Institutional traders had been the main power behind the Bitcoin rally in 2021, realizing its potential use instances sooner or later. Institutional traders reminiscent of JPMorgan, Ark Make investments, MicroStrategy, Tesla, Andreessen Horowitz, and others grew to become supporters of Bitcoin and different cryptocurrencies. Nevertheless, institutional traders are extra keen to spend money on Ethereum (ETH) than Bitcoin (BTC).

Institutional Buyers Choose Investing in Ethereum Than Bitcoin

The narrative concerning Ethereum overtaking Bitcoin continues to rise after Ethereum Merge and Shanghai improve. Merchants anticipate smaller swings in Ethereum than Bitcoin within the close to time period.

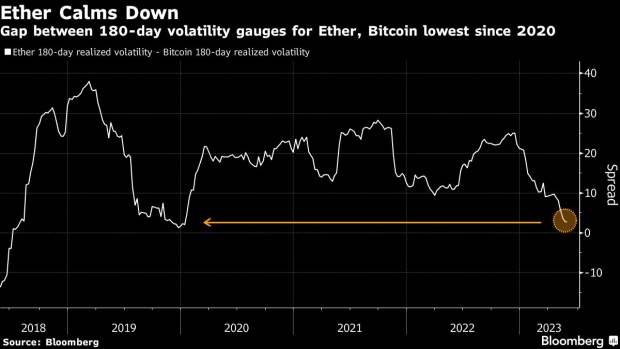

Ethereum’s 30-day volatility index now trails greater than Bitcoin volatility index. Furthermore, the 180-day realized or historic volatility of Ether relative to Bitcoin has decreased immensely since 2020, according to Bloomberg.

This makes institutional traders extra concerned with investing in ETH than BTC as decrease volatility sometimes allows institutional traders to allocate extra capital to crypto. Lengthy-term traders usually tend to enhance publicity to Ethereum.

Bitcoin and Ether implied volatility indexes are based mostly on choices pricing. Each indexes fell from current peaks in March however the Ethereum index dropped extra.

Richard Galvin, co-founder at fund supervisor Digital Asset Capital Administration, argues Ethereum staking yields rising after the Shanghai improve in April will additional suppress volatility. Nevertheless, the US SEC refuses to think about Ethereum as non-security. SEC Chair Gary Gensler believes Ethereum’s proof-of-stake (PoS) transition transformed it right into a safety.

In the meantime, Bitcoin blockchain is impacted by Bitcoin ordinals non-fungible tokens and meme cash. Furthermore, Bitcoin and Ethereum value correlation fell to its lowest since 2021.

Additionally Learn: Ethereum Client Releases Pruning Update After Vitalik Buterin Updated The Roadmap

ETH Worth Stays Steady As in comparison with BTC Worth

ETH price continues to commerce above $1800 regardless of a number of macro components, regulatory points, and the looming US debt ceiling disaster impacting the worldwide market immensely. The worth is presently buying and selling at $1813, up 1% within the final 24 hours.

BTC price stays prone to falling beneath $25,000. The worth is down 1% prior to now 24hrs, with the 24-hour high and low of $26,549 and $26,986, respectively.

Additionally Learn: Peter Brandt Predicts Bitcoin Price Fall Below $25K In May

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.