Sonic Labs has simply permitted its plan to broaden into the US market, together with establishing Sonic USA LLC and opening a New York workplace. Moreover, it should roll out TradFi-related merchandise similar to ETFs and PIPEs.

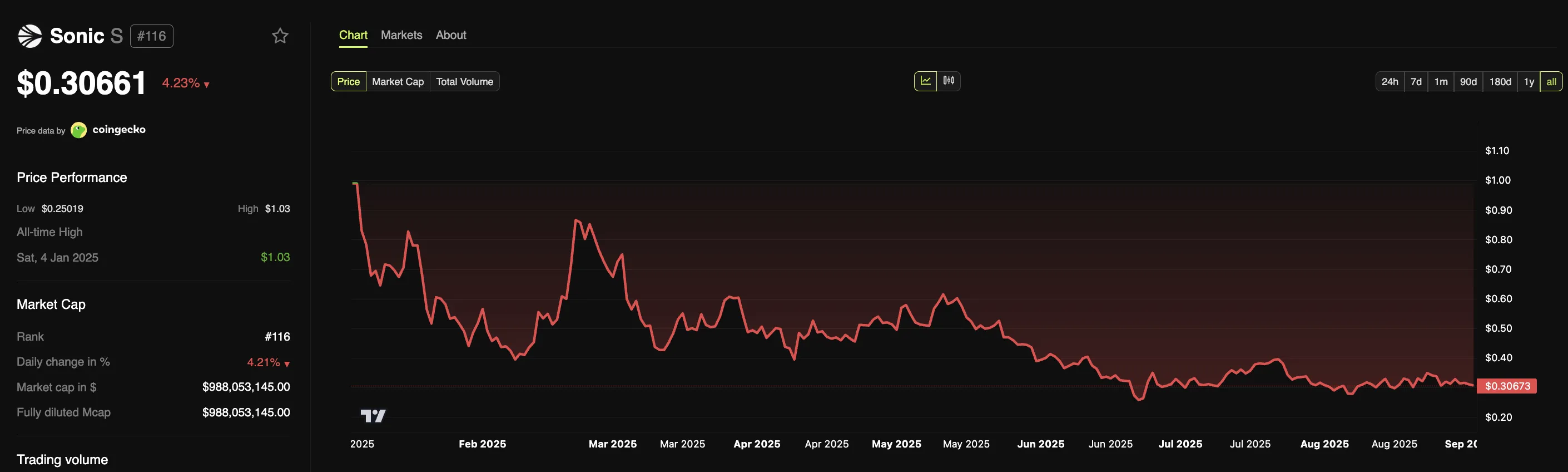

This transfer guarantees to unlock institutional capital entry for $S, whereas elevating the problem of balancing short-term dilution with long-term deflationary potential.

A Strategic Increase for S Token?

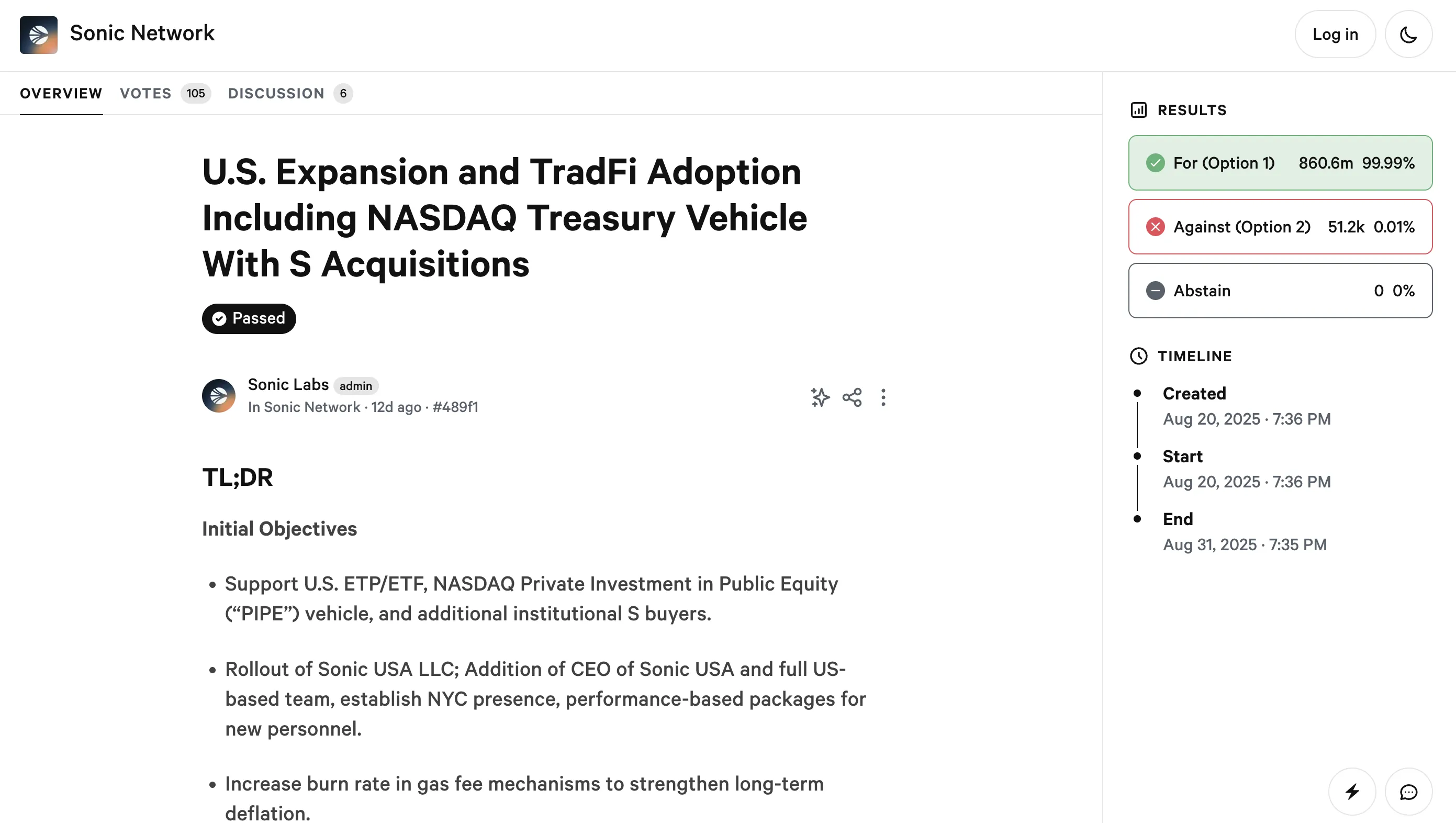

The Sonic Labs neighborhood voted in favor of the “US Market Expansion and TradFi Adoption Plan.” The proposal allows the venture to ascertain a US authorized entity named Sonic USA LLC, rent a CEO and an area staff, and open a New York workplace. Moreover, it should apply a performance-based compensation scheme.

The proposal additionally outlines a long-term deflationary mechanism by gas fees to offset provide progress because the community prompts its enlargement plans.

A key technical spotlight of the decision package deal is the adjustment of community parameters to concern tokens for 2 potential choices: First, a $50 million allocation for managed ETF/ETP buildings, $100 million for a Nasdaq PIPE program, and $150 million S tokens (previously FTM) designated to fund Sonic USA. Alternatively, rejecting the entire above changes.

On the institutional demand aspect, the ETF/ETP allocation might create a compliant entry channel for conventional buyers. Moreover, it will standardize custody, improve transparency of holdings, and streamline the creation/redemption course of.

In the meantime, the Nasdaq PIPE serves as a strategic “capital reserve,” permitting Sonic to work together with public markets extra controlledly. This aligns with its long-term goal of positioning S nearer to the requirements of institutionally held belongings.

On the availability aspect, the fuel charge deflationary mechanism is essential. If transaction exercise grows alongside ecosystem enlargement, burned charges might take in a part of the availability stress from issuance. Moreover, locked charges would contribute to mitigating this stress. Nonetheless, its effectiveness is determined by the precise charge design, community exercise, and treasury self-discipline throughout market cycles.

US Approval Nonetheless Stays as Dangers

Nevertheless, buyers ought to stay cautious: new issuance to finance the ETF, PIPE, and Sonic USA represents rapid dilution. The online affect will rely upon product rollout pace, compliance progress, and the power to transform these channels into actual money flows for the ecosystem.

On the flip aspect, the principle dangers lie within the regulatory delays of US ETF/ETP approvals. Moreover, strict disclosure necessities for PIPEs and the operational prices of working a US entity might weigh closely if the market contracts. Due to this fact, the important thing metric after this vote isn’t the rapid worth motion, however the execution milestones.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.