Solana is among the many largest losers as cryptos bleed amid considerations over the fierce conflict between Israel and Hamas. The aggressive sensible contracts token misplaced 4.2% of its worth to commerce barely above $21.

Bitcoin and Ethereum are additionally within the purple, down 1.3 and 1.5% respectively to commerce at $26,697 and $1,544. The market capitalization which had rallied above $1.1 trillion early final week because of the pleasure surrounding the SEC’s approval of Ether futures exchange-traded funds (ETFs) within the US, has tumbled to $1.08 trillion.

Solana Worth Prediction: Can SOL Rebound With This Assist?

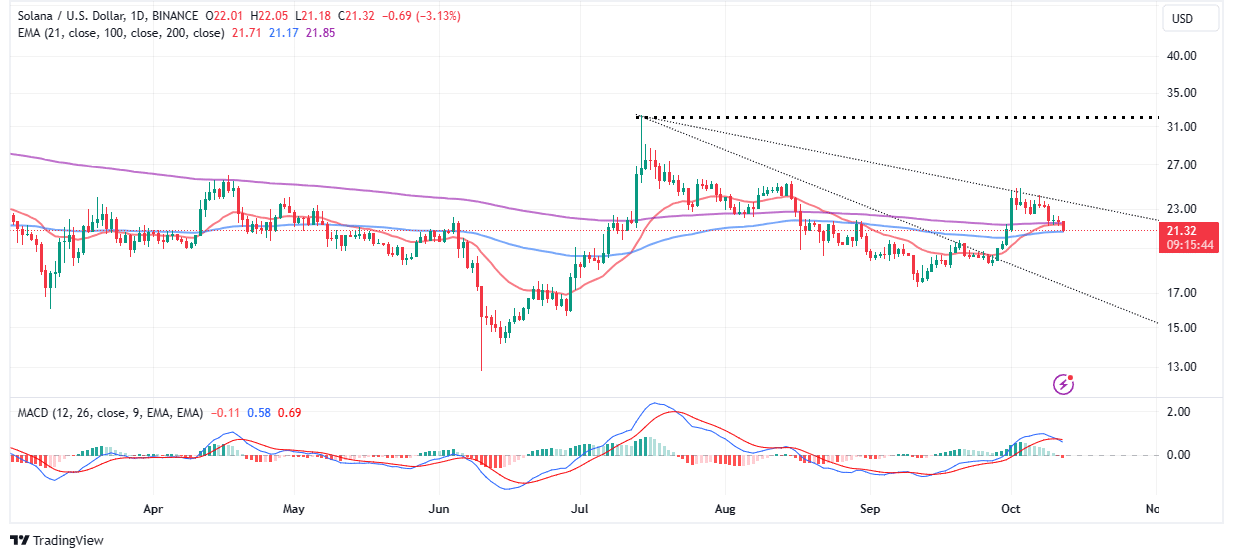

Solana worth is in a dangerous spot because it balances on the cliff’s edge – the 100-day Exponential Transferring Common (EMA) (blue). Following the rejection from resistance at $25 originally of October, it has been a downward spiral.

With the ball within the bears’ courtroom, the bulls should efficiently defend the 100-day EMA help at $21.17 to scale back the danger of SOL falling under $20.

The Transferring Common Convergence Divergence (MACD) is in help of the bearish outlook after confirming a purchase sign within the each day timeframe. So long as the MACD line in blue holds under the sign line in purple, the trail with the least resistance would keep on the draw back.

A break under the fast help would mark the quick sellers’ occasion who could need to begin reserving income at $20. Different key help areas to bear in mind whereas buying and selling Solana embrace $17.5 and $15. Past this, we could possibly be looking at an analogous crash that befell SOL in the course of the FTX implosion in November.

US Inflation Information Catches Solana Off-Guard

The discharge of the US Consumer Price Index (CPI) is hurting the crypto regardless of information exhibiting inflation is easing within the buck nation. In accordance with the report from the Bureau of Labor Statistics (BLS), CPI rose 0.4% in September in comparison with 0.6% in August—the most important hike in 14 months.

From the beginning of the yr to September, the CPI elevated by 3.7% however the metric on a year-over-year foundation revealed that costs have decreased from the 9.1% peak in June 2022.

Economists are already predicting that the Fed will keep interest rates unchanged on the finish of the following FOMC assembly on November 1.

John Haar, Swan Bitcoin’s head of personal consumer providers mentioned in a press release that “Given the current transfer increased in Treasury yields, and up to date commentary from Fed officers, it seems that the Fed is more likely to preserve charges fixed at their subsequent assembly on November 1.”

Nonetheless, the conflict within the Center East between Israel and Hamas might negatively affect oil costs which could knock on the core inflation.

There are extra macro occasions and associated speeches this week, however they’ve little affect on the crypto market, which continues to be primarily going unbiased.

For instance, the discharge of CPI information right this moment had virtually no affect available on the market, on the one hand, the information launched was in line… pic.twitter.com/HadafgjhsZ— Greeks.stay (@GreeksLive) October 12, 2023

For now, merchants must be eager on how Solana reacts to help on the 100-day EMA. A break under might set off a sell-off whereas an instantaneous rebound may permit for consolidation earlier than the following transfer to $25 and $30, respectively.

Associated Articles

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: