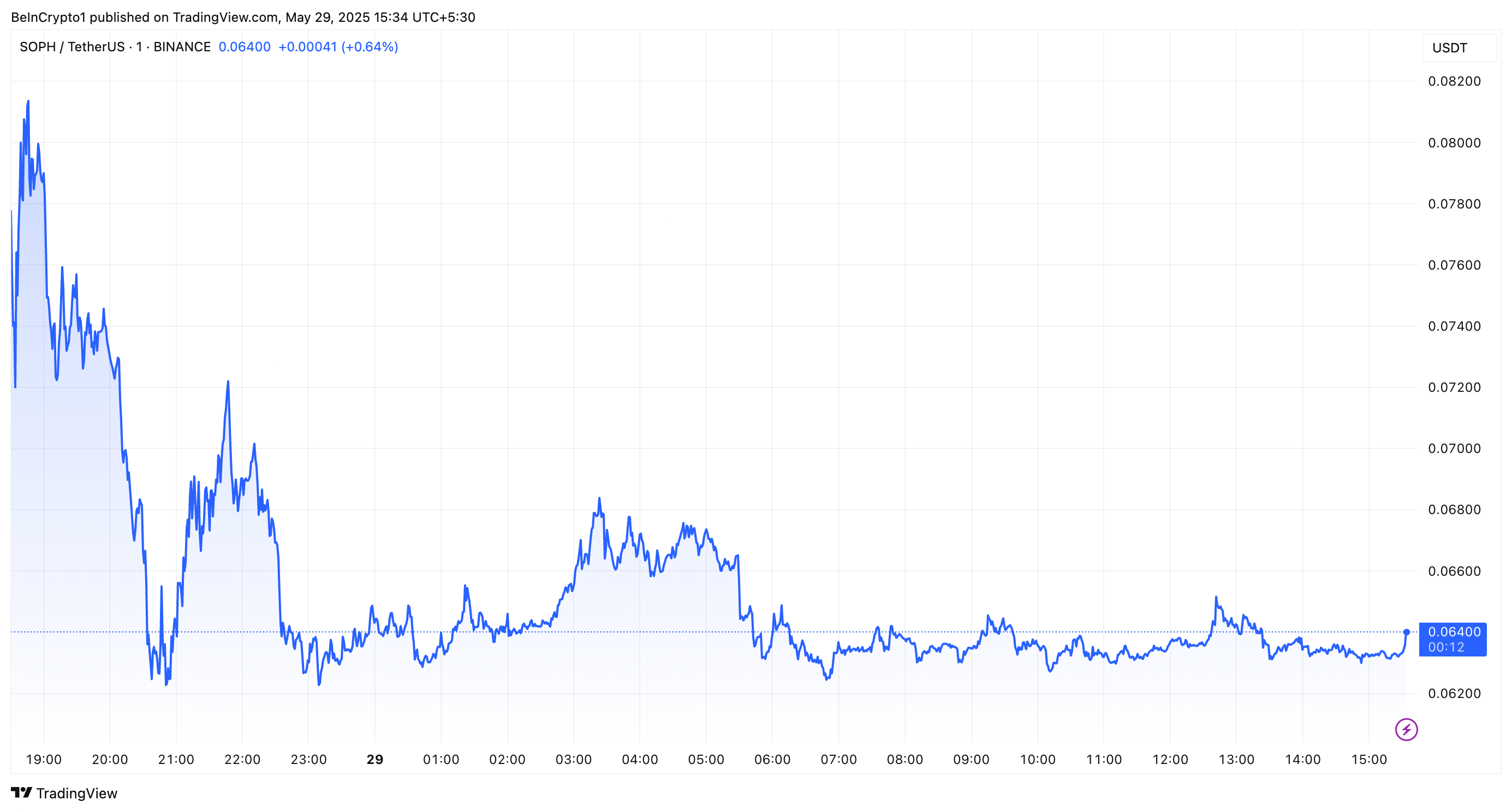

Sophon’s utility token, SOPH, skilled a pointy decline of greater than 33% inside 24 hours of its debut and itemizing on Binance.

The first driver behind the worth plunge seems to be the airdrop of 900 million SOPH tokens, 9% of the full 10 billion provide, unlocked at launch.

Why is SOPH’s Value Declining?

For context, Sophon is a Layer 2 ZK (zero-knowledge) blockchain constructed on Validium know-how and a part of ZKsync’s Elastic Chain imaginative and prescient. It’s designed as a consumer-focused platform concentrating on leisure functions. The blockchain offers high throughput, low fees, and Ethereum-level safety.

The challenge has raised over $70 million from outstanding buyers, including Binance Labs. On Could 23, Binance announced SOPH’s listing by way of an X (previously Twitter) put up.

“We’re happy to announce that Binance would be the first platform to function SOPHON (SOPH),” Binance posted.

Trading commenced at 13:00 UTC on May 28. On the identical day, SOPH additionally started buying and selling on different main exchanges, together with OKX, KuCoin, Upbit, Bitget, and MEXC, marking a broad rollout.

In response to data from CoinGecko, the token climbed to an all-time excessive of 0.11 shortly after launch. Nonetheless, it noticed a steep drop after this. Over the previous day, SOPH’s value has depreciated by 33.3%. On the time of writing, the altcoin was trading at $0.06.

The decline additionally worn out over $80 million in market capitalization. Moreover, the trading volume surged 2,724.8%, indicating heavy distribution by early airdrop receivers.

On the Token Era Occasion, Sophon unlocked 9% of SOPH’s complete provide for distribution. This included 6% allotted to Layer 1 farmers and three% for eligible early contributors, zkSync customers, and NFT holders.

Notably, airdrops often lead to short-term price declines because of elevated provide. That is very true when a token’s utility shouldn’t be but totally established.

Presently, SOPH’s speedy utility stays limited to gas fees and sequencer decentralization. Thus, this may occasionally not but present sufficient demand to counterbalance the airdrop-driven sell-off.

“We count on the utility to evolve over time as our community and our product providing grows, incorporating new utilities as we do. There’s a lot deliberate on the product entrance so keep tuned for the evolution of SOPH,” Sophon stated.

Including to the volatility, Binance utilized a “seed tag” to SOPH. The seed tag is a classification for cryptocurrencies with larger danger and better volatility than different tokens. It sometimes identifies new initiatives which might be susceptible to bigger value swings.

Moreover, the trade introduced futures buying and selling for SOPH with as much as 75x leverage, amplifying value swings. Given these elements, the market sentiment surrounding SOPH stays fragile.

That’s not all. After three months, an additional 20% of SOPH’s provide, allotted as node rewards, will start unlocking weekly. If market sentiment doesn’t enhance, this could exert further downward pressure.

Regardless of this, on-chain exercise provides some optimism. Data from DefiLama revealed that Sophon’s complete worth locked (TVL) reached a peak of $20.28 million in the present day.

This mirrored a rise of 14.1% from yesterday. Moreover, decentralized trade quantity reached a document peak of $47.44 million.

The put up Sophon’s SOPH Token Faces Over 33% Drop Post Airdrop and Binance Listing appeared first on BeInCrypto.