Key Notes

- Solana worth holds above $200 regardless of weakened quantity, supported by Wrapped Bitcoin inflows and ETF hypothesis.

- WBTC provide on Solana surpasses $1 billion, marking 5 straight months of progress.

- Cyber Hornet recordsdata an ETF that blends Solana futures with S&P 500 shares, signaling Wall Avenue’s gradual integration of crypto.

Solana (SOL) worth managed to keep away from a detailed beneath the $200 regardless of a big decline in buying and selling quantity. A $1 billion influx of Wrapped Bitcoin minted on Solana and one other important ETF submitting from US agency Cyber Hornet, had been amongst key occasions that boosted Solana’s resilient displaying over the weekend.

On Friday, Solana information aggregator SolanaFloor alerted the group to wrapped Bitcoin (WBTC) provide on Solana crossing the $1 billion milestone. In accordance with the Dune chart shared within the publish, Solana’s WBTC provide has recorded 5 consecutive month-on-month progress spurts since Might 2025.

🚨NEW: Wrapped Bitcoin provide on @Solana has hit an all-time excessive of 9,270 $BTC, surpassing $1.03B market cap onchain for the primary time. pic.twitter.com/nkjxEHTt7D

— SolanaFloor (@SolanaFloor) September 26, 2025

This alerts that current revolutionary community upgrades have seen Solana emerge as a prime vacation spot for traders looking for passive revenue on their BTC holdings because the market consolidates. If this constructive affect from the lively inflows from BTC holders pattern has been pivotal to the Solana worth, it has averted main downswings beneath $200.

Cyber Hornet ETF Filling May Set off Delayed SOL Value Response

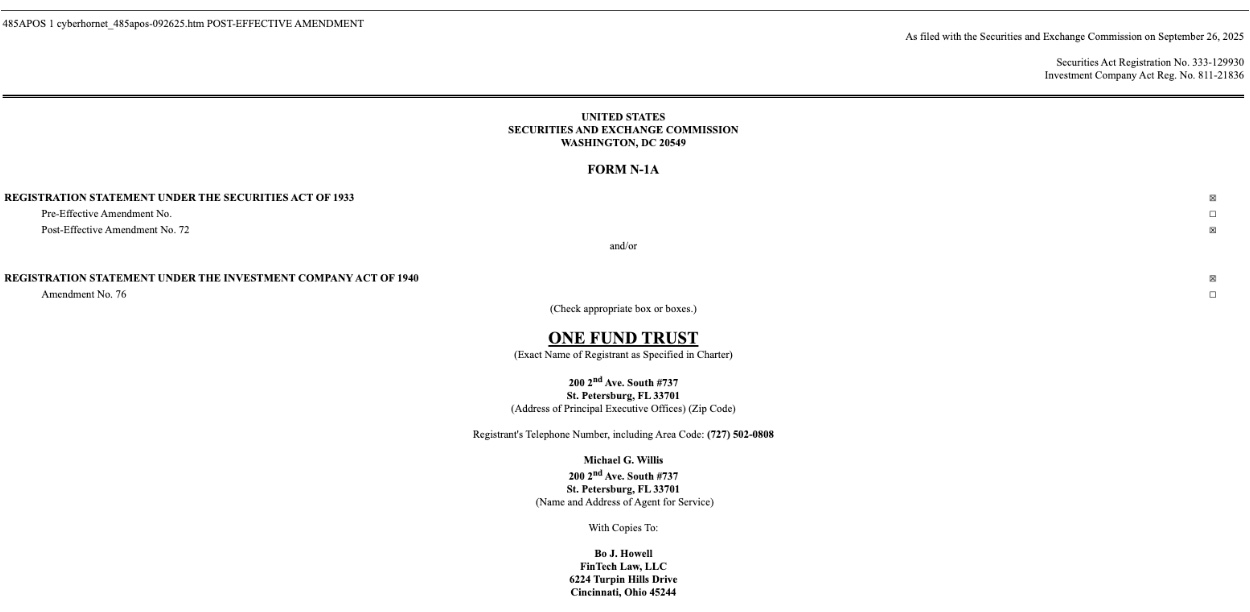

Solana’s inclusion in Cyber Hornet ETF Submitting is one other key occasion that won’t have been absolutely priced in earlier than the market closed official markets on Friday. Cyber Hornet Belief disclosed plans to launch three ETFs that combine S&P 500 equities with crypto futures publicity.

Cyber Hornet recordsdata FORM N-1A launch three ETFs combining S&P 500 shares with Ether, Solana, and XRP futures | Supply: SEC.gov

In accordance with the SEC filing dated Sept 26, one proposed car will allocate 75% of property to large-cap U.S. equities whereas dedicating 25% to Solana futures. The fund gives oblique crypto publicity through CME-listed contracts and controlled exchanges.

If authorised, the ETF will commerce on Nasdaq, giving conventional traders one other diversified and controlled publicity to the Solana ecosystem.

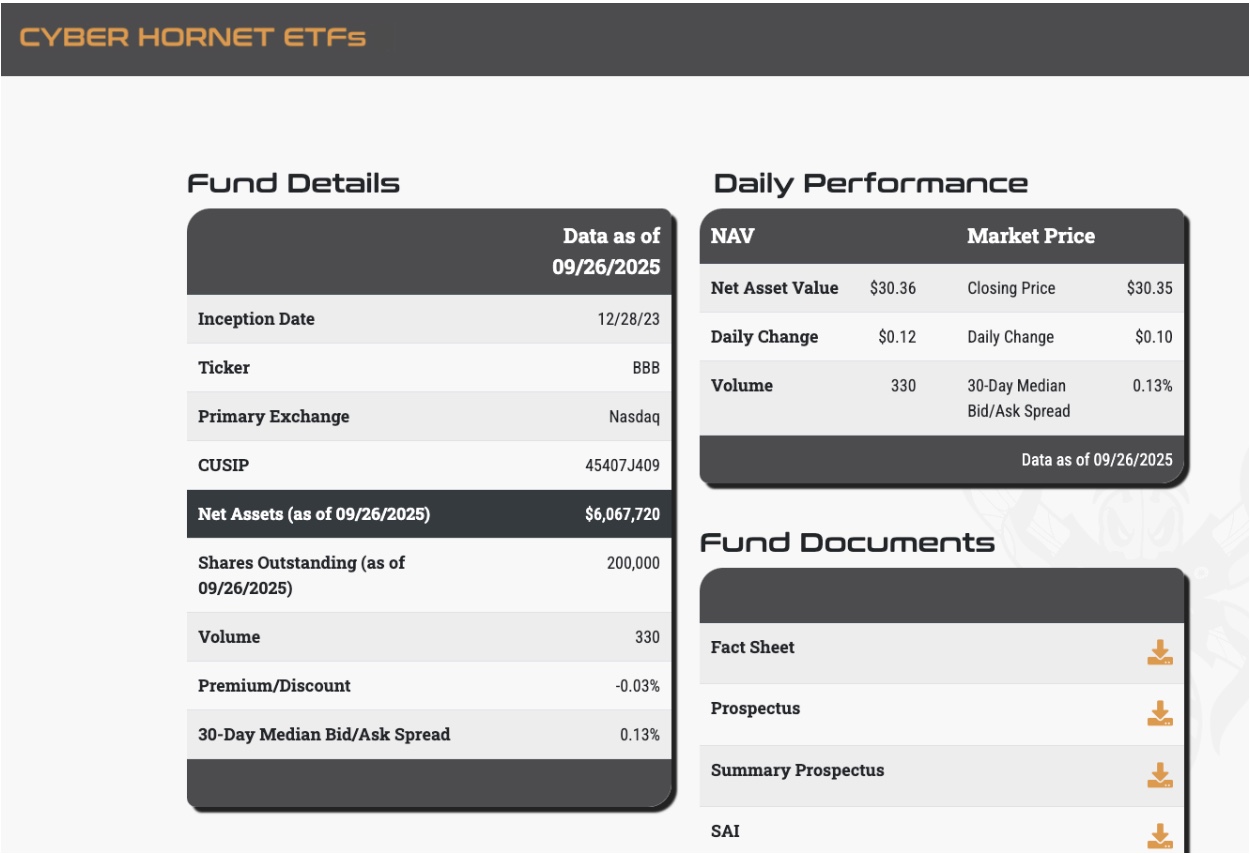

Cyber Hornet Belief S&P 500 and Bitcoin 75/25 Technique ETF (BBB) Efficiency as of Sept 28, 2025 | Supply: cyberhornetetfs.com

Notably, Cyber Hornet Belief presently manages the same ETF product, the S&P 500 and Bitcoin 75/25 Technique ETF (BBB), which as of September 26, has attracted web property value $6 million.

The most recent submitting enhances Cyber Hornet’s present Bitcoin 75/25 ETF, signaling an intent to broaden protection into main altcoins. S

Topic to approval, Solana’s inclusion in Cyber Hornet’s newest submitting additional emphasizes its choice amongst company traders, particularly these looking for extra upside from yield revenue.

Solana Value Forecast: Is $250 Rebound in Play for the Week Forward?

Solana worth consolidated close to $203 at press time, after defending the $200 flooring. Nevertheless, technical indicators on the SOLUSD every day worth chart reveal combined alerts.

The Keltner Channel locations speedy resistance close to $216.98, aligning with the midline. A breakout above this degree might spark momentum towards the higher channel at $239.24. Conversely, the decrease channel at $194.72 stays the important thing draw back marker, with failure to carry doubtlessly exposing additional declines.

Solana (SOL) Technical Value Forecast | Supply: TradingView

The Volatility Cease (VStop) indicator sits close to $215.24, suggesting bulls should reclaim this degree to neutralize ongoing bearish momentum. The Relative Power Index (RSI) at 42.28 signifies that SOL stays in bearish territory however is trending upward, suggesting a attainable aid rally if shopping for persists.

Sustained protection of the $200 help, mixed with a push above $217, might unlock a rebound towards $239. If bulls stay dominant, a breakout past the higher Kelter channel ban would validate a $250 goal, particularly if WBTC inflows and ETF enthusiasm maintain institutional curiosity.

On the draw back, failure to clear $215 resistance might see Solana worth enter a chronic correction part towards $194.

Greatest Pockets (BEST) Presale Reaches $16.1M as Solana Rebound Attracts Curiosity

Amid Solana’s current worth consolidation above $200, Greatest Pockets (BEST) has additionally emerged as a standout early-stage undertaking. Designed as a multi-chain storage resolution, it emphasizes institutional-grade security measures to deal with vulnerabilities in present non-custodial wallets.

Greatest Pockets (BEST) Presale Greatest Pockets Presale

Business estimates trace that the non-custodial pockets market may very well be value greater than $11 billion within the coming years, providing important upside potential for Greatest Pockets’s early traders.

At press time, Greatest Pockets’s presale has crossed $16.1 million, with simply hours left earlier than the subsequent worth replace. members can nonetheless purchase BEST tokens at $0.0257 by way of the official website.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed info however shouldn’t be taken as monetary or funding recommendation. Since market circumstances can change quickly, we encourage you to confirm info by yourself and seek the advice of with an expert earlier than making any choices primarily based on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting numerous Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is presently learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.