Key Notes

- The non-public token deal consists of long-term lockup phrases with potential low cost incentives for prolonged alignment.

- Solana’s staking ecosystem generates roughly $5 billion yearly in rewards regardless of latest $1.4 billion withdrawals.

- A16Z’s funding follows related main token purchases in LayerZero and EigenLayer over the previous 12 months.

Enterprise capital agency Andreessen Horowitz (A16Z) acquired $50 million price of JTO, the native token of Solana staking protocol Jito, marking a major institutional funding in one among Solana’s main liquid staking platforms.

According to a Fortune report, the transaction marks the most important single dedication by an investor in Jito’s historical past.

Brian Smith, government director on the Jito Basis, confirmed that the non-public deal is structured for long-term cooperation between each corporations, hinting at low cost incentives.

“For those who’re accepting long-term alignment the place you may’t promote for some time, then there’s historically some modest low cost related to that,” mentioned Brian Smith, government director on the Jito Basis.

The acquisition represents a non-public token acquisition relatively than an fairness stake, a construction more and more frequent amongst institutional traders looking for liquid publicity to blockchain protocols.

Over the previous 12 months, A16Z has executed a number of giant token-based offers, together with $55 million in LayerZero and $70 million in EigenLayer.

Solana Staking Rewards Hit $5B Yearly as Establishments Accumulate

According to StakingRewards data, Solana’s staking ecosystem generates roughly $5 billion in annual rewards, making it one of the vital profitable proof-of-stake networks globally. A16Z’s $50 million allocation locations it on a rising checklist of company entities resembling Forward Industries and DeFi Company, each of which maintain and stake substantial SOL reserves of their treasuries.

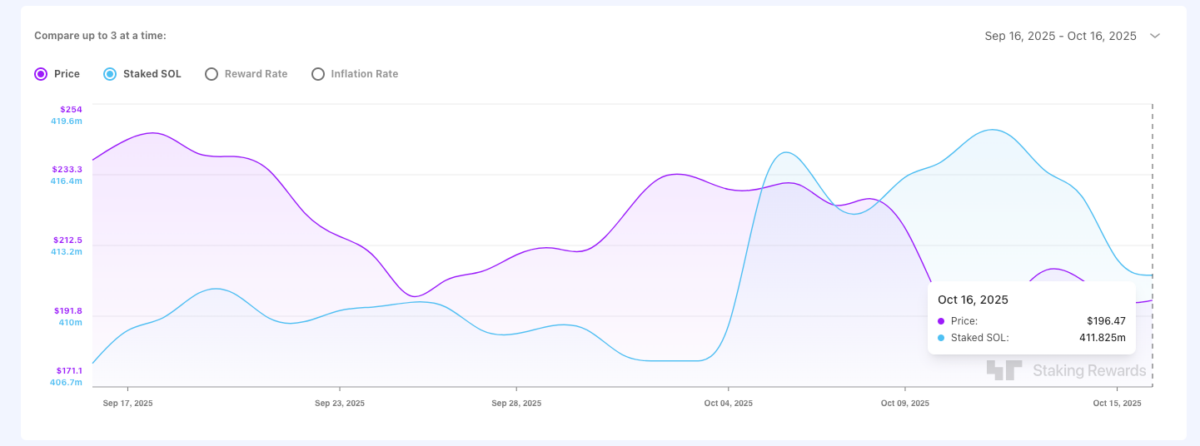

Nonetheless, latest on-chain metrics point out that Solana combination staking flows stay destructive because the record-breaking market crash final week. As seen beneath, Complete SOL stake has declined from 418.6 million on October 11 to 411.5 million SOL at press time, a withdrawal of seven.1 million SOL price over $1.4 billion.

Complete Solana (SOL) Staked declined 7.1 million SOL (~$1.4 billion) since Oct 11 market crash | Supply: StakingRewards

Elevated circulating provide from the latest $1.4 billion staking withdrawals provides to bearish stress pinning Solana worth beneath $200 this week.

Nonetheless, recent company inflows from A16z reinforces long-term confidence in Solana’s tokenomics amongst institutional corporations, anticipating an imminent restoration from the continued market consolidation section.

SUBBD Presale Crosses $1.2M as Solana Ecosystem Progress Lifts Web3 Investor Confidence

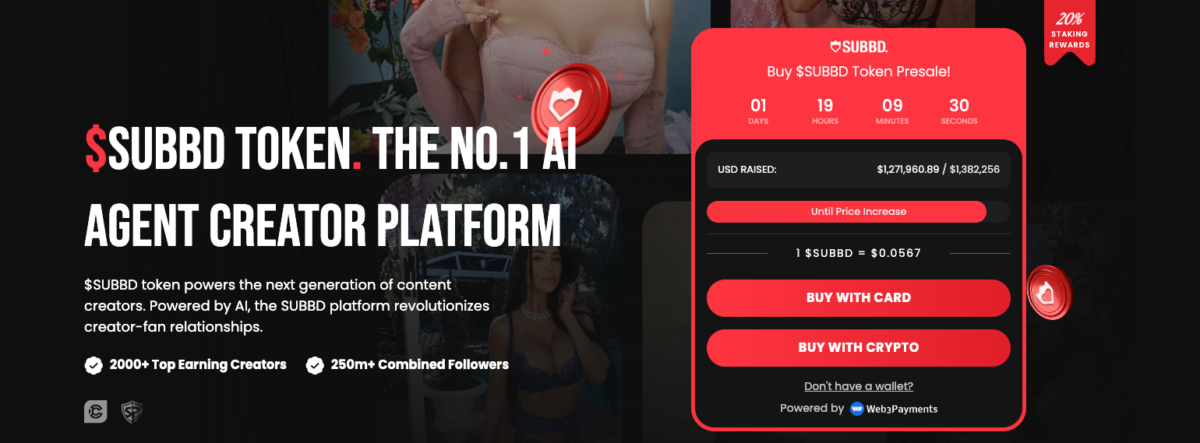

Solana’s latest whale inflows have reignited curiosity in rising tasks like SUBBD ($SUBBD).

SUBBD integrates AI-driven personalization with creator monetization, enabling influencers and types to construct fan communities.

SUBBD Presale

The SUBBD presale has now surpassed $1.2 million of its $1.4 million fundraising goal, with tokens at the moment priced at $0.056 every. With lower than 24 hours earlier than the subsequent worth tier, individuals can go to the official SUBBD presale web site to unlock early-entrant rewards.

Disclaimer: Coinspeaker is dedicated to offering unbiased and clear reporting. This text goals to ship correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Since market situations can change quickly, we encourage you to confirm data by yourself and seek the advice of with an expert earlier than making any selections based mostly on this content material.

Ibrahim Ajibade is a seasoned analysis analyst with a background in supporting varied Web3 startups and monetary organizations. He earned his undergraduate diploma in Economics and is at the moment learning for a Grasp’s in Blockchain and Distributed Ledger Applied sciences on the College of Malta.