenges Shibarium faces could possibly be the tip of the iceberg with safety, security, and scalability issues more likely to comply with. Buyers have been suggested by Beosin to keep away from the Shibarium protocol till the problems are resolved.

Shiba In Bleeding – A Purchase The Dip Alternative

The problems plaguing Shiba Inu, though not micro, are leaving the meme coin weak to losses. Furthermore, buyers are more likely to proceed promoting as a approach of defending the beneficial properties accrued over the previous couple of weeks from being worn out.

Reports in the market suggest many of the promoting strain is coming from whale exercise in SHIB, LEASH, and BONE tokens.

The trail with the least resistance will possible stay to the upside, with the Shifting Common Convergence Divergence (MACD) indicator exhibiting a brand new promote sign. Merchants who could also be looking for publicity to brief positions in SHIB could be looking for the value to drop under preliminary help at $0.000009, validated by the MACD line in blue crossing under the sign line in pink.

There’s the opportunity of Shiba Inu bouncing off the confluence help created at $0.000008724 by the 50-day Exponential Shifting Common (EMA) (pink) and the 100-day EMA (blue). Nonetheless, if losses proceed undeterred buyers might wish to acclimatize to SHIB retesting decrease help areas at $0.0000075 and $0.0000065.

It is usually untimely to rule out a possible rebound, with Shiba Inu presenting buy-the-dip alternatives for one more try on the rally to $0.00002.

Associated Articles

The offered content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.