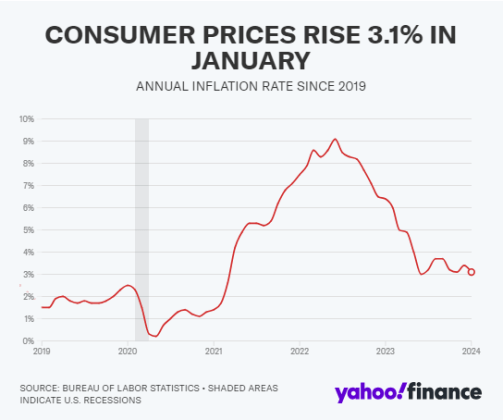

Inflationary pressures in the USA are poised to hit crypto-friendly fast food chains, probably resulting in a downturn of their fortunes. Current information from the Bureau of Labor Statistics signifies a surge in inflation, leading to challenges associated to uncooked supplies and the labor market. As the price of important elements rises, quick meals institutions might expertise decrease income, a lower in buyer footfall, and better labor prices.

Eating Dilemma: Price Of Consuming Out Soars

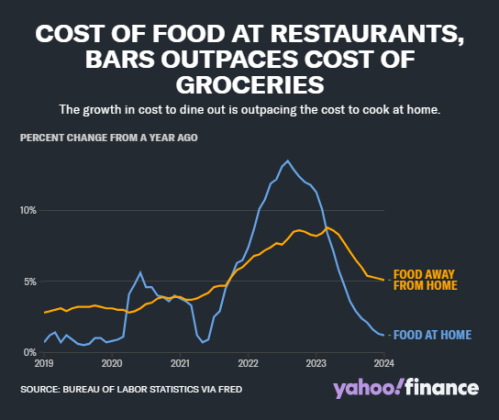

In line with a report by Yahoo Finance, Individuals have gotten more and more hesitant to simply accept invites for elegant eating experiences outdoors their houses. In January alone, the price of consuming out rose by 5.1% in comparison with the identical month final 12 months and by 0.5% from the earlier month. Conversely, grocery costs witnessed a extra modest improve of 1.2% over the earlier 12 months and 0.4% over December, stabilizing thereafter.

Up to now, in response to Citi analyst Jon Tower, a sample has emerged the place, if commodity inflation outpaces labor inflation, grocery costs are inclined to rise sooner than these at eating places. Conversely, when labor inflation exceeds commodity inflation, restaurant costs are inclined to surpass these of groceries.

This development suggests that buyers might decide to cook dinner at house extra incessantly as the price of eating out continues to rise. Moreover, the upper value of dwelling interprets into elevated costs for uncooked supplies, posing profitability challenges for quick meals chains.

A number of crypto-friendly quick meals chains are already going through the affect of hovering inflation. KFC, famend for promoting the “Bitcoin Bucket,” encountered difficulties as poultry costs reached an all-time excessive final 12 months.

Whole crypto market cap at $1.859 trillion on the day by day chart: TradingView.com

Equally, Starbucks, which allows clients to pay with Bitcoin, confronted a greater than 40% improve in commodity costs for Arabica espresso for the reason that onset of the pandemic. Subway, one of many pioneers in accepting Bitcoin as cost, has grappled with the rising prices of important greens, bread, and different uncooked supplies.

Along with the escalating prices of uncooked supplies, quick meals chains working at the least 60 websites throughout America will quickly face the need of accelerating the minimal wage for his or her restaurant workers to $20 per hour. This impending change, set to take impact in April, is more likely to exacerbate challenges associated to profitability and money move.

Crypto Funds Dwindle Amid Inflation Considerations

The affect of rising inflation extends past the quick meals trade to the realm of crypto transactions. As eating places battle to keep up their foothold available in the market, many purchasers might decide to keep away from utilizing cryptocurrencies as cost.

Conducting crypto transactions on numerous platforms incurs charges, and with buying energy already underneath pressure, clients might search to reduce further bills and as a substitute choose money or card funds.

Featured picture from , chart from TradingView