Bitcoin’s latest climb has been calm and measured, a pointy distinction to the explosive rallies of the previous. It’s buying and selling above its historic progress path, however removed from overheating. Lengthy-time holders stay largely inactive, whereas the majority of buying and selling exercise is coming from contemporary faces available in the market.

Bitcoin Progress Stays On Monitor

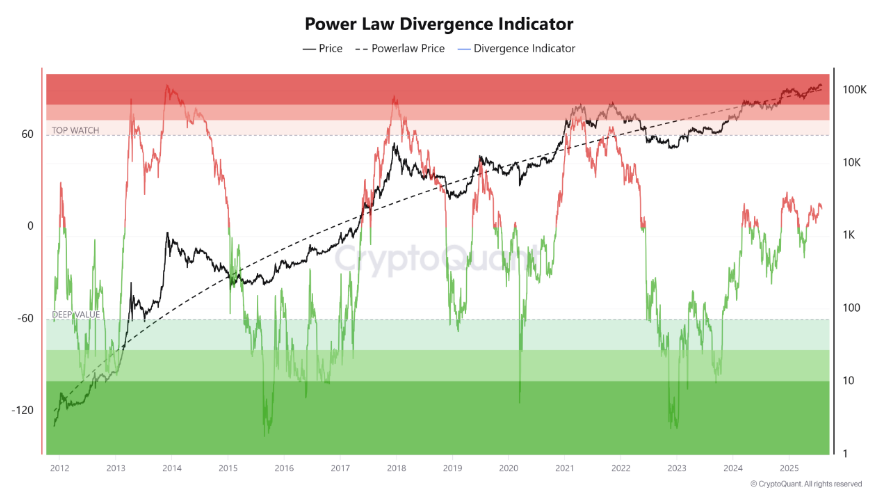

Based mostly on stories by Arab Chain utilizing CryptoQuant information, Bitcoin’s worth is monitoring a Power Law trend that implies a clean, logarithmic rise over time.

That mannequin creates a curved path reasonably than sudden spikes. Proper now, BTC sits above the anticipated progress line however properly under the higher “purple zone” that alerts overheating.

The divergence indicator is optimistic, but removed from ranges seen in previous bubbles. This sample hints at pure progress or maybe the early levels of renewed betting.

Divergence Retains Room For Upside

Analysts word that staying under the highest watch zone leaves room for extra features earlier than panic units in. In prior cycles, costs shot by way of that purple zone after which collapsed.

Right this moment, Bitcoin is about $50,000 below its most up-to-date peak degree. That hole suggests consumers nonetheless have respiration room in the event that they select to push costs greater.

On-chain information from Glassnode reveals short-term holders (STHs) are behind many of the motion. Round 86% of Bitcoin’s spent quantity during the last 24 hours got here from wallets energetic lower than 155 days, totaling $18 billion.

Lengthy-term holders (LTHs) accounted for under 14.5% of spent quantity, or $3.10 billion. That cut up means newer entrants are driving swings, whereas veteran holders keep largely on the sidelines.

Lengthy-Time period Holders Present Conviction

That dichotomy between STHs and LTHs tends to point intense conviction amongst core believers. When long-term house owners stay in place, worth drops are typically extra delicate. Consumers who’ve held on for years or months sometimes view dips as alternative so as to add reasonably than occasions to promote.

Bitcoin was buying and selling round $114,113 at press time following a pullback from latest highs of about $118K. The every day Relative Energy Index had fallen to 43, indicating a lack of bullish momentum with out going into oversold ranges. On-Stability Quantity has been declining prior to now week, indicating weakening shopping for strain.

Market Cooling Doesn’t Imply Collapse

Experiences have disclosed that this mixture of alerts matches a market that’s cooling reasonably than crashing. Merchants are taking earnings, but they aren’t dashing for the exits. The general image factors to a maturing market that also has room to run however gained’t doubtless repeat the manic swings of years previous.

Featured picture from Pexels, chart from TradingView